Movie Theater Chains Brace for Summer’s Long Cool-Down

Movie theater giants may be on top of the world right now … but they are also staring off a cliff. It’s been a blockbuster few months for, well, blockbusters, and films like Top Gun: Maverick and Minions: The Rise of Gru proved that groups that may have been wary of returning to theaters (older moviegoers and young families) are willing to go back for the right film.

And yet, there’s a sense of foreboding in the air, as theater chains like AMC, Cinemark and Marcus Corp. reconcile great first-half momentum with what is shaping up to be a momentum-stopping second half of the year.

More from The Hollywood Reporter

China Box Office: 'Detective vs. Sleuths' Wins Weekend, 'Mozart From Space' Disappoints

Box Office: 'Where the Crawdads Sing' Takes $2.3M in Thursday Previews

B. Riley analyst Eric Wold writes that after the release of Thor: Love and Thunder, the only Q3 films with box office potential are the Brad Pitt-starring Bullet Train (which is not based on any existing IP) and the animated Dwayne Johnson and Kevin Hart starrer DC League of Super-Pets. “After that, the film slate is relatively bleak and tougher than typical summer doldrums,” Wold says.

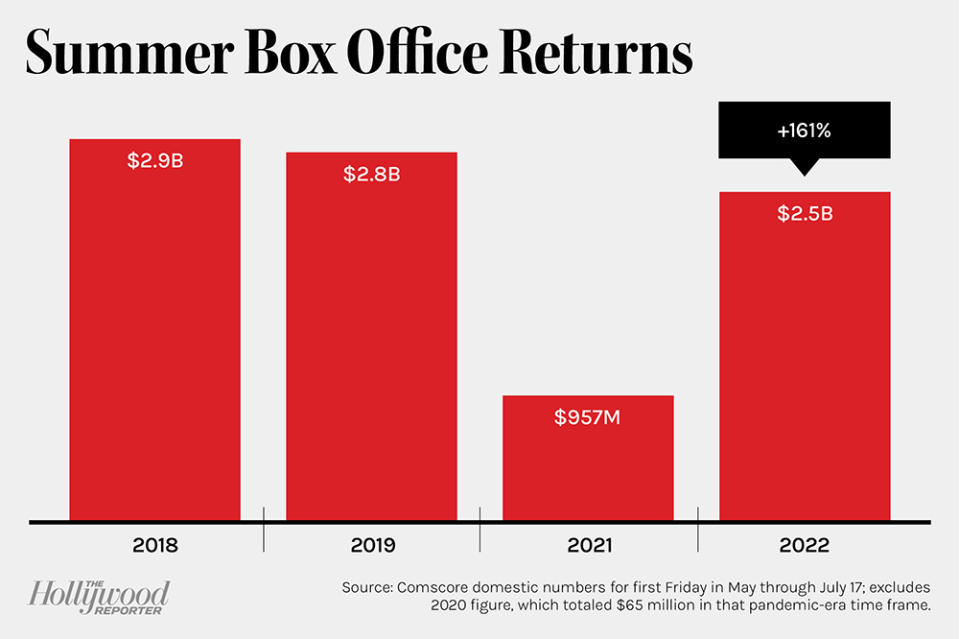

That’s a big reason Wold and B. Riley revised their 2022 box office projections to reflect a 28 percent decline this year as compared to the last pre-pandemic year, 2019. (B. Riley projects 2023 box office revenue to be down only 7 percent from 2019.)

And that lack of product already has Cinemark chief Sean Gamble and AMC CEO Adam Aron — who has leveraged enthusiasm from retail stock traders to keep his company’s share price high — planning their next moves. Aron, who hosted a Top Gun: Maverick screening in a Washington, D.C., suburb July 14 for AMC investors (attendees posted photos of themselves on Twitter with the “Silverback,” as they call him), in July teased a cryptic announcement from the company, signaling his next move will coincide with the doldrums of August, the beginning of what is shaping up to be the weakest part of the theatrical calendar this year. That may be the perfect time to make a splashy move to keep retail traders engaged.

“I keep getting asked ‘Wen pounce?’” Aron tweeted, referencing online chatter asking him when AMC will “pounce” on a new business opportunity. “I’ve said publicly a pounce would not happen before Second Quarter 2022 earnings are announced. 3. Press release issued today that Q2 earnings to be announced on Thurs, August 4. Read between those lines.”

But it’s not clear whether Aron’s next pounce will be something to shore up its theatrical business — Wold says he sees “an opportunity to continue the strategy of improving the overall theater base as discussions for additional transactions remain ongoing – and in markets where DOJ interference is unlikely” — or if it will be an out-of-left-field move to placate online traders, like AMC’s $27.6 million investment this year in a Nevada gold mine.

But as grim as things seem, there remain silver linings. MKM Partners managing director Eric Handler observed in a July 8 note that the Richard Gelfond-run Imax may be uniquely positioned to flourish this year, despite the slate of potential U.S. blockbusters slowing to a trickle.

Writing that “sentiment toward Imax remains overly bearish,” Handler adds that Imax’s “asset-light” business model and exposure to China will work in its favor.

Despite many of China’s cinemas being shuttered in the first half as the government issued strict COVID-related lockdowns, their reopening should make for a rapid bounce back. In fact, he says that “movie-going will snap back relatively fast in China (as it did when the country first reopened in late 2020, early 2021) and provide a nice tailwind in the back half of this year.”

And, somewhat counterintuitively, Wold argues that theatrical exhibition companies “can be viewed as somewhat of a safe haven within the consumer and entertainment spending segments.”

The risk to businesses reliant on streaming subscriptions is that it is very easy to cancel and churn out whenever consumers feel pressure on their wallets, and while moviegoing has certainly gotten more expensive (inflationary pressures spare no business) other in-person entertainment options remain even more expensive.

“Not only is moviegoing an entertainment option that is available close to home, but the price point relative to other local entertainment options (e.g., sporting events and concerts) is attractive,” Wold writes. “With consumers typically looking for an escape in these environments, having exclusive theatrical windows will drive that purchase decision, in our view.”

With the big entertainment companies seemingly poised to return to a theatrical-first distribution strategy, exhibitors could be the winners. Of course, nothing is without risk. While there are stronger titles on tap in Q4 (Black Panther 2, Avatar 2, Black Adam), a fresh fall COVID surge could spoil some of that fun.

Source: Comscore

This story appeared in the July 20 issue of The Hollywood Reporter magazine. Click here to subscribe.