Media & Telecom M&A Fell In 2022, But It’s A Good Time For The “Well-Capitalized” And The “Bold”

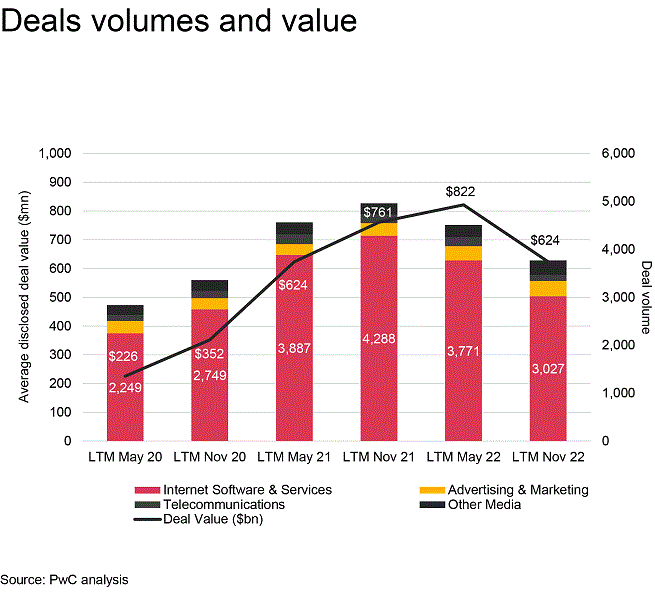

After record deal-making in 2021, the number and dollar value of M&A in media and telecommunications fell during the past 12 months through November, according to the latest report by PwC.

There have been 3,772 deals, a 26% year-over-year drop. The dollar value of M&A totaled $624 billion, an 18% dip, the firm said in its biannual U.S. Deals Outlook. That’s still above pre-pandemic levels but squeezed by higher interest rates and inflation, a soft stock market, growing geopolitical tensions and enhanced regulatory oversight — i.e. the FTC’s announcement today that it will sue to block Microsoft’s planned $69 billion acquisition of Activision Blizzard. All are pressures that will continue to color M&A into 2023.

More from Deadline

Related Story

Microsoft, Activision Blizzard Confident Merger Will Close As FTC Prepares To Challenge $69-Billion Deal In Court – Update

Related Story

'Saw' Alum Shawnee Smith Circling 10th Installment As Synnøve Macody Lund, Steven Brand & Michael Beach Sign On

Related Story

Sandra Stern Promoted To Vice Chairman Of Lionsgate Television Group

Microsoft-Activision and Elon Musk’s $44 billion Twitter takeover were the biggest deals of the year in the space, which includes everything that was announced over the 12 months whether it closed or not. It does not include any transactions that were announced previously but may have closed 2022, like Warner Bros. Discovery ($43 billion) or Amazon’s buy of MGM ($8.5 billion).

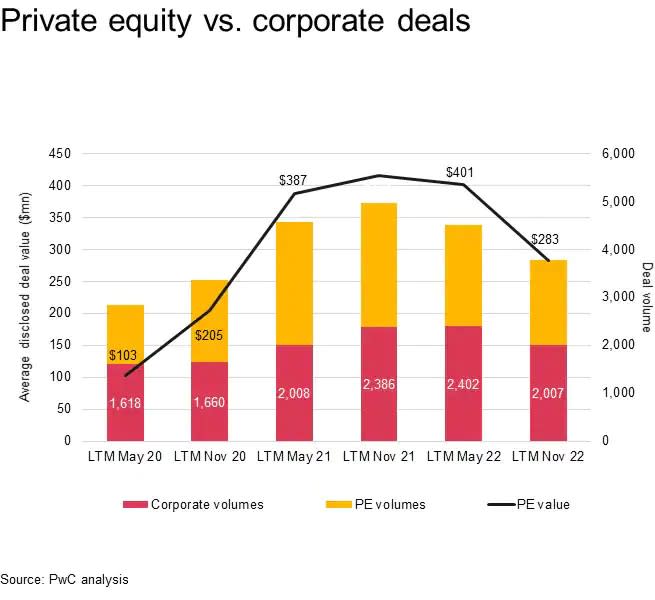

Higher interest rates make financing deals more expensive, so private equity firms, which are prolific buyers in the media and telecom space, are sticking more to the sidelines. That means fewer bidders on any given asset, so valuations fall. And sellers might ask, “‘Do I want to be out in the market right now, given that there are financing challenges, and diminished buyer pools? Or do I want to wait and see how everything looks in six months?’ So there is less coming to market to be sold, whether it’s an entire company or a business unit,” Bart Spiegel, Global Entertainment & Media Deals Leader, PwC US, told Deadline. “The overall M&A market is just really grim,” he said.

