Most Viewers Watch Only One Program on the Major Streamers – and Chances Are It’s These 6

You’ll be surprised to learn that across most premium streaming video-on-demand (SVOD) services in the United States, more than half of viewers watch only one of the top programs on any given platform, according to a recent report from third-party streaming viewership firm Samba TV. That may sound blasphemous to proud binge watchers accustomed to hopping from series to series, but it’s more in line with recent viewing habits.

In other words, when a subscriber logs on to, say, Netflix, HBO Max or Disney+, they are likely to select just one of the top 50 titles offered on that platform before calling it a day. That makes these titles among the most valuable in their respective libraries as first-watch selections, a criteria the major streamers play close attention to.

“A critical finding in the Q2 report points to the need for streaming platforms to think differently about how they market their content,” Samba TV co-founder and CEO Ashwin Navin said. “With more than $40 billion being spent this year alone on new content, consumers are overwhelmed by choices. Platforms need to ensure they are driving smart strategies ahead of content launches to draw in not just built-in fans but broader viewers who may be interested.”

Also Read:

Amazon’s Commitment to Hollywood Is Serious, CEO Says: ‘We’re in It for the Long Haul’

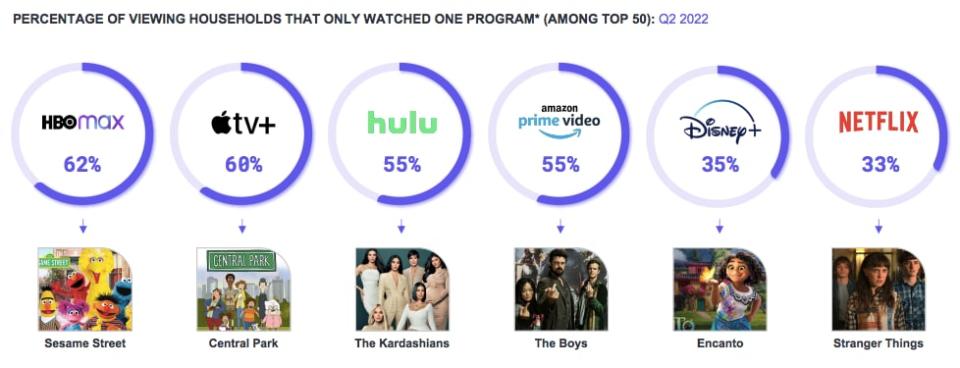

Samba TV found that top program viewers watched just one program among the streamer’s top 50 shows during the second quarter on HBO Max (62% of customers sampled just one title), Apple TV+ (60%), Hulu (55%) and Amazon Prime Video (55%). Disney+ (35%) and Netflix (33%) fared slightly better than the rest of the pack at convincing viewers to tune in for an additional title after their first selection. (Samba TV gathers viewership data via its proprietary Automatic Content Recognition technology on opted-in Smart TVs across 28 million U.S. devices, but does not account for non-TV devices such as mobile phones and laptops).

The highest-reaching shows among single-program viewers in the U.S. throughout Q2, according to Samba TV, were:

HBO Max: “Sesame Street”

Apple TV+: “Central Park”

Hulu: “The Kardashians”

Amazon Prime Video: “The Boys”

Disney+: “Encanto”

Netflix: “Stranger Things”

Using HBO Max an an example, throughout Q2 Samba found that 62% of Max viewers only watched one of the service’s top 50 programs. Among households that watched only one HBO Max program, it was most likely to be “Sesame Street,” according to the report. That holds true for the other streamers and their respective top picks as well.

Interestingly, HBO Max recently removed 200 episodes of “Sesame Street” as part of a larger strategic cost-cutting measure to pull back from live-action kids and family content. Perhaps the company should rethink that decision before abandoning the genre completely.

