Netflix (NASDAQ:NFLX): Valuation is Still Reasonable - but Sentiment Will Drive the Price

This article originally appeared on Simply Wall St News.

Netflix, Inc. ( NASDAQ:NFLX ) has been a standout performer over the last two weeks. While the broader market, and specifically technology stocks, have declined the most since May, the price of Netflix shares has gained over 13%. This move has largely been attributed to the success of the new hit show Squid Game, which is on track to become the platform’s most streamed show. Netflix has also dominated the ratings in the latest Nielsen Top10 Streaming programs surve y.

The latest price move confirms the stock’s breakout from a trading range which has frustrated market participants for over a year. Potential investors may now be wondering whether it's still worth chasing the stock at current levels.

See our latest analysis for Netflix

What is Netflix worth?

Our rough estimate of the fair value of Netflix, based on analyst forecasts, is $780. This implies there would only be 19% upside from the current price before the stock would be fairly valued. However, we should keep in mind that for most of its trading history Netflix has been labelled as expensive.

The stock is currently trading on a price-to-earnings (P/E) ratio of 64X, which is very high compared to most stocks, but actually historically low for this company. The risk to this price multiple is the fact that forecast earnings growth over the next few years is expected to lag the entertainment industry (23.4% vs 31.9%). This means that earnings forecasts will probably need to rise to maintain the price multiple.

Improving profitability

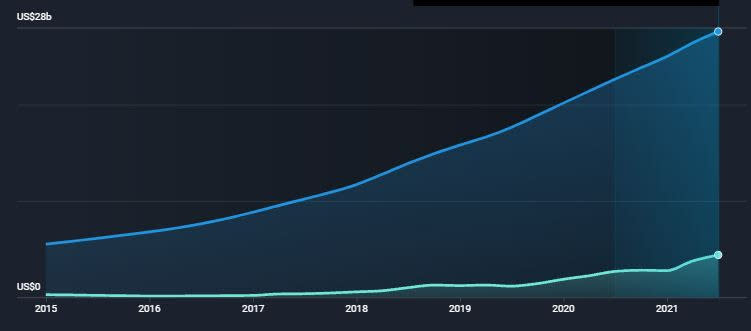

Until recently, the key metric for Netflix was subscriber growth. Until 2019, the company was barely profitable and operating cash flows were negative. Investors were more concerned with growth and the potential for future profitability.

As the following chart illustrates, the situation has changed since 2019 with earnings beginning to accelerate as more revenue makes it the bottom line. The company is now benefiting from economies of scale and margins play an increasing role in the company’s intrinsic value . In addition the company has demonstrated that it has pricing power and can increase prices without losing too many customers.

NasdaqGS:NFLX Past Earnings and Revenue Growth October 8th 2021

Netflix is facing increased competition and market saturation in North America - but is countering these headwinds with new products. The company is investing in video gaming and has also begun to sell merchandise for its top shows - including for Squid Game.

Sentiment still Drives Price in the Short Term

While subscriber growth is less crucial to the company than it was in the past, the stock price is still very sensitive to news and sentiment. In January this year the stock price gapped 18% higher when the company reported higher than expected subscriber additions , despite lower than expected EPS. Then in April, the stock price fell 8% when subscriber growth stalled unexpectedly.

The rally we have witnessed over the last few weeks has also been spurred on by news rather than hard data related to revenue or profitability. Historically the stock price has been sensitive to the new content it releases each quarter.

Another point to note is that Netflix does not manage investor expectations in the way other companies do. A lot, if not most, companies provide guidance that leads to estimates that can be beaten more often than not. Netflix guidance is often more accurate, but sets a higher bar when it comes to beating estimates. This means the company does miss estimates quite often, which can lead to volatility.

What this means for you:

Netflix stock price doesn’t appear unreasonable despite the fact that it is trading at a new all-time high. But the stock is still very sensitive to news flow and sentiment. This means investors should be cautious chasing the stock, and may want to wait for negative news to create a better buying opportunity.

The company will be releasing third quarter results on 19th October, which may lead to updated forecasts. Analyst estimates and the valuation model are updated daily on our analysis page for Netflix.

If you are no longer interested in Netflix, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com