UPDATE: Disney’s Bob Iger Touts “Franchise Potential” Of ‘Frozen’ After Movies Fuel Q1 Ratings Surge

UPDATE, 3:28 PM: Bob Iger continued to tubthump for the red-hot Studio Entertainment division during the company’s analyst call– and specifically Disney Animation’s runaway hit Frozen. While not going so far as to say that potential includes another feature film, the Disney CEO noted the pic, which is up for a pair of Oscars, has made $864.4M worldwide since its late November release, passing The Lion King as the company’s biggest animated hit ever — and that’s with China just opening and Japan to come in mid-March. “This has real franchise potential” across Disney’s businesses, Iger said, adding that in Disney’s parks “we will see Frozen in more places” along with Marvel properties including Iron Man. CFO Jay Rasulo said Frozen is the top-selling brand in Disney’s stores (followed by Disney Junior properties), which helped Consumer Products to gains in revenue and operating income.

Related: ‘Frozen’ Becomes Shining Star For Disney: Is Broadway Next?

Several analysts asked about Disney Interactive, a day after the unit said it would lay off about 200 employees. Iger touted the success of the Infinity business, which increased revenue and operating profit during the quarter, and said the next phase of Disney Interactive’s rollout will involve mining new iterations of characters. Iger said to look for more licensing deals as the division moves off more traditional platforms and zeroes into the mobile space “where the users are.” Rasulo said Q2 will see “downdraft” as there are no big names due out during the quarter.

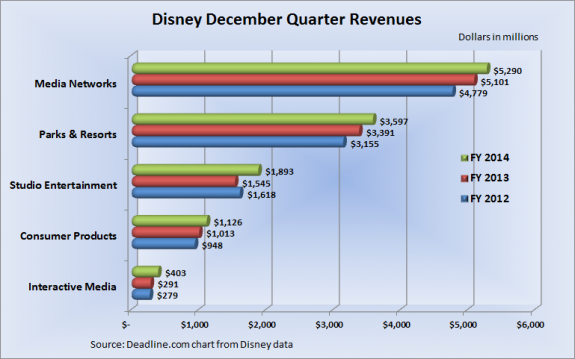

PREVIOUS, 1:18 PM: The stock is up, CEO Bob Iger is talking up the fiscal Q1 numbers on CNBC — and at first glance it looks like there’s enough in the results to justify all of that enthusiasm. Disney reported net income of $1.8B, +33% vs the period last year, on revenues of $12.3B, +9%. Analysts thought that the top line would come in a little lower, $12.2B. Diluted earnings at $1.04 a share handily beat expectations for 92 cents. Unlike at most Big Media companies, the Studio Entertainment unit was the star for Disney’s year-end quarter. Revenues rose 23% to $1.9B, with operating income +75% to $409M, as Frozen and Thor: The Dark World hammered last year’s results with Wreck-It-Ralph. The studio also benefited from sales to overseas streaming services. Media Networks revenues increased 4% to $5.3B with operating income +20% to $1.5B. ESPN and Disney’s 50% stake in A&E helped to drive a $325M increase in operating income to $1.3B for the cable networks unit. But ABC struggled with revenues falling 2% to $1.5B and operating income down 32% to $178M. Ad sales were hurt by lower ratings. The broadcast operating also had higher writeoffs for programming, and higher costs including a “contractual rate increase” for Modern Family. Theme Park revenues rose 6% to $3.6B with operating income +16% to $671M due in part to increases in ticket prices and guest spending. Although the company says its MyMagic+ program required additional investment, that was somewhat offset by “lower pension and postretirement medical costs.” Consumer Products did well with revenues +11% to $1.1B with operating income +24% to $430M. And the Interactive unit’s revenues increased 38% to $403M with operating income up to $55M from $9M. “These results reflect the strength of our unprecedented portfolio of brands, a constant focus on creativity and innovation, and the continued success of our long-term strategy,” Iger says.

Related stories

The Takeaway On A Record Holiday Weekend? Be Fearless In Making Good Movies And Audiences Will Come

Disney Fiscal Q1 Earnings And Revenues Beat Expectations

Get more from Deadline.com: Follow us on Twitter, Facebook, Newsletter