Meta Platforms (META) Launches Features to Drive User Growth

Meta Platforms META recently unveiled new features to switch between and create new accounts and profiles on Facebook and Instagram more easily.

Meta’s new features will allow both Facebook and Instagram users to switch between the two social media profiles through the same Accounts Center, and people can view their Facebook and Instagram profiles in one place.

To deal with rising security concerns, Meta is also concentrating on developing its privacy and security factors. In addition to its two-factor notification, which will still apply to the new updates, users will be updated if new Instagram and Facebook accounts are created using their existing accounts.

Meta’s legal woes are ever-increasing and negatively impacting user growth across its platforms. Early September 2022 Instagram was slapped by Ireland’s data regulators with a €405 million fine for violating the European Union’s General Data Protection Regulation and failing to protect children’s information.

Earlier in March, META was fined €17 million by the Irish regulator following an investigation into a data breach on Facebook. Last year, it was fined €225 million for violating privacy laws on WhatsApp.

Meta’s recent launch of new features will help users navigate its different platforms seamlessly and more securely. It expects these features to boost its user growth and drive ad revenues.

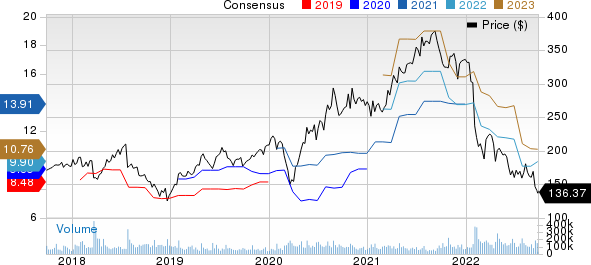

Meta Platforms, Inc. Price and Consensus

Meta Platforms, Inc. price-consensus-chart | Meta Platforms, Inc. Quote

Meta Driving User Growth to Boost Share Price

META is currently facing the worst downturn in its history with its declining digital advertisement revenues.

The recent revenue fall can be attributed to geopolitical tensions like the Russia-Ukraine war, which reduced META’s monthly active users across its family of apps, namely Facebook and Instagram. Also, rising inflation weakened digital advertising revenues. This, in turn, hurt investors’ sentiments around the ad revenue-dependent companies.

Also impacting Meta’s ad revenue growth are ad targeting-related headwinds created by Apple’s AAPL iOS changes.

Apple’s iOS changes have made ad targeting difficult, which has increased the cost of driving outcomes. Measuring these outcomes is very difficult, and Meta expects these factors to hurt advertising growth in the third quarter and throughout 2022.

Shares of Meta, which currently has a Zacks Rank #5 (Strong Sell), have tumbled 59.5% in the year-to-date period compared with the Zacks Internet – Software industry’s decline of 53.7%.

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Intensifying competition for ad dollars and user engagement from the likes of Snap SNAP, Twitter TWTR and TikTok is another persistent headwind.

Snap is benefiting from improving user engagement, particularly in the 13-34-year-old demography, which is expanding its advertiser base. SNAP is also giving competition to META in the metaverse space. It collaborated with Vogue to feature a virtual try-on experience of select pieces from Balenciaga, Dior and Gucci, which will be available for snapchatters, globally.

Even as Meta is investing aggressively in building the metaverse, Twitter surpassed it as the first social media giant to enter the non-fungible token marketplace by launching a tool to showcase and sell NFTs on its platform.

Rising legal woes, strong competition and geopolitical headwinds negatively impacted revenue growth in the second quarter of 2022.

Revenues of $28.82 billion beat the Zacks Consensus Estimate by 0.44% but decreased 0.9% year over year. At constant currency (cc), the top line improved 3%.

Although Meta’s short-term revenue growth looks bleak, it is confident about its long-term prospects. It is pumping resources into developing AI to address solutions for megatrends like a hybrid work environment, which will drive its user base across various platforms like Meta Portal Go. Investments in AI are also expected to draw higher revenues from Meta’s ad business.

Further, Meta’s investments in AI will allow social feeds on Facebook and Instagram to be more recommended by AI, reducing privacy breaches and protecting its users' data.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Twitter, Inc. (TWTR) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research