With Electronic Arts In The Lead, Media Stocks Trail Overall Market In 2014

If you doubt that the stock market is no place for the faint of heart, then consider this: Two of 2014’s worst performing stocks among the media and tech companies we track (DreamWorks Animation and Pandora) ranked among the biggest gainers in 2013 , and three of this year’s best bets (RealD, Barnes & Noble, and Apple) were underperformers in 2013.

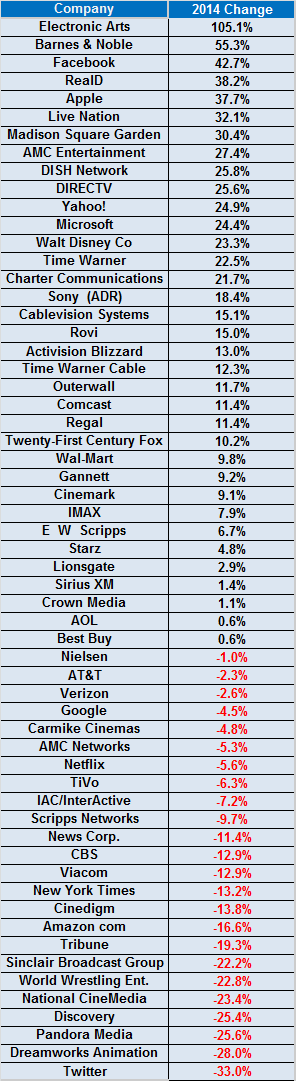

The general results reflect investors’ growing reluctance to invest in media as a sector, focusing instead on the quirks of individual stocks. Wall Street still likes media companies, but it doesn’t love them as they grappled with growing competition from digital content providers, and an uncertain ad market. The Dow Jones U.S. Media Index ended 2014 +10.2% — slightly below the overall market measured by the Standard & Poors 500, which was +11.4%. Last year the Index was up 47% for the year vs 29.6% for the S&P.

The change of heart is especially apparent when you look at traditional Big Media companies. They were mixed in 2014, a contrast to 2013 when all were up by double-digit percentages. The top 2014 performer in the elite group was Disney (+23.3%) followed by Time Warner (+22.5%), Sony (+18.4%), Comcast (+11.4%), and Fox (+9.2%). But CBS shares — which led the pack in 2013 — fell 13.2% followed by Viacom (-13.8%), and Discovery (-25.4%).

Here are 2014’s best and worst performing media stocks. Note: The list doesn’t include Liberty Media and its related equities. The spin off of Liberty Broadband — which includes Liberty’s Charter Communications holdings — makes a straight year-over-year comparison meaningless. We also left off companies with IPOs in 2014 including Alibaba.

Winners

1. Electronic Arts (+105.1%). Hits including FIFA, Madden NFL, Hockey Ultimate Team, and Dragon Age: Inquisition helped the game maker to achieve its goal to generate a 20% operating margin — and grow enough to join the NASDAQ 100. And next year looks strong with widely anticipated planned releases including Battlefield Hardline, Titanfall, and Star Wars Battlefront.

2. Barnes & Noble (+55.3%). The stock price took a roller coaster ride in 2014. But at year end investors like the plan to spin off the struggling Nook digital business. The college textbook operation is still strong. And they have faith that CEO Michael Huesby, a seasoned deal maker, will come up with a strategy that rewards shareholders who stick with the book retailer.

3. Facebook (+42.7%): The social media giant overcame investor concerns that it would have trouble selling ads on mobile devices. Investors are eager to see what’s in store for 2015 as it expands into video and search — and integrates its newly acquired messaging service WhatsApp and virtual reality provider Oculus Rift.

4. RealD (+38.2%): A rising stock price doesn’t always mean a business is thriving. In the case of the struggling 3D technology company, this year’s gains followed decisions to cut costs including 20% of RealD’s staff — part of an attempt to fend off a hostile $600 million takeover proposal from hedge fund Starboard Value. In a November letter to CEO Michael Lewis, Starboard’s Jeffrey Smith said that his fund “reaffirmed its desire and ability to own” RealD and said that it “has reserved all of its rights to take any action” to buy it.

5. Apple (37.7%): The bad news: The company became more dependent on iPhone sales after disappointing those who eagerly anticipated an Apple TV or some other game-changing new product. The good news: Consumers like the new iPhone 6 and 6 Plus. Investors have high hopes for the Apple Watch when it comes out in 2015. Oh, and Apple quieted Wall Street naysayers by raising its stock repurchase plan by $30 billion to $90 billion through next year.

Losers

1. Twitter (-33.0%): The stock soared after its November 2013 IPO, and this year it fell back to earth. Investors became alarmed in February when Twitter reported disappointing sub growth numbers. CEO Dick Costolo vowed to make the service easier for newbies to use. But he exacerbated fears that the company was off track by replacing nearly all of the company’s top officers including the COO, head of product, and chief engineer.

2. DreamWorks Animation (-28.0%): It wrote down $13.5 million in February for Turbo (which the SEC is investigating), plus $57 million in April for Mr. Peabody & Sherman. Analysts are bracing themselves for another loss from the studio’s latest release, Penguins Of Madagascar. Meanwhile deal talks with Japan’s Softbank and Hasbro collapsed. That’s a lot of drama for a company that makes comedies.

3. Pandora (-25.6%): The Internet’s largest radio music service struck a sour note this year as competition intensified from rivals including Apple iTunes Radio, Google Play Music, iHeart Radio, and Spotify. Investors also are concerned about a pending Copyright Royalty Board ruling that will determine how much Pandora will have to pay for tunes beginning in 2016. It wants to shell out less, but music companies want more.

4. Discovery (-25.4%): As a pure-play basic cable company, Discovery was exposed as the industry saw domestic ratings and ad sales decline. Investors like its overseas expansion — including acquisitions of EuroSport and Scandanavia’s SBS. But they also know it will take years to see a big payoff from them.

5. National CineMedia (-23.4%): The leading movie theater ad sales company has been struggling to persuade buyers to divert dollars from TV to multiplexes. And it thought it had solved its biggest problem in May, when it agreed to buy its top competitor, ScreenVision. But the vision of becoming a one-stop shop for movie ads blurred in November when the Justice Department challenged the merger on antitrust grounds. Courts will hear the case next year.

Related stories

Biggest TV Controversies Of 2014 – Photo Gallery

Notable Hollywood Passings In 2014 – Photo Gallery

Dominic Patten's Top 10 New TV Shows of 2014 (Pt. 2)

Get more from Deadline.com: Follow us on Twitter, Facebook, Newsletter