Documentary Filmmaker Wins Closely Watched Tax Dispute With IRS

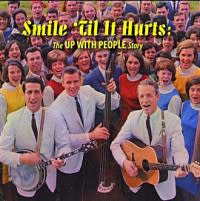

Documentary filmmaker Lee Storey has emerged victorious in an IRS dispute over production-related tax deductions for expenses that allowed her to write off losses at the same time she earned substantial income as a lawyer, according to a Forbes magazine post. “I need to go celebrate. I need to pinch myself,’’ said Storey, producer and director of Smile `Til It Hurts: The Up with People Story, “The documentary film community is going to be thrilled. That’s a huge issue for them.” The IRS rejected Storey’s claims and assessed $259,842 in back taxes and penalties. Tax court judge Diane L. Kroupa initially seemed to agree, suggesting that documentary filmmaking amounted to a hobby because “it’s not for profit. You’re doing it to educate. You’re doing it to expose.’’ The International Documentary Association and five other non-profit groups hurriedly filed a friend of the court brief. As the brief noted, “A judicial pronouncement that documentary filmmakers are not engaged in a profit-making activity would have a chilling effect on the documentary filmmaking industry, as documentarians would no longer be able to claim deductions for their business expenses.” In an about face to her earlier comments suggesting that Storey’s filmmaking amounted to an expensive hobby, Judge Kroupa ultimately decided in Storey’s favor, taking into consideration that she kept detailed records and conducted her filmmaking in a businesslike manner — writing and then modifying a business plan, seeking financing, hiring a bookkeeper, obtaining liability insurance and soliciting feedback from industry pros.

Get more from Deadline.com: Follow us on Twitter, Facebook, Newsletter