Millennial drinking habits show why White Claw and hard seltzers are just getting started

A new survey on millennial and Gen Z drinking preferences is delivering some hard news to the beer industry, which continues to lose ground to the rise of hard seltzers.

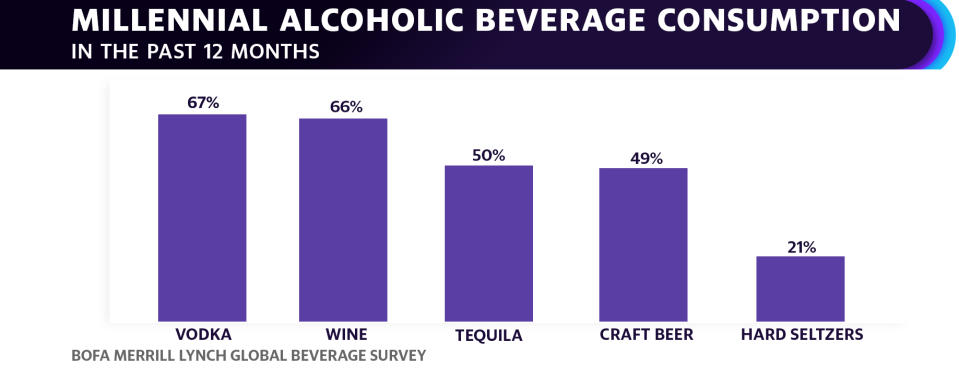

Bank of America Merrill Lynch’s global beverage survey, which polled younger drinkers aged 18 to 34 in the U.S. and the U.K., revealed a drop in millennial alcohol consumption as well as a continued shift away from beer being a drink of choice.

Overall, the trend among younger drinkers matches the decline in alcohol consumption seen within all age groups. While most millennials say they are drinking about the same as they did before, nearly one-third of participants said they are cutting back on drinking this year, compared to just 22% in 2018.

Beer ‘makes them fat’

For the millennials claiming to be cutting back, beer was the single-most eliminated beverage type. Of those saying they were drinking less beer, 37% said the reason was that beer had too many calories and that it “makes them fat.”

Perhaps more alarming than that for beer aficionados was that the survey showed younger drinker’s favor for hard seltzers still has a long way to go.

Despite the fact that hard seltzer sales grew at a clip of 164% in July over last year, still only about one-third of millennials and Gen Z consumers reported drinking hard seltzers recently. Nearly half of respondents said that their hard seltzer consumption was coming in addition to other alcohol. But the bulk of respondents, who said they were replacing other types of alcohol, listed beer as the leading displaced beverage.

With fewer calories, the malt liquor infused seltzers on the market today have offered a relatively healthier alternative for a younger and often more health-conscious alcohol consumer. Of the seltzers mentioned in the survey, Mark Anthony Group’s White Claw was noted as a share leader along with Boston Beer Company’s Truly (SAM), while Diageo’s Smirnoff Spiked Seltzer (DEO) seemed to have the largest upside with a 47% preference among young consumers, but only 5% market share. Since the explosion in popularity, beer brands have played catch up with Anheuser-Busch Inbev (BUD) acquiring what became Bon & Viv Spiked Seltzer and Corona-maker Constellation Brands (STZ) launching their own Corona Refresca seltzer line.

While the survey didn’t paint a positive picture for the beer market overall when it comes to younger tastes, Corona was a standout in knocking Bud Light from the top spot among younger beer drinkers. Interestingly, no craft beers cracked the top 10 most preferred beer brands.

Looking ahead, analysts expect beer to continue losing share to spirits as the alcohol of choice for Gen Z and millennial drinkers, since younger cohorts had an even stronger preference for vodka and tequila over beer.

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read the latest financial and business news from Yahoo Finance

Read more:

Investor who called the Great Recession explains why China is fueling bitcoin's rally

Trump's attack on crypto could push bitcoin up to $40,000 by year-end: Tom Lee

Illinois becomes the latest state to legalize marijuana, these states may follow

The Farm Bill could end the multimillion dollar industry of cockfighting

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews,LinkedIn,YouTube, and reddit.