Take That, Netflix: 39% of Subscribers Will ‘Most Likely’ Cancel Subscriptions if Prices Increase, Study Says

Netflix might want to think twice about that reported post-SAG-strike price hike.

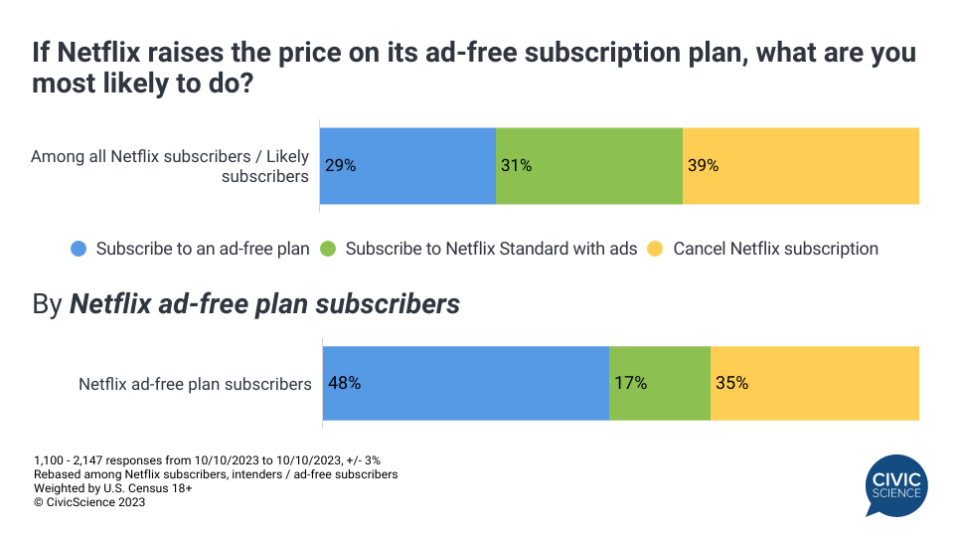

According to a new study by CivicScience, if the streamer raises prices on its ad-free tier 39 percent of all Netflix users say they will “most likely” cancel their subscription outright. Another 31 percent say they will mostly likely choose to subscribe to Netflix with ads. The rest, about 29 percent, plan to subscribe to ad-free Netflix.

More from IndieWire

'The Cow' Director and Iranian Film Pioneer Dariush Mehrjui Murdered with His Wife - Reports

Suzanne Somers, 'Three's Company' Star and Wellness Mogul, Dead at 76

When isolating the ad-free users, the numbers change a bit: 35 percent say they’ll likely cancel Netflix, 17 percent plan to downgrade to ad-supported Netflix, and 48 percent will probably stay put. The main difference between the two POVs is, obviously, that those already on Netflix’s ad-supported tier would be unaffected by a price increase at ad-free, and thus would maintain their own status quo.

Readers can see the data in graph form below.

CivicScience had “close to” 4,000 U.S. (and Puerto Rico) adult respondents to its survey, which it conducted October 10 — one week after the Wall Street Journal reported Netflix’s intention to raise the monthly rate for its ad-free users. The report did not have a dollar amount or a date for the price hikes.

Netflix is “discussing raising prices in several markets globally,” WSJ wrote, “but will likely begin with the U.S. and Canada.”

Not all price hikes are equal, of course. And what the CivicScience survey “doesn’t adequately address,” per Wedbush Securities analyst Alicia Reese, “is the precise price elasticity of its users.” A lump sum of users may indeed scrap Netflix at a $5 monthly increase, but probably not for a dollar or two.

Netflix, a data-driven company itself, knows this. The streamer is regularly doing more market research on its own users than a one-off CivicScience survey. (No offense to CivicScience; this is just how it works.)

If an instant 35-39 percent chunk of churn sounds astronomical, it would be devastating to Netflix. So that’s not going to happen; it’s just what could happen with the wrong execution.

