There’s More to the Concert Business Boom Than Taylor Swift, Beyoncé

- Oops!Something went wrong.Please try again later.

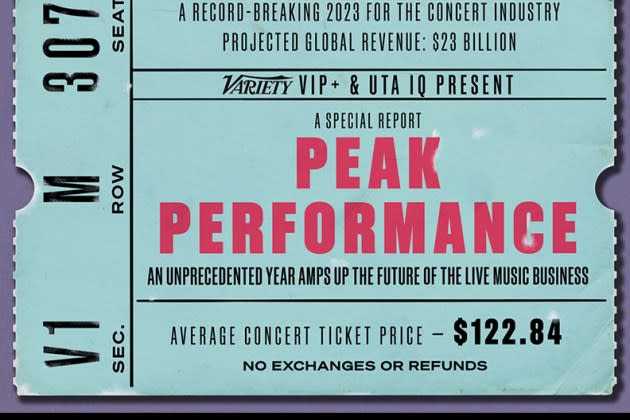

When Variety Intelligence Platform (VIP+) teamed up with UTA IQ, the research, analytics and insights division of the UTA talent agency to conduct a consumer survey in August to understand the market forces driving the explosion in the live-music industry, they learned a lot more was at play than just the success of Taylor Swift and Beyoncé.

With industry trade publication Pollstar estimating that the $5.7 billion global gross from the top 100 tours is up a whopping 50% in the third quarter of the year, the industry’s leading ladies definitely have a lot to do with bringing a flood of female fans to arenas everywhere. But the “Peak Performance” study found many data indicators that the 2023 concert boom was a more broad-based phenomenon.

More from Variety

Taylor Swift Drops Live Version and New Remix of 'Cruel Summer' From Eras Tour

Why Isn't Taylor Swift's 'Eras Tour' Playing in Theaters During the Week?

“The survey told a more more complex story about who exactly was driving the surge, not just this year but also pre-pandemic,” said Heidi Chung, VIP+ media analyst and correspondent on the latest episode of the Variety podcast “Strictly Business.” “Men were super under-appreciated in that sense.”

Listen to the podcast here:

For instance, Chung cited survey stats that found men were more likely to have gone to a concert in 2023, with 42% saying they’ve attended a concert in the past 12 months, compared to 31% of women.

Chung was joined by UTA IQ global head Joe Kessler, who shared an optimistic outlook for the business, citing the survey stat that more than half of all U.S. consumers ages 15-69 anticipate going to a concert in the next 12 months, which is higher than the 36% who have attended in the past 12 months or the 41% who went in 2019.

“That people are still willing to invest and spend more on their concert-going is, I think, indicative of the fact that this is going to sustain,” said Kessler. “How far ahead, I don’t know, that’s hard to say. But I think for the foreseeable future, we’re going to see a continued, very vibrant, live music business.”

There’s more to see in the 2023 VIP+ Peak Performance Study about the live music business:

Understanding what motivates audiences to attend concerts & festivals

Consumer attitudes toward ticket prices, resale platforms, different purchase methods

Live-music event discovery checklist, including breakdown of social-media preferences

Pre-pandemic vs. post-pandemic live-music behaviors and attitudes

Genre popularity at concerts/festivals across demos: pop, rock, hiphop, R&B, country, metal, etc.

Exploration of “music tourism” phenomenon: breakdown of travel habits and economic impact

Music festivals: ticket spending patterns, audience preferences, future outlook

Live-music venues: Top audience preferences and barriers to entry

How audience interest in concerts stack up to many other kinds of live events

Audience loyalty patterns: frequency and repeat attendance for same performers, tours

Gender differences in concert and festival attendance patterns

Future outlook: Gauging consumer intent beyond 2023 in demand for live-music

“Strictly Business” is Variety’s weekly podcast featuring conversations with industry leaders about the business of media and entertainment. A new episode debuts each Wednesday and can be downloaded on iTunes, Spotify, Stitcher and SoundCloud.

Best of Variety

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.