Meanwhile, “The Boys” and “Stranger Things” have cemented themselves as flagship series for their respective streamers while “Encanto” is one of the most popular movies ever released on streaming in terms of U.S. viewership hours since Nielsen began tracking streaming viewership in mid 2020. (And the animated film’s appeal to kids demands repeat viewing long after its November 2021 release.) “Central Park” topping Emmy winner “Ted Lasso” may be a big surprise for Apple TV+, which has built a carefully curated library of quality shows but has struggled to produce breakout broad-appeal hits.

Also Read:

What NBC Ditching the 10 PM Hour Could Mean – for Local Stations, Fans and Broadcast TV’s Future

Still, as the top choice for one-program viewers, these titles are highly valuable for engaging infrequent users, an audience demographic Netflix is known to highly prioritize. If a streamer can more actively engage an infrequent viewer, it lowers the risk of that customer canceling their subscription and increases the platform’s retention rate. Remember, streamers are all about securing that sweet, sweet monthly recurring revenue.

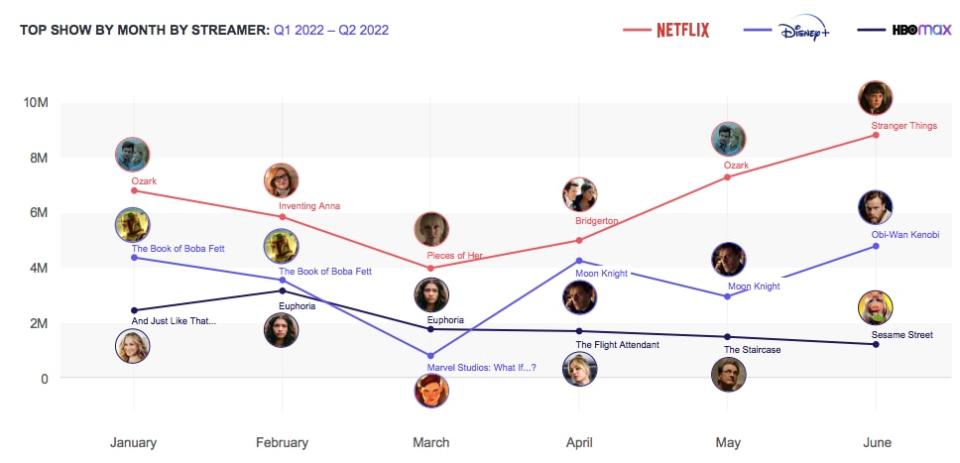

Samba TV found that “Stranger Things” was the most popular show across Netflix, HBO Max and Disney+ over the last six months with the series as a whole driving nearly 9 million tune-ins. That momentum helped Netflix reverse course from Q1, when the tops shows of February and March saw progressively lower viewership. Disney+ saw a similar boost in June from the “Star Wars” prequel series “Obi-Wan Kenobi,” which approached 5 million views.

At the same time, HBO Max has struggled to produce a new show that breaks 2 million views since the release of “Euphoria” in early Q1 (though Samba found that the brand-new “House of the Dragon” series premiere attracted 4.8 million U.S. households in its first four days of availability).

While the first-selection shows are positioned as crucially important to their streamers as gateway titles, the lack of interest that viewers seem to be displaying in sampling multiple titles underscores the obstacles these services face in viewer retention. This is an especially concerning trend as a looming recession threatens spending habits in the months to come.

Just one in five consumers plan to add an additional SVOD service in the next year, while 79% report keeping or even reducing their current subscriptions, according to a report from Screen Engine/ASI and streaming network FilmRise. As a result, streamers need to figure out how to funnel viewers from their top content choice — whether it be a “Sesame Street” or “Stranger Things” — to additional programming within their walled gardens.

“In today’s content streaming wars, just because you build it, doesn’t mean viewers will come to it,” Navin said. “We need to be much more strategic about how we drive engagement before, during and after launches.”

As the battles within the so called streaming wars continue to escalate, these consumer selections can be used as strategic signifiers as rival companies battle it our for our attention spans and subscription dollars.

Also Read:

Netflix’s Cloud Computing Cost Cutting Could Open the Door for Microsoft