The Federal Reserve has raised interest rates six times since March to slow down the economy and curb inflation, but that’s also been battering the stock market as investors fear the country is tipping into recession. Some think it already has – they can be hard to spot until after the fact. Spiegel hopes the situation improves in a few months but could drag through next spring.

That said, the current downturn an also be an opportunity for some.

“While the next several months may be challenging for certain buyers given current capital costs, the market has historically rewarded those companies that can be bold and aggressive in finding opportunistic M&A when other players remain on the sidelines,” Spiegel said. “We expect well-capitalized companies to continue to execute on their M&A strategy, finding accretive and opportunistic transactions to add to their portfolio.”

Media and telecom overall “may fare better than others, as it sits at the center of many sectors’ investment patterns and growth strategies. It also has some large corporations with significant cash reserves that can be opportunistic and execute on M&A in an environment when other market participants may be sidelined due to financing constraints.”

The media landscape right now is colored by a broad re-evaluation of the business of streaming. Market dynamics and investor expectations have moved away from a focus on content spending to attract and retain subscribers, towards discipline and profitability. It’s a moment of major upheaval. The initial pivot to streaming combined with cord cutting and now a weak ad market has smacked the industry with write-downs, layoffs and restructuring that may well usher in a new era of M&A. Executives seem to be talking about it more freely than in the past.

“Consolidation has been the rule in business for a long time, certainly been the rule in media. So, it’s hard for me to bet on anything other than consolidation will happen in the future,” he said. “

Paramount Global CEO Bob Bakish this week: “When it will happen, what the combination is, who’s on the top, who’s is getting acquired? Who the hell knows? But consolidation will happen, and streaming will be part of that.”

PwC has found that consumers will subscribe to three to five streaming services.

Lionsgate, which recently took a big writedown for Starz, is planning to split itself up. AMC Networks’ CEO just left and the company is restructuring without one under James Dolan. Bob Iger is back at Disney to face its many challenges, taking some pressure off struggling WBD, which many believe will sell itself in a few years when it can. Analyst Rich Greenfield asked in a note, “why not just admit DTC is too hard” – a question he directed to WBD but that he said applies to other legacy media companies as well.

By the way, PwC noted that it crunched some numbers from recent years and found companies that sold assets made out better financially and strategically than companies that acquired them.

There are always some deals, and PwC describes a few ongoing catalysts:

Continued demand for live sports: The demand for live sports continues to drive M&A activity in the sector, with notable activity including the sale of the NFL’s Denver Broncos. Potential sales of other franchises, such as English Premier League’s Manchester United and Liverpool, are rumored to be attracting global interest from high-net-worth individuals, private equity and even some corporate buyers.

Repurposed movie theaters: The box office recovery after Covid lockdowns is taking longer than anticipated, while much else has recovered. The question is whether the sector can return to pre-pandemic levels in light of changing demographics, alternative release-window strategies and shifting production slates. To the extent challenging times continue for the box office, it will be interesting to see if this invites any potential M&A — especially since the Paramount Consent Decrees governing licensing rules were terminated in 2020.

Videogames: Interest in the videogame sector should continue for a handful of reasons, including that it’s viewed as the gateway to all things metaverse-related. Market opinions may vary around the immediate relevance of the metaverse, but it doesn’t change the fact that certain market players are moving full steam ahead on this strategy. Additionally, videogame companies have a loyal user base attached to franchise intellectual property, which they can easily monetize via subscriptions, advertising in their own walled garden and in-app purchases. While the broader entertainment industry has been reluctant to aggressively invest in new IP, the videogame subsector continues to manage and invest in original IP. Finally, as these companies experiment with new technologies and software, we are seeing alternate applications outside of gaming that will likely provide incremental sources of revenue. Who wouldn’t want a streaming service to offer some form of entertainment beyond video?

Telco vs. broadband: With subscriber numbers and average revenue per user flattening, the war between telecommunications companies and broadband providers is heating up as they encroach on one another’s territory for incremental revenue and subscriber growth. Broadband providers are looking to bundle mobile services, and the telcos are offering fixed wireless access to homes. The M&A angle isn’t necessarily among the major players, but could be the technologies, user interface and back-office infrastructure needed to keep their systems operating While these types of bolt-on deals may not make headlines, they are necessary to ensure the underlying tech powering consumer and B2B solutions are best in class and minimize subscriber attrition.

Best of Deadline

Sign up for Deadline's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.