Microsoft-Activision Isn’t the End of Video Game M&A – It’s Just the Beginning | Analysis

Video game IP has become hotter than ever in Hollywood, with films like the “Super Mario Bros. Movie” and television shows like “The Last of Us” dominating box office returns and streaming charts in recent months.

Microsoft’s $68.7 billion deal to buy Activision looks to be on the ropes after UK authorities moved to block it last week. But the need to fill all kinds of displays, from smartphones to consoles to 79-foot Imax projection screens, with engaging stories is only growing. Experts say more consolidation between streaming, gaming and other tech-driven media is likely, with regulators putting the brakes on only the very largest transactions.

“The convergence of the broader tech market and gaming is continuing and there are significant growth opportunities for tech companies that can execute on these types of deals,” Chris Stafford, a partner in the mergers and acquisitions practice at West Monroe, told TheWrap.

Also Read:

UK Regulator Blocks Microsoft’s $68.7 Billion Activision Blizzard Acquisition

Netflix is a prime example, having made video games a key part of its strategy to grow revenue and retain subscribers as streaming competition heats up. It acquired “Dungeon Boss” creator Boss Fight Entertainment and Helsinki, Finland-based Next Games in 2022 and “Oxenfree” creator Night School Studio the year before that.

Co-CEO Greg Peters emphasized the point on a call discussing the streaming company’s first-quarter results with analysts last month. Netflix, he said, was committed to making “must-play games that create buzz off the service and motivate people to sign up,” highlighting the link he saw between video games and streaming subscriber retention.

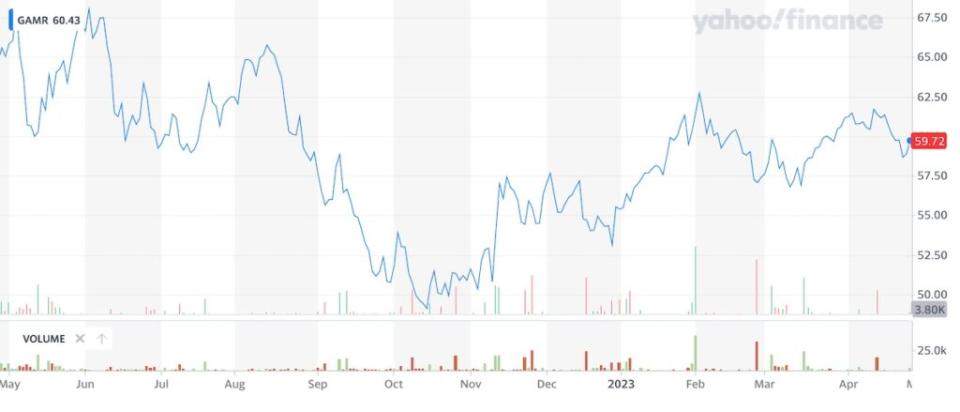

Within the gaming sector itself, consolidation continues, too. Sega agreed to buy “Angry Birds” maker Rovio for $776 million in April. Take-Two acquired Zynga for $12.7 billion a year ago. And Microsoft managed to acquire “Elder Scrolls” developer Bethesda in 2020 for $7.5 billion. After dropping for much of 2022, share prices in the sector have risen steadily since the fall, as measured by Wedbush Securities’ GAMR ETF, which tracks the sector and is up 8.5% since the beginning of the year.

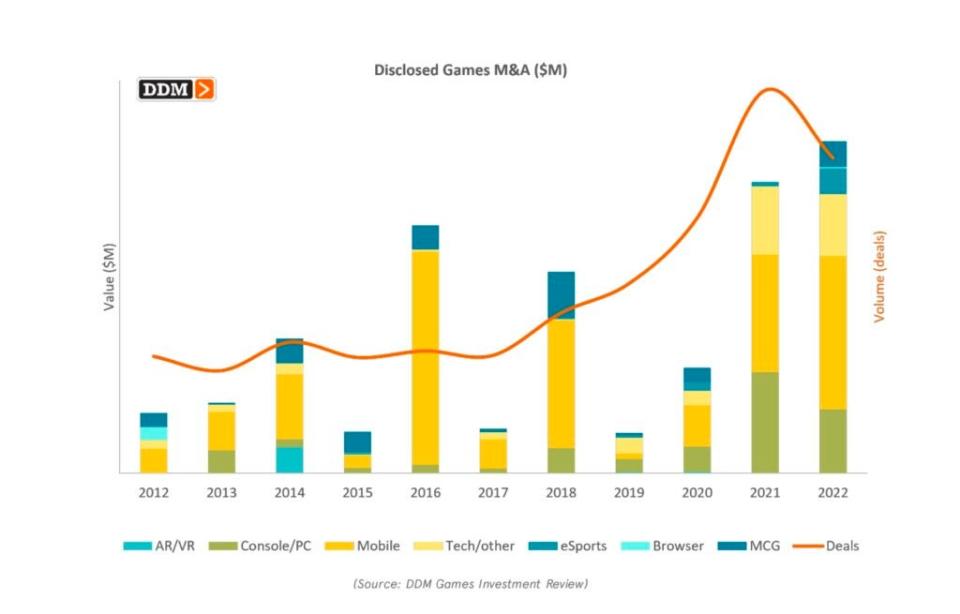

Video game M&A totaled $38.1 billion across 289 transactions in 2022, a record, according to a February report published by video game agency Digital Development Management.

Microsoft’s Activision deal would easily beat that, if regulators allow it. Wednesday’s decision by the Competition and Markets Authority to block the deal, along with the FTC’s pending lawsuit to stop the acquisition in the U.S., make it unclear if that will happen. But there are many other transactions that could still happen in the sector. Deloitte forecasts 25% growth in M&A in the sector in 2023, only a slight slowing of the pace of growth it saw in 2022.

