What’s Next for Hulu Under Disney CEO Bob Iger?

- Oops!Something went wrong.Please try again later.

As Bob Iger returns to the helm of Disney for the next two years, he faces a corporate version of one of the Disney-owned streaming service Hulu’s biggest limited-series hits: “Little Fires Everywhere.”

And one of the fires he must face is what to do with Hulu, the hybrid subscription/ad-supported streamer in which Disney holds a controlling stake since completing its acquisition of 21st Century Fox three years ago. Under a 2019 agreement, Disney can buy out rival Comcast’s remaining 33% stake in Hulu as early as January 2024 (and Comcast can require that Disney do so).

But Iger has been mum on his plans for Hulu, even suggesting at a company town hall on Monday that he’s “very, very comfortable with the set of assets we have” and “there’s no sense of urgency or even interest right now in acquiring anything more.”

Still, it’s unclear if the man who grew Disney through pricey acquisitions of Pixar, Marvel, Lucasfilm and 21st Century Fox considered a deal for Comcast’s share a new acquisition. The very next day, Disney closed a $900 million deal to buy out Major League Baseball’s minority stake in the video-streaming firm BAMTech. (Representatives for Disney didn’t respond to TheWrap’s requests for comment for this story.)

Also Read:

Bob Iger Sets Creativity as ‘Number One Priority’ for Disney

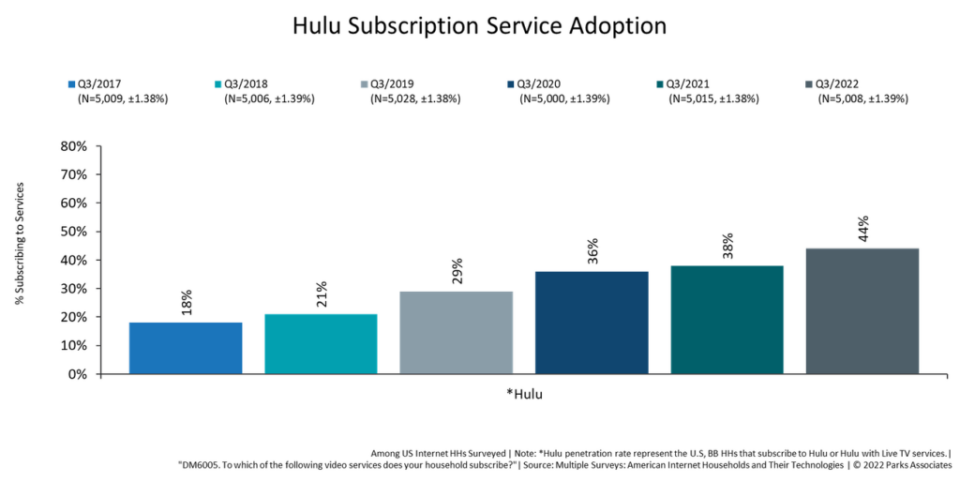

There’s no question that Hulu has become a valuable asset in Disney’s streaming lineup. According to market research and consulting firm Parks Associates, 44% of U.S. internet households reported subscribing to Hulu in the third quarter, a 6 point increase over 2021.

Hulu’s average revenue per user or paid subscriber (ARPU) for the fourth quarter came in at $12.23 for its subscription video on demand (SVOD) service. When combined with Live TV, Hulu’s ARPU grew to $86.77. In comparison, Disney+’s domestic ARPU was $6.10 for the quarter, while ESPN+’s ARPU was $4.84.

Omdia media analyst Sarah Henschel said the primary advantage of Disney buying out Comcast’s stake would be “wholly controlled ownership” of Hulu.

“While they have total operational control of Hulu, Comcast is reaping profits from Hulu’s initiatives without extending the deals and investment prior to the Disney acquisition. Comcast/NBCU have started taking NBC next-day air content off of Hulu and have more priority in bolstering Peacock,” Henschel told TheWrap. “Disney would do well to acquire Comcast’s remaining share so that it can own total profits of Hulu. Hulu has really paved the way for hybrid advertising and subscription service success so owning it outright is beneficial especially as Disney+ looks to integrate more advertising.”

