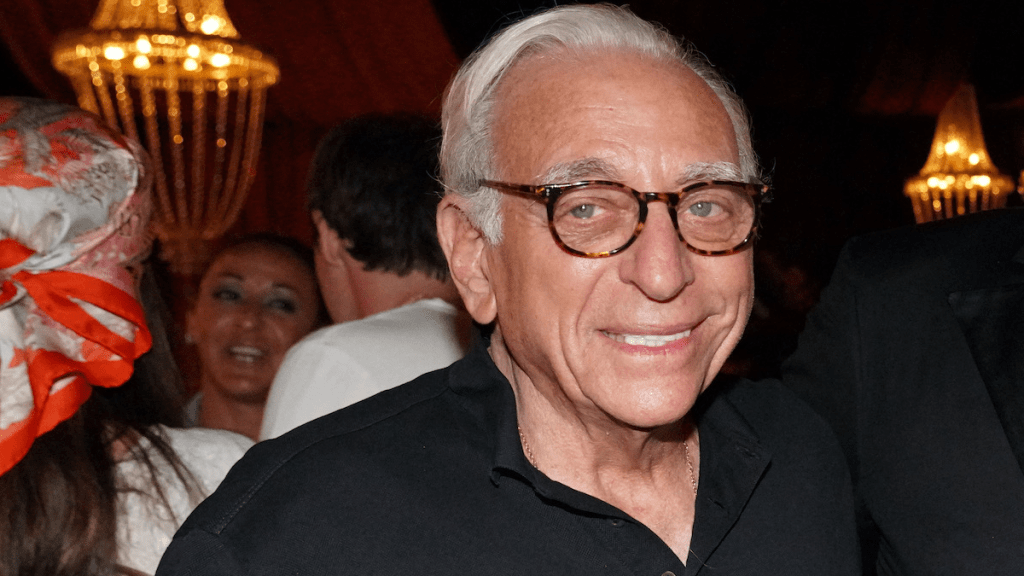

Nelson Peltz Slams Disney’s Sports Streaming Joint Venture, $1.5 Billion Epic Games Stake

- Oops!Something went wrong.Please try again later.

Nelson Peltz has targeted Disney’s new $1.5 billion stake in Epic Games and sports streaming joint venture with Warner Bros. Discovery and Fox, in a letter sent to shareholders on Wednesday.

Peltz and his firm Trian Fund Management, who beneficially own $3 billion in Disney stock, has argued that entertainment giant has “woefully underperformed its peers and its potential,” which it blames on a board that lacks focus, alignment and accountability.

In Wednesday’s letter, the activist investor argued that “throwing spaghetti at the wall” is not going to feed shareholders who have been “starved of returns for so long.”

Despite Disney recently beating earnings expectations for its first quarter of 2024, Peltz said that its streaming business lost another $1.7 billion during the quarter, its 2024 earnings per share estimates are down nearly 20%, and its stock price remains lower than a year ago. He added that two of Disney’s last five movies have failed to turn a profit and that the board has yet to identify a successor for CEO Bob Iger.

“With the stock waning and Disney facing another proxy contest, Disney appears to again be trying to distract shareholders with what we see as a fanciful tale, claiming it has “turned the corner and entered a new era.” And with that, Disney announced a slew of new promises and ideas — most still in the process of being developed — hoping that shareholders would just believe all was well and improving,” the letter states.

“This time, Disney’s spaghetti-against-the-wall “plan” includes a $1.5 billion-dollar strategic investment that, according to Disney’s own Chief Financial Officer, lacks a product roadmap or expected return targets, and a sports streaming venture that likely confused consumers, surprised important content partners and competes with the Company’s own services.”

“But frenetic activity, in the face of a proxy contest, is not a substitute for a well-considered corporate strategy. Nor is throwing spaghetti at the wall going to feed shareholders who have been starved of returns for so long,” the letter continued. “Disney shareholders need the company to consistently perform under the watchful eye of a vigilant Board. That is the recipe for good eating.”

Trian has nominated Peltz and former Disney CFO Jay Rasulo to stand election at Disney’s annual shareholder meeting set for April 3. The firm has also set several goals for the company, including:

Adopting best-in-class governance; finally complete a successful CEO succession; and align management pay with performance

Targeting and achieving Netflix-like profit margins of 15-20% by fiscal year 2027

Commiting to a reasonable, defined payback period and return profile on ESPN Flagship DTC and communicate it in detail prior to launch

A board-led review of creative processes and structure to restore leadership accountability and reclaim #1 box office position with leading economics

Executing on a clear vision for parks targeting at least high-single digit operating income growth to ensure adequate returns on about $60 billion of capital expenditure

The House of Mouse’s board has argued that Peltz and Rasulo lack the “appropriate range of talent, skill, perspective and/or expertise to effectively support Disney’s building priorities in the face of continuing industry-wide challenges.”

In addition to the Epic Games stake and sports streaming venture, Disney announced sequels to “Moana” and “Zootopia” and revealed that it has obtained the streaming rights to Taylor Swift’s Eras Tour concert film. It also confirmed that ESPN’s standalone direct-to-consumer offering will launch in fall 2025, increased its dividend from January by 50%, and set a $3 billion share repurchase program for fiscal year 2024.

“We are building for the future, taking the necessary steps to position Disney as the preeminent creator of global content and a leader in technological innovation, and our first quarter FY24 results show we’re moving in the right direction,” the company said in a letter to shareholders on Monday.

The post Nelson Peltz Slams Disney’s Sports Streaming Joint Venture, $1.5 Billion Epic Games Stake appeared first on TheWrap.