Netflix’s $5 Billion Rumble Into WWE’s ‘Monday Night Raw’ May Shake up Live Sports

- Oops!Something went wrong.Please try again later.

Netflix is ready to rumble after closing a $5 billion, 10-year media rights agreement with TKO Group Inc. for WWE’s “Monday Night Raw,” a major step in advancing its live programming ambition as well as an opportunity for the streamer to shake up the live sports category that linear TV networks have long dominated.

As sports continue to shift to a streaming future, Netflix’s entry into the space is inevitable, analysts said, and will only add to the struggles for its pay TV competitors by creating upward pressure on rights costs going forward.

Where it has scale, Netflix could outbid its legacy media competitors, including Disney’s ESPN, Comcast’s NBCUniversal, Warner Bros. Discovery, Paramount and Fox, for exclusive live rights to major sports events and boost its earnings from those rights, Morgan Stanley analyst Benjamin Swineburne wrote in a note to clients. “That’s an enviable competitive position to be in,” he said.

Entering the ring

Netflix co-CEO Ted Sarandos emphasized during last week’s earnings call that the WWE deal does not signal a change to its sports-adjacent programming strategy, maintaining the company has “not seen a profit path” in “renting big sports.”

Still, the addition of live year-round WWE content offers Netflix entertainment programming with a global audience at an “affordable price,” streaming media analyst Dan Rayburn told TheWrap. The $500 million price tag for one year translates to about 2.9% of the roughly $17 billion Netflix plans to spend on content in 2024. Rayburn anticipates that “Raw” will give Netflix “long viewing times, great engagement and higher ad CPMs” without having to pay to license expensive sports rights.

“Raw” is currently the No. 1 show on NBCUniversal’s USA Network and one of TV’s best-performing shows in the 18-49 advertising demographic, bringing in 17.5 million unique viewers over the course of the year. That deal, which is valued at about $265 million per year, runs through October 2024.

Starting in 2025, Netflix will be the exclusive home of “Raw” in the U.S., Canada, U.K. and Latin America, with additional countries and regions to be added over time. The deal also includes all WWE shows and specials outside the U.S., including “Raw,” “Smackdown,” “NXT” and live premium events like “WrestleMania,” “SummerSlam” and “Royal Rumble.”

Netflix’s WWE deal marks the first time that “Raw” has left linear television since its inception in 1993, the streamer said in announcing the deal last week.

Its access to WWE in overseas markets will help Netflix perform better where that programming best resonates, such as India, Lightshed Partners analyst Brandon Ross said in a Jan. 23 blog post. India has the biggest WWE fanbase outside of the U.S., with more than 335 million unique TV viewers annually.

The WWE deal also gives Netflix flexibility to look for growth beyond paid sharing. Wells Fargo analyst Steve Cahall estimates that annual ad revenue from the Netflix-WWE deal could hit $260 million in the U.S. — roughly 15% of the bank’s $1.7 billion U.S. and Canada ad revenue estimate for the streamer for 2025 — and $35 million each in the United Kingdom and Latin America.

Netflix’s ad tier, which was not material to earnings in 2023, has surpassed 23 million monthly active users globally and now accounts for 40% of all sign-ups. The offering’s base grew by nearly 70% quarter over quarter, supported by product improvements and the phasing out of Netflix’s basic plan for new and rejoining members.

“WWE is a gateway drug,” Laura Martin, Needham & Company senior entertainment and internet analyst, Laura Martin told TheWrap. Netflix is “going to find it drives viewing and retention, so then they’ll buy some other types of rights.”

WWE’s award-winning documentaries, original series and forthcoming projects will also be available on Netflix internationally beginning in 2025. The streamer has the option to opt out of the agreement after five years as well as extend it for an additional 10 years.

Sports’ streaming shift

In recent years, live sports has grown its footprint in streaming, with Prime Video acquiring rights to “Thursday Night Football,” Apple TV+ acquiring “Friday Night Baseball” and “Major League Soccer,” and YouTube TV acquiring the NFL Sunday Ticket, all in multi-billion-dollar deals.

Most recently, Peacock obtained exclusive rights to the AFC Wild Card game between the Dolphins and the Chiefs, which resulted in the platform’s largest single day ever in audience usage, engagement and time spent with 27.6 million total viewers.

Streaming services are currently using live sports as “loss leaders,” Insider Intelligence analyst Ross Benes told TheWrap, noting that they usually don’t generate enough advertising or subscription revenue to justify paying for expensive sports rights in the short-term. But over the long-term, sports on streaming platforms generates consumer awareness, gets people habituated into using the service, and signals to advertisers their commitment to generating consistent ad inventory, he said.

“Right now there’s a $66 billion a year growing pot of streaming subscription revenues in the U.S., and sports leagues want to tap into that to justify bigger rights deals in the future,” Benes said. “WWE made the boldest move to lay stack to some of those dollars, sports leagues will follow.” The analyst predicted that bidding by streaming services will boost the demand for sports rights, which will result in more expensive deals when rights to broadcast leagues like the NBA come up for renegotiation.

WWE is a gateway drug… it drives viewing and retention, so then they’ll buy some other types of rights.