Hulu’s success is even more crucial as the industry shifts its focus from subscriber growth to revenues. In the quarter ending Oct. 1, Disney+ had a total of 164.2 million subscribers, including 46.4 million in the U.S. and Canada. Meanwhile, Hulu and ESPN+ have 47.2 million and 24.3 million subscribers, respectively. Chief Financial Officer Christine McCarthy emphasized that bundled offerings with Hulu and ESPN+ accounted for over 40% of Disney+’s fiscal year-end domestic subscriber count.

“Hulu is in a good position to help bolster Disney’s role in the market, but clearly the company is reassessing its strategy,” Parks Associates president and chief marketing officer Elizabeth Parks told TheWrap. “In any event, success is in the execution and future integration of services and bundled services, increased content offerings, as well as global distribution strategies.”

Third Bridge senior analyst Jamie Lumley told TheWrap that Hulu has been a “good home for content from the Fox acquisition that doesn’t fit well alongside Disney’s traditional kid-friendly, family focused programming on Disney+.”

“Even though Disney+ has introduced some adult-targeted content, Hulu is an effective platform for broadening Disney’s appeal to different audiences,” Lumley noted. “Prior to Iger’s return as CEO, our experts framed the question of whether Disney would buy Hulu outright as not an if, but a when.”

A full buyout of Comcast’s stake would also give Iger the option to merge Hulu and Disney+ into one platform — a move that seemed to be favored by his short-lived successor/predecessor, Bob Chapek.

Also Read:

‘Guardians of the Galaxy': James Gunn on How Baby Groot Became ‘Swoll Groot’

However, Needham senior internet and media analyst Laura Martin believes that it would be a better marketing strategy for Iger to keep the two streaming services separate. “That Hulu audience is much more mature and it should stay a separate brand rather than merging it into Disney+, which is kid safe,” she said. “It’s a better strategy to keep them separate from a brand protection sort of view.”

Still, not everyone thinks that full ownership of Hulu is worth the cost — especially for a company carrying $48.4 billion in long-term debt. It’s “hard to see Iger spending $9-$13 billion on the one-third of Hulu they do not own right now,” Lightshed Partners analyst Rich Greenfield wrote in a recent blog post. ”That would increase Disney’s balance sheet pressure, albeit consolidating streaming services would generate some meaningful go forward cost synergies.”

Instead, he believes that Disney would be better served to sell its two thirds stake to Comcast while keeping the most important Disney-owned Hulu programming and migrating ABC content to Disney+ exclusively over the next couple of years. “While this would meaningfully reduce the value of Hulu in a sale to Comcast, it would expand the [total addressable market] for Disney+ and generate some incremental cash to de-lever Disney,” he added.

Despite Comcast’s whopping $95.6 billion in long-term debt, Greenfield told TheWrap that the cable giant could afford to purchase Disney’s two-thirds stake, noting that its price would be “dictated by what content goes or doesn’t go.”

Also Read:

‘Top Gun: Maverick’ Will Return to Theaters for 2 Weeks

In September, Comcast CEO Brian Roberts signaled an interest in buying out the streamer. “Hulu’s a phenomenal business. Its scale is fantastic. It has wonderful content,” Roberts said during the Goldman Sachs Communacopia and Technology Conference. “I believe if it was for sale, put up for sale, Comcast would be interested, and so would a lot of other tech and media companies.” (A rep for Comcast directed TheWrap to Roberts’ comment.)

But Martin pointed out that there’s nothing in the language of the original agreement that gives Comcast the option to buy Disney’s stake. She views Roberts’ comment as a “negotiating ploy” to drive up the price tag of the company’s minority stake.

Ironically, Hulu’s strong revenue model could also elevate the price that Disney will have to pay Comcast to own the streamer outright. In 2019, Disney said Hulu’s fair market value would be assessed by independent experts, but guaranteed a minimum total equity value of $27.5 billion, suggesting that Comcast’s share would be worth at least $9 billion. As of Oct. 1, 2022, Disney valued Comcast’s stake at $8.7 billion, according to its latest annual report. But the final price is likely to be significantly more.

For Iger to sell Hulu would be a “huge shift in strategy,” Lumley added, and one that would “significantly strengthen Comcast’s positioning in a crowded streaming landscape.”

Also Read:

‘Wall-E’ Director Andrew Stanton Explains How Pixar’s Sci-Fi Darling Joined the Criterion Collection