Sizing up the players

Most of the major studios have flirted with video games over the years. Besides Sony, which has the giant PlayStation business and a library of games, only Warner Bros. is an active publisher today. Disney shut its games division in 2016 and NBCUniversal followed suit in 2019. They, along with Paramount, typically license entertainment IP out to video game makers.

Also Read:

‘Super Mario Bros.’ Proves That Universal Has a Box Office Gold Mine With Nintendo

And increasingly, the deals flow the other way: Universal teamed up with Nintendo for “Super Mario Bros.” and also have theme park deals, and Sony, which publishes the “The Last of Us” game, a longtime PlayStation exclusive, also co-produced the HBO series through Sony Pictures.

Given that, strategic tie-ups are possible with little overlap, though finding the right price and strategic combination may be difficult, experts said. Sarah Hindlian-Bowler, Macquarie’s head of technology research for the Americas, believes there’s more M&A between studios and gaming companies to come.

“I think studios and gaming companies will generally merge depending on fit, customer target base, and monetization opportunities,” she said.

Also Read:

Why Hollywood Has Turned to Video Games as Its Next IP Gold Mine | Charts

Brandon Ross of LightShed Partners is more skeptical, noting that it is “very hard for traditional media to buy interactive at this point given low multiples, cash needs and lack of expertise.”

If Hollywood doesn’t get in on the gaming action, tech companies still might. Apple and Amazon have made gaming part of their all-in-one subscription offers, which also include streaming services.

If the Microsoft-Activision deal closes, Digital Development Management noted that 2023 would become the single best year ever recorded for video game M&A with just one transaction.

“Nevertheless, even if this acquisition does not close, the gaming industry will continue to be on a consolidation path where strategics will continue acquiring game studios for capacity or to bolster the portfolio,” the firm added. “These acquisitions will only increase as macroeconomic pressures ease.”

Regulators on the march

The issues raised by regulators about the Microsoft-Activision deal don’t seem to apply to most potential deals in the space. Rather, they’re particular to Microsoft’s status as one of the world’s largest tech companies, its already large presence in the video game industry through its Xbox business and its growing push for cloud gaming.

In its final decision, the U.K.’s Competition and Markets Authority determined that Microsoft would “find it commercially beneficial to make Activision’s games exclusive to its own cloud gaming service.”

Also Read:

Federal Trade Commission Sues to Block Microsoft’s Acquisition of Activision Blizzard

Microsoft submitted a proposal to address some of the CMA’s concerns, which included promising to make games available on rival consoles or services for at least a decade. The CMA rejected that, saying that “preventing the merger would effectively allow market forces to continue to operate and shape the development of cloud gaming.”

In addition to the CMA, the Federal Trade Commission also moved to block the merger, filing a lawsuit in December. The FTC cited Microsoft’s acquisition of Bethesda as an example of how the company makes franchises that fall under its ownership into exclusive titles.

Microsoft and Activision have said they would appeal the U.K. decision, and Microsoft is fighting the FTC in court. Experts differ on whether such efforts — either to pursue legal remedies or to offer concessions to appease regulators — will succeed. The merger agreement terminates on July 18, though the companies could renegotiate the deal to extend that.

An Activision Blizzard spokesperson told TheWrap that the British regulator’s move “contradicts the ambitions of the U.K. to become an attractive country to build technology businesses.”

Also Read:

Meta Permitted to Buy VR Fitness Firm, Despite Monopoly Concerns – Here’s Why

Microsoft president and vice chair Brad Smith added that the CMA’s decision “rejects a pragmatic path to address competition concerns and discourages technology innovation and investment in the United Kingdom.”

The situation with Microsoft and Activision Blizzard is “consistent with a broader pattern of increased regulatory scrutiny on mergers and acquisitions” over the past several years, Stafford said.

Wedbush Securities analyst Michael Pachter saw the situation as more nuanced. The CMA’s decision reflects a regulatory environment that has become “extremely hostile to consolidation in tech, but tolerant of other mergers,” he said, noting that the WarnerMedia-Discovery merger and Disney’s acquisition of 21st Century Fox had similar issues but were ultimately approved.

“I expect a favorable resolution by the end of May” of the Microsoft-Activision deal, Pachter told TheWrap. “The CMA provided a road map to the concessions they are seeking, and Microsoft would be foolish not to concede.” The company could, for example, offer to maintain Game Pass pricing at $15 per month plus inflation, Wedbush wrote in an April 26 note to clients.

Also Read:

Activision Blizzard to Pay $35 Million to Settle Workplace Misconduct Reporting Probe

Hindlian-Bowler of Macquarie thinks the deal is “far from over” and criticized the CMA’s decision for relying on “fundamental misunderstandings … particularly around the competitive landscape of cloud gaming.”

The next play

If the deal falls through, Hindlian-Bowler said Activision would have to “rebuild and reassess its future growth drivers.” LightShed’s Ross thinks Activision could become a “horizontal consolidator” and go shopping itself.

Microsoft, meanwhile, would have the $68.7 billion it’s committed to Activision to play with. It could buy back shares or pursue smaller video game deals or a different type of acquisition altogether. It could, for example, throw its hat in the ring as a potential buyer for Hulu.

One way or another, Constellation Research analyst Ray Wang said, Microsoft would have to “find other ways to get to content to support its vertically integrated ambitions.” Those strategic considerations, as well as the increasingly overlap between audiences for Hollywood’s traditional fare and narratives spun out of video games, means more deals are likely. In gaming, it seems, everyone wants to level up right now.

Also Read:

Disney CEO Bob Iger Is Open to Selling Hulu – But Finding a Buyer Will Be a Challenge | Analysis