What you need to know for the week ahead

Coming off a holiday-shortened trading week, stocks are at record highs as November nears an end. On Friday, retail stocks led the S&P 500 and Nasdaq to all-time highs as retailers booked $7.9 billion in online sales on Thanksgiving and Black Friday, a 17.9% jump from a year ago. Amazon’s (AMZN) 2.6% gain on the day sent CEO Jeff Bezos’ net worth north of $100 billion. Retailers will remain in focus as consumers continue their holiday season shopping on Cyber Monday.

In the week ahead, the economic calendar will have some of the usual month-end data like auto sales, though the monthly jobs report will not be released this week despite Friday marking the first Friday of a new month. Other economic highlights should include The Conference Board’s consumer confidence reading on Tuesday, the second look at third quarter GDP on Wednesday, and the aforementioned November reading on auto sales due out Friday.

On the earnings side, things will be noticeably slower, with highlights coming from Kroger (KR), Jack in the Box (JACK), Workday (WDAY), Ulta Beauty (ULTA), and Barnes & Noble (BKS).

Economic calendar

Monday: New home sales, October (-6.8% expected; +18.9% previously); Dallas Fed manufacturing index, November (24 expected; 27.6 previously)

Tuesday: FHFA home price index, September (+0.5% expected; +0.7% previously); Case-Shiller home prices, September (+0.3% expected; +0.45% previously); Conference Board consumer confidence, November (123.8 expected; 125.9 previously); Richmond Fed manufacturing index, November (14 expected; 12 previously)

Wednesday: Third quarter GDP, second estimate (+3.2% expected; +3% previously); Pending home sales, October (+1.2% expected; +0% previously); Federal Reserve Beige Book

Thursday: Initial jobless claims (239,000 previously); Personal income, October (+0.3% expected; +0.4% previously); Personal spending, October (+0.2% expected; +1% previously); “Core” PCE, year-on-year, October (+1.4% expected; +1.3% previously); Chicago PMI, November (62 expected; 66.2 previously)

Friday: Markit U.S. manufacturing PMI, November; ISM manufacturing PMI, November (58.3 expected; 58.7 previously); Construction spending, October (+0.5% expected; +0.3% previously); Auto sales, November (17.5 million expected; 18 million previously)

Investors are mad for bitcoin

Last week, we noted that a prevailing theme in financial markets right now is certainty.

There is certainty from consumers about their economic outlook and certainty from Wall Street strategists about how the next year will look for markets.

But another side of certainty is hubris. If the only sure things in life are death and taxes, then who is anyone to say what will happen in the economy or the stock market next year? Surely, as we noted, contrarians will see the aligning views on how the future will look as a sign that surprises are ahead for investors.

Now, another aspect of the certainty around what the future will look like that we didn’t address is bitcoin and the enthusiasm around cryptocurrencies.

Bitcoin and cryptocurrencies may or may not overtake the modern financial system as we’ve come to know it since the turn of the 21th century. But the rising price of bitcoin has begun to make the future status of these assets seem like less of a wild card.

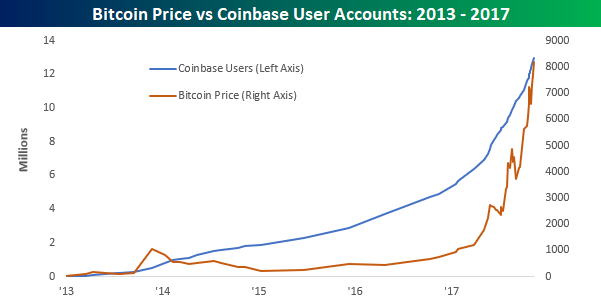

On Friday, Bespoke Investment Group noted that Coinbase, the most popular platform for trading bitcoin and other cryptocurrencies, now has more accounts than Charles Schwab. Not surprisingly, the number of accounts being opened has surged in the last year as the price of bitcoin has risen ten-fold.

Clearly, there is investor enthusiasm for bitcoin. But beyond a conviction among many investors that bitcoin prices are going higher, it’s less clear what this enthusiasm really means for bitcoin’s future.

A tweet that made the rounds this weekend pointed out that using Alexa rankings, Coindesk — one of the leading sites in the crypto space and a popular source of up-to-date bitcoin price quotes — is bigger than the Financial Times. This data point was then used to argue that cryptocurrencies and bitcoin are taking over the traditional finance industry.

Which, sure. Leaving aside almost all other potential issues with using this crude ranking as evidence that traditional finance is in decline relative to cryptocurrencies, a clear problem with this argument is that a raw rise in the popularity of a cryptocurrency website on its own does not signify anything other than that — increasing popularity.

But it’s these kinds of leaps of logic that have come to be a feature of the relative certainty with which cryptocurrency evangelists speak about the future of these assets in the global financial industry.

The scorn that finance industry leaders like Jamie Dimon and Larry Fink have shown for bitcoin have been used as evidence that these folks are scared of bitcoin’s rise, which we’re told poses an existential threat to their businesses. It would seem more likely, however, that Jamie Dimon simply thinks bitcoin is silly, an opinion he can have and one with which you can disagree.

Bespoke writes that the rise in Coinbase accounts shows that, “the idea that crypto-currencies users are just a fringe part of the financial universe is not accurate.” And we wouldn’t argue with that.

But the recent rise in the price of bitcoin is largely significant in and of itself — investors are mad for bitcoin. The leaps in confidence being made about bitcoin’s future as a financial asset simply because of its price increase are another side of the certainty that is permeating financial markets today.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: