Netflix’s Hold on Viewers Is Eroding – and the Competition Is Catching Up | Charts

It was just a year ago that Netflix’s stock was lingering in the $200 doldrums after it shocked the industry with alarming subscriber losses, kicking off a wholesale reconsideration of the streaming wars.

Since then, its shares have rebounded, more than doubling from its 52-week low, as its recent earnings results reassured Wall Street that efforts like a crackdown on shared passwords and an ad-supported tier were paying off in renewed growth, and Hollywood’s strikes didn’t seem to be having a visible impact on subscriptions.

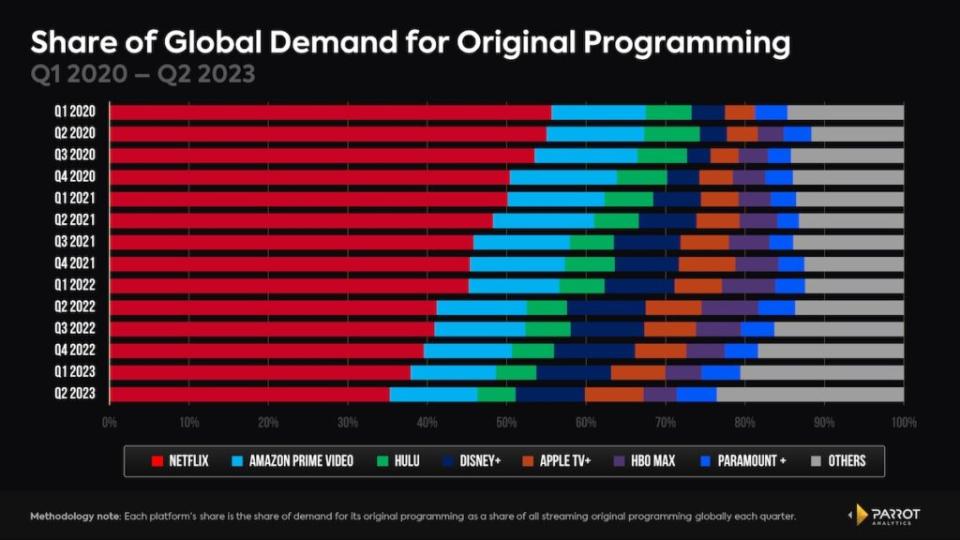

While it remains far larger and more profitable than the competition, there’s a longer-term cause for alarm in Netflix’s performance. Over the past three years, Netflix’s global share of demand for original series has steadily eroded, according to Parrot Analytics‘ data, which takes into account consumer research, streaming, downloads and social media, among other engagement.

In the second quarter, it reached a record low of 35.3%, down nearly 20 percentage points from its early-pandemic level of 55% in the second quarter of 2020. While its rivals aren’t anywhere near that level of demand, they’ve collectively nibbled away at Netflix’s lead. Both Apple TV+ and Paramount+ reached record highs in global demand share in the second quarter, at 7.4% and 5% respectively.

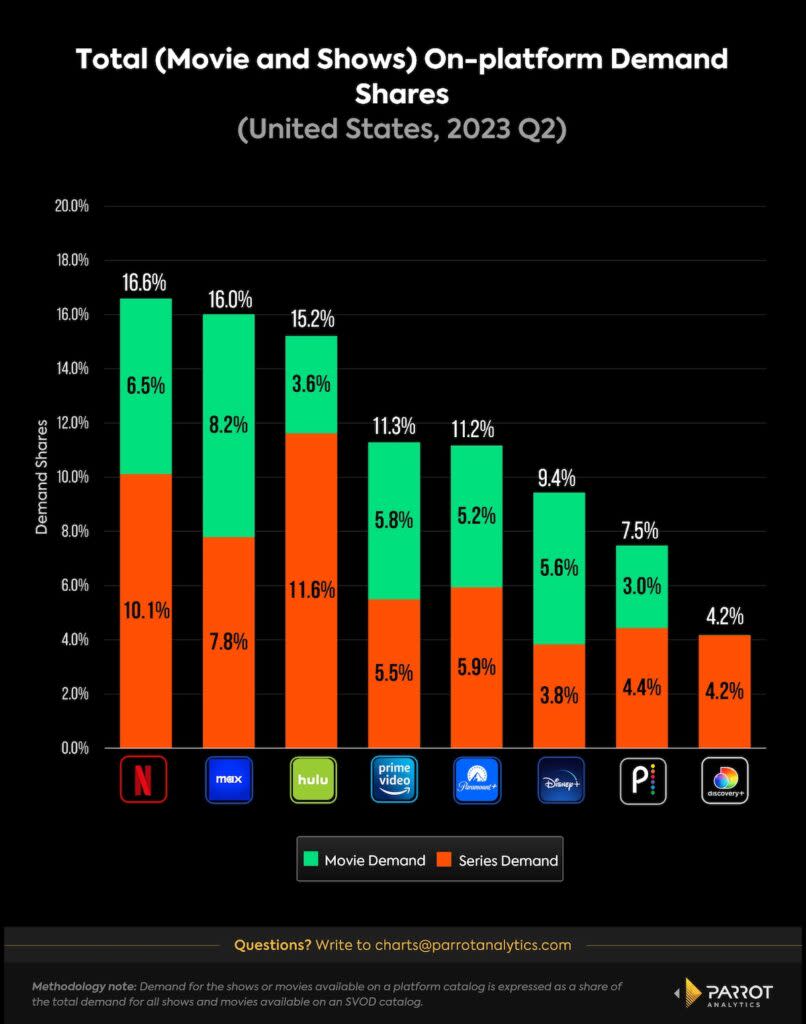

While original content fuels subscription growth, library content plays a vital role in retaining customers. This is becoming increasingly important in the streaming landscape as consumers now have more choices and find it easier to cancel subscriptions. Netflix still holds the top spot in on-platform demand share in the U.S. market, but its lead has narrowed significantly this quarter.

This could largely attributed to Warner Bros. Discovery’s relaunch of Max, now enriched with much of the Discovery+ catalog. In the first quarter, Netflix led with 17.9%, a 2.1% advantage over Hulu’s 15.8%. Now Max is in second place and Netflix’s lead is down to 0.6%.

Netflix’s dominance is further threatened by other players such as Disney, which has unveiled plans to merge Hulu and Disney+ into a single app. The total on-platform share of the combined service would account for nearly a quarter of all content demand among U.S. consumers.

All the same, Netflix remains Wall Street’s favored entertainment media stock. If the advertising tier continues to grow and efforts to prevent password sharing bolster revenue, Netflix is likely to keep its position as the most profitable premium streamer in the industry, even if it no longer has a lock on audience loyalty.

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

The post Netflix’s Hold on Viewers Is Eroding – and the Competition Is Catching Up | Charts appeared first on TheWrap.