Laura Martin, analyst with Needham & Company

Could Netflix make the sports rights bubble pop?

Despite its growing presence on streaming, sports rights remain a linchpin of the pay TV bundle, which has allowed sports leagues to command increasingly higher fees to broadcast games on linear even as its subscriber base declines.

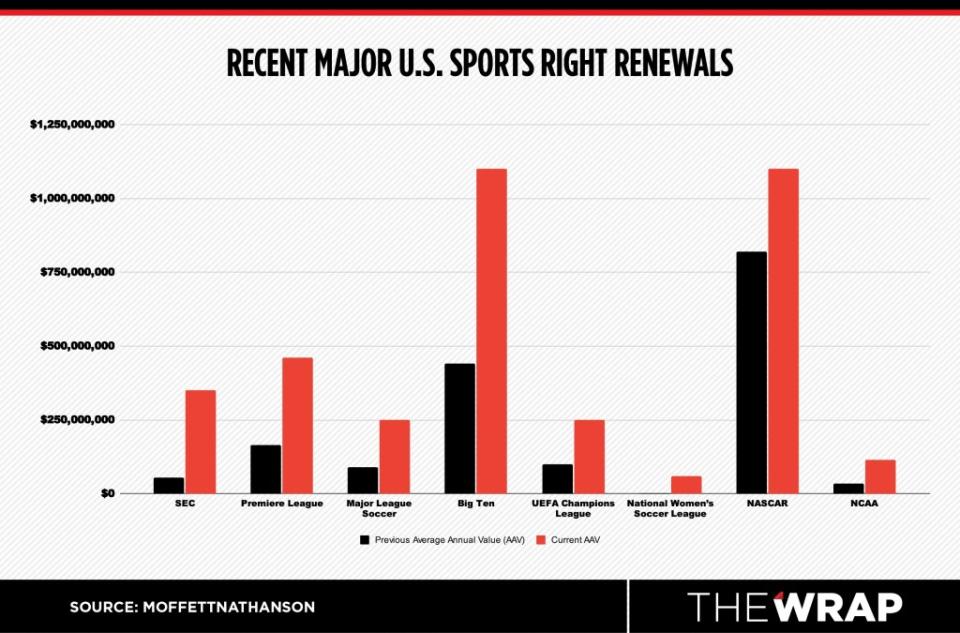

In a note to clients on Monday, MoffettNathanson estimated that ESPN’s $350 million per year deal for the Southeastern Conference in 2020 increased the average annual value of the conference package by 536%. The English Premier League ($460 million pear year), Big Ten ($1.1. billion per year), Major League Soccer ($250 million pear year) and UEFA Champions League ($250 million per year) have also seen more than 150% increases in their latest renewals. Not to be outdone, the NCAA ($115 million per year) and NASCAR ($1.1 billion per year) have also seen the value of their media rights jump by 238% and 40%, respectively, according to the firm.

Swineburne argued that the Netflix-WWE deal is a “net negative” to traditional sports broadcasters that “puts upward pressure on the cost of live entertainment and likely live sports.”

He stopped short of predicting the deal with the streamer will fuel a “new sports bubble” but said Netflix-WWE “is a real new headache” for traditional sports broadcasters already facing a series of difficult rights renewal decisions while navigating accelerating cord-cutting.

“If Netflix bids away sports from linear, and linear TV erodes more quickly, rights holders may in fact end up with fewer bidders in the future than they would if Netflix stayed out of the business,” Swineburne said.

To bid or not to bid

Despite “Raw” leaving USA Network and Peacock in October 2024, WWE’s premium live events in the U.S. will still be available on Peacock through a five-year deal valued at $1 billion, or $200 million per year, lasting until March of 2026. NBCU will benefit from a likely near-term bump in popularity but will have to pay for that popularity later during its WWE renewal negotiations, Ross warned.

MoffettNathanson expects NBCU to make a bid to renew its Peacock – WWE deal, but said with “high certainty” that Netflix will be at the table as well, resulting in a contested rights negotiation. The firm estimates that the negotiations could lead to at least a 75% increase in the average annual value for the WWE Network domestic package to $350 million from $200 million.

WWE’s “Smackdown” will move from Fox to USA Network in October 2024 through a five-year deal valued at $287 million per year, while “NXT” shifts from USA Network to The CW in a five-year deal valued around $25 million per year.

When it comes to upcoming sports rights, all eyes will be on the expiration of ESPN and Turner Sports’ NBA rights at the end of the 2024-2025 season. “Most traditional media companies are competing for NBA rights,” Ross said. “Now there is no fallback option.”

While Benes does believe Netflix will eventually get involved in bidding for live sports, he does not anticipate the shift happening overnight.

“WWE allows them to get into live programming for much cheaper than if they purchased NBA rights,” he said. “They may snap up rights to less sought-after leagues, or get international rights to show games outside their primary countries. But they probably won’t bid on packages that command near $100 billion for another few years.”

A spokesperson for Netflix did not respond to TheWrap’s request for comment.

The post Netflix’s $5 Billion Rumble Into WWE’s ‘Monday Night Raw’ May Shake up Live Sports appeared first on TheWrap.