“Similar to prior years in which they instituted a price increase, (Netflix) would not do so without careful analysis in order to limit churn,” Reese told IndieWire. “If Netflix’s research shows that they will lose one-third of their premium subscribers on a $1 monthly price increase, they would be unlikely to implement the price increase.”

Colin Dixon of nScreenMedia also doesn’t see a third (or more) of Netflix users bailing after the next price increase. Survey respondents can be all talk, he said. “I haven’t seen a strong correlation between the number of people who say they are going to quit and those who actually do.”

But still, Netflix ought to tread lightly here. “They are now pushing the upper boundary of what they can charge before they see a substantial decrease in subscribers,” Dixon emailed us.

At the October 12 Bloomberg Screentime event, Netflix co-CEO Ted Sarandos said he had “nothing new to announce” in terms of price increases. “Our pricing philosophy has not changed, which is we have to add more value to the consumer,” he said. “And then we come back and ask them to pay a little bit more for it if they if they agree.”

Incredibly, Sarandos added: “We really don’t spend that much time on trying to figure out how much we’ll get you to pay.”

The purported Netflix plan was to wait out the actors strike — but in early October, there was more optimism surrounding those negotiations. The breakdown in the SAG-AFTRA and AMPTP talks buys Netflix time to reconsider — and gives Netflix users time to consider their options.

Netflix declined comment to IndieWire on both the reported price increase and the CivicScience findings.

Of Netflix’s more than 238 million global paid subscribers as of the end of June, 73 million came from the U.S. & Canada. We’ll get an update on Netflix subscribers — and maybe a bit more about the reported price hike — when the company reports third-quarter results October 18.

CivicScience found that the more one watches Netflix, the more likely they are to subscribe to an ad-free plan: These are the consumers who feel they are getting their money’s worth. While “weekly” users of Netflix would “drop significantly” from ad-free, it is the “monthly” users who are most likely to switch plans and/or drop out of the ecosystem completely.

A CivicScience study in August found that inflation is taking a significant toll on streaming subscriber numbers. The group’s monthly tracking finds that 33 percent of U.S. adults “have reduced or plan to reduce spending on streaming subscriptions” — up from 28 percent in January. The monthly percentage of those with four or more streaming subscriptions has steadily declined all year.

Thirty-seven percent of Netflix ad-free subscribers, and 24 percent of ad-supported subscribers, expressed “increased price sensitivity over the last year.” (Drilling down further, it is the 35-54 crowd that is the most price-sensitive and the most likely to ditch Netflix.)

The Hollywood strikes are also having an impact. Recent CivicScience data finds that 29 percent of streaming users say they are having trouble finding content to watch, up from 24 percent in pre-strike April. More than a third of the respondents who said they would cancel Netflix due to a price hike said they are running out of content. Less than 25 percent of ad-free users had the same complaint.

Currently, Netflix’s most-popular (and least expensive) commercial-free plan is $15.49 per month. The Premium plan is $19.99/month.

Price increases have Netflix playing catch-up, for once. Rival Disney has recently been the most aggressive streamer when it comes to price increases. As of today, October 12, ad-free Disney+ and Hulu are getting more expensive.

Discovery+ recently announced its first price increase since launching in January 2021. Beginning November 2, ad-free Discovery+ will cost $8.99 per month, up $2 from $6.99/month. Discovery+ with ads will remain $4.99 in the U.S.

Peacock, Max (then HBO Max), Starz, and other streamers also raised rates in 2023.

Netflix, which added an ad-supported tier in November 2022, has not directly raised prices since January 2022. It has, however increased the monetization of former freeloaders via a password-sharing crackdown. And the ads are beginning to pay off: Netflix’s ad-supported tier is delivering higher ARPU (average revenue per user, or what Netflix calls ARM — average revenue/member) than the more-expensive ad-free options.

Brian Welk contributed to this story.

Best of IndieWire

Guillermo del Toro's Favorite Movies: 54 Films the Director Wants You to See

The Best LGBTQ Movies and TV Shows Streaming on Netflix Right Now

Nicolas Winding Refn's Favorite Films: 37 Movies the Director Wants You to See

Sign up for Indiewire's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.