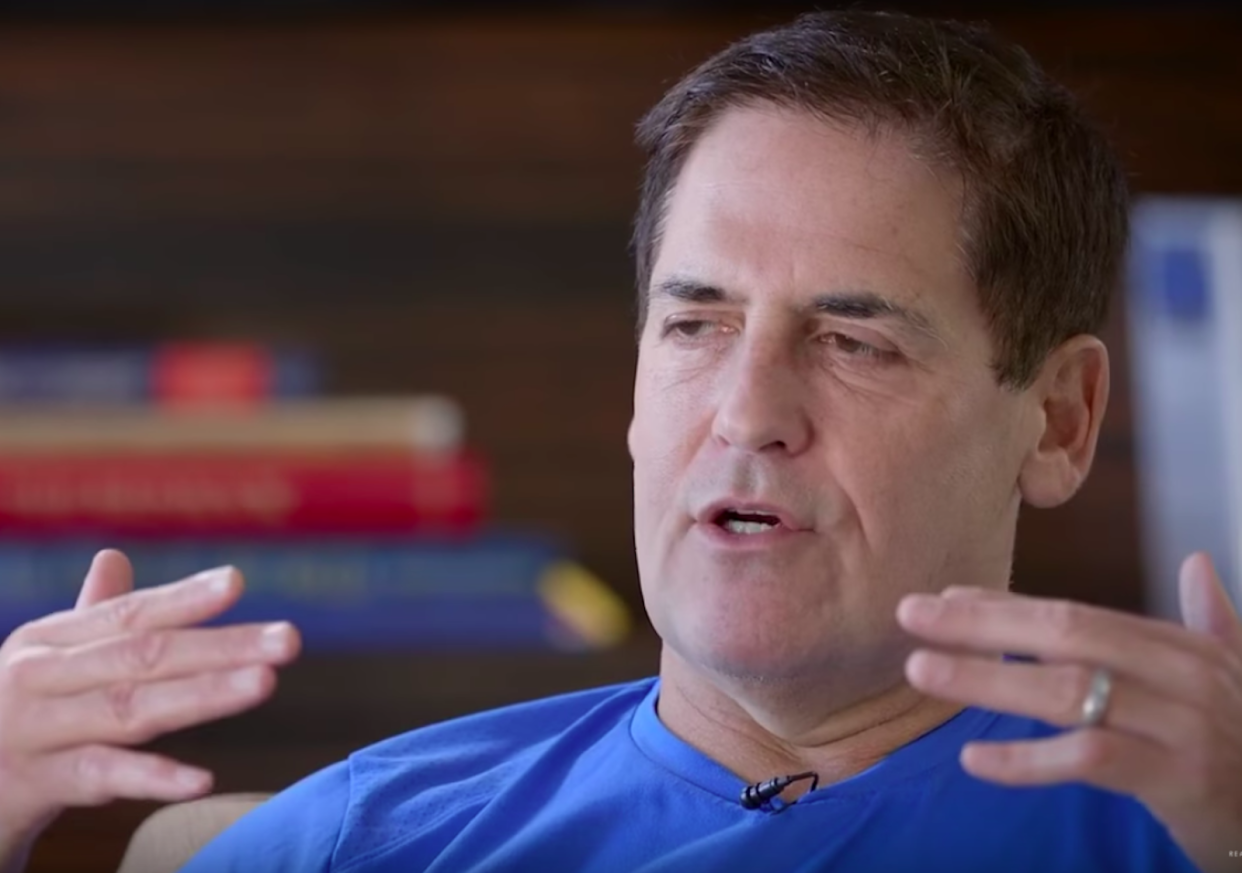

Mark Cuban: Bitcoin is more of a collectible than a currency

Billionaire tech entrepreneur Mark Cuban made a case that cryptocurrencies like Bitcoin and Ethereum are more of a collectible than a currency.

“If they were truly currencies, you wouldn’t try to convert them or value them based off of other currencies. [Their value] would just be intrinsic,” Cuban told J. Kyle Bass of Hayman Capital in an hour-long interview earlier this month that aired on RealVision Television, a subscription-based financial video service.

Cuban, who described himself as “more spectator” in the digital currency space, said that he’s a big fan of blockchain, the underlying technology. But when it comes to Bitcoin, Cuban sees issues with transactions.

“It’s going to be very difficult for it to be a currency when the time and expense of doing a transaction is 100 times what you can do over a Visa or MasterCard, right?” Cuban said.

‘A brilliant collectible’

He thinks the value of so-called cryptocurrencies comes from their scarcity.

“In this particular case, it’s a brilliant collectible that’s probably more like art than baseball cards, stamps, or coins, right, because there’s a finite amount that are going to be made,” Cuban said. “There’s 21.9 million Bitcoins that are going to be made.”

Cuban drew a comparison to the rising stock market, where the investment opportunities have been on the decline.

“When we went public in 1998, there were 8,000, approaching 9,000 public companies. Now there are 3,500,” Cuban said. Meanwhile, the number of shares outstanding keeps going down.

“Look at IBM, right? They make a living in financial engineering, right?” he said. “So there’s scarcity. So point being, scarcity sells … And there’s no greater scarcity than Bitcoin and Ethereum.”

Cuban told Vanity Fair in its “Guide to Getting Rich” video series recently that he would advise people to limit putting 10% of their savings in bitcoin.

“If you’re a true adventurer and you really want to throw the Hail Mary, you might take 10% and put it in Bitcoin or Ethereum,” he said. “But if you do that, you’ve got to pretend you’ve already lost your money. It’s like collecting art, it’s like collecting baseball cards, it’s like collecting shoes. Something’s worth what somebody else will pay for it. It’s a flyer, but I’d limit it to 10%.”

Watch the full interview below:

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.