Max May Be a Streaming Bargain Now | Charts

Warner Bros. Discovery, which has struggled with slowing streaming subscriber growth, has made a good move by merging content from HBO Max and Discovery+ into the new Max service. That’s because the combination offers better value for consumers, comparing the dollars spent against demand for the content provided, according to Parrot Analytics’ data, which takes into account consumer research, streaming, downloads and social media, among other engagement.

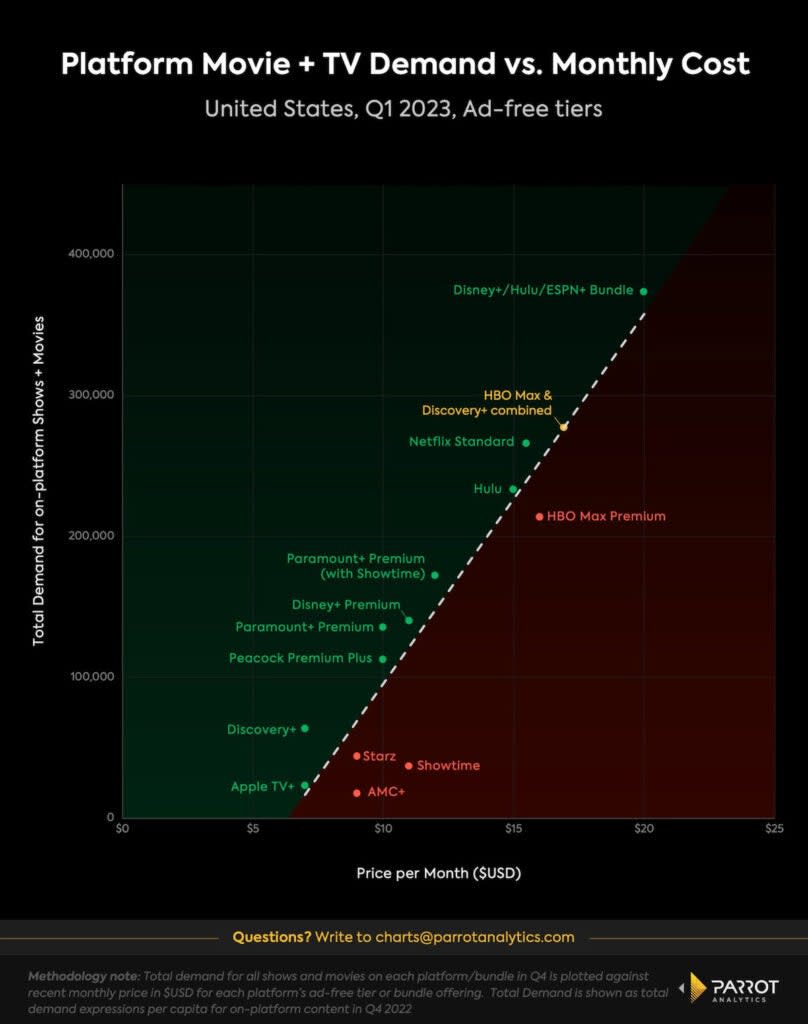

Our analysis suggests that a market-competitive price for a combination of HBO Max and Discovery+ would be roughly $17 per month (if all Discovery+ content is rolled into the combined service). Max’s price is $15.99 per month for the standard, ad-free tier, making it a better deal than HBO Max was: The HBO-branded service was overpriced by $1.50 per month, according to Parrot’s demand data.

Also Read:

The Streaming Services That Are Priced Right – and the Ones That Miss the Mark | Chart

Discovery+ will continue to be available for $6.99 per month without ads. WBD’s decision to maintain the cheaper standalone service is smart, since it’s underpriced by $2 per month.

With two relatively cheap services, Warner Bros. Discovery has better positioned itself to attract subscribers away from Disney’s similarly priced Disney+/ Hulu/ ESPN+ bundle and Netflix. It also gives it some room to raise prices down the road without too much backlash from consumers.

