Nexstar Risks $6.7 Million Per Month in Lost Fees During Fios Blackout

The blackout of Nexstar Media Group stations in households served by Verizon Fios TV is putting $6.7 million in retransmission and distribution fees per month at risk, according to an analysis by S&P Global Market Intelligence.

Nexstar’s retransmission-consent agreement with Verizon Communications expired on Friday and the two sides were unable to reach an agreement on an extension.

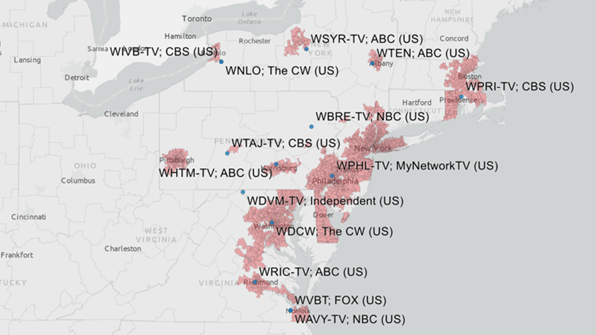

The dispute impacts 14 full-power Nexstar stations in 11 markets. S&P estimates that Verizon serves about 22.3% of the 11.3 million TV households in the market.

Also blacked out is NewsNation, Nexstar's cable news network.

Kagan also estimates that in the second quarter, the affected Nexstar stations averaged $4.19 a month per subscriber in fees. Those fees are expected to go up in a new agreement. If Nexstar gets $4.25 per month, it would generate $79.4 million in revenue annually.

Nexstar advertising revenue is also in jeopardy as the midterm elections and holiday shopping period approaches.

Kagan estimates the affected stations will generate $316 million in ad revenue in 2022, with $70.5 million coming from the blacked out homes. That's $5.9 million a month.

It is harder to estimate what Verizon Fios has at risk. The pay TV business is already declining at a precipitous rate and it's hard to tell, even during football season, how quickly subscribers will pull the plug and switch to another provider.

But once a pay TV distributor loses a subscriber, it's difficult to get them back, which puts pressure on cable operators, satellite companies and telcos during retransmission disputes.

In contrast, station ad revenue usually returns to pre-blackout levels shortly after a new distribution agreement is reached. ■