Max must increase time spent on the service, and content from Discovery+ is designed to do just that with rewatchable shows consumers put on in the background while cooking or folding laundry. This strategy should help improve subscriber retention, which will lead to higher average revenue per user (ARPU). However, it does little to immediately address subscriber acquisition, which has plateaued for Warner Bros. Discovery in recent quarters.

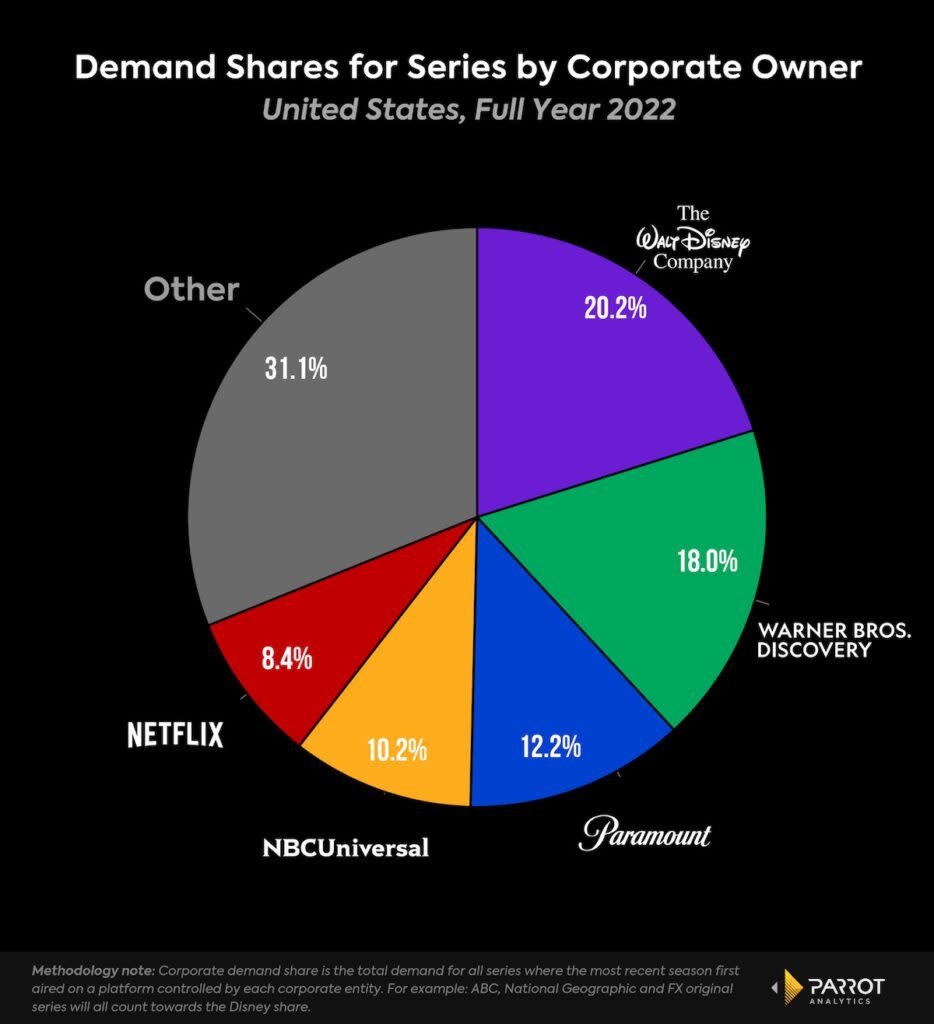

Max benefits immensely from the huge content library owned by its parent company. Warner Bros. Discovery content is responsible for 18% of the demand for TV series in the U.S. market, behind only The Walt Disney Company (20.2%) and miles ahead of Paramount in third place (12.2%).

There are two ways to look at high corporate demand share. In past years, as the streaming wars peaked, companies sought to consolidate original content on their own streaming offerings to woo audiences and juice growth in subscriber numbers. More recently, companies like Warner Bros. Discovery, Paramount and even Disney have expressed openness to licensing some of their shows as Wall Street has focused increasingly on profit. The strong demand across Warner Bros. Discovery’s library positions it well wherever the pendulum swings between growth and profitability.

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

Warner Bros. Discovery Wants to Compete for Kids and Families – and HBO Was in the Way | Analysis