What Makes a High-Demand Comedy Series? Here’s a Breakdown | Charts

Sitcoms are one of the cornerstones of American TV culture. Ever since the 1940s, they have been shaping the audience’s cultural landscape and promoting trends. “Sitcom” was the most in-demand sub-genre in the U.S. in 2022, ahead of “Crime Drama” by more than 12.5%, according to Parrot Analytics‘ data, which takes into account consumer research, streaming, downloads and social media, among other engagement.

With short-length episodes and a loose storyline that makes a show easy to follow even if watched in non-sequential order, comedy series are highly re-watchable and often the kind of show that people have in the background while doing something else.

Also Read:

Demand for ‘1899’ Rose for 2nd Consecutive Week – but Netflix Still Canceled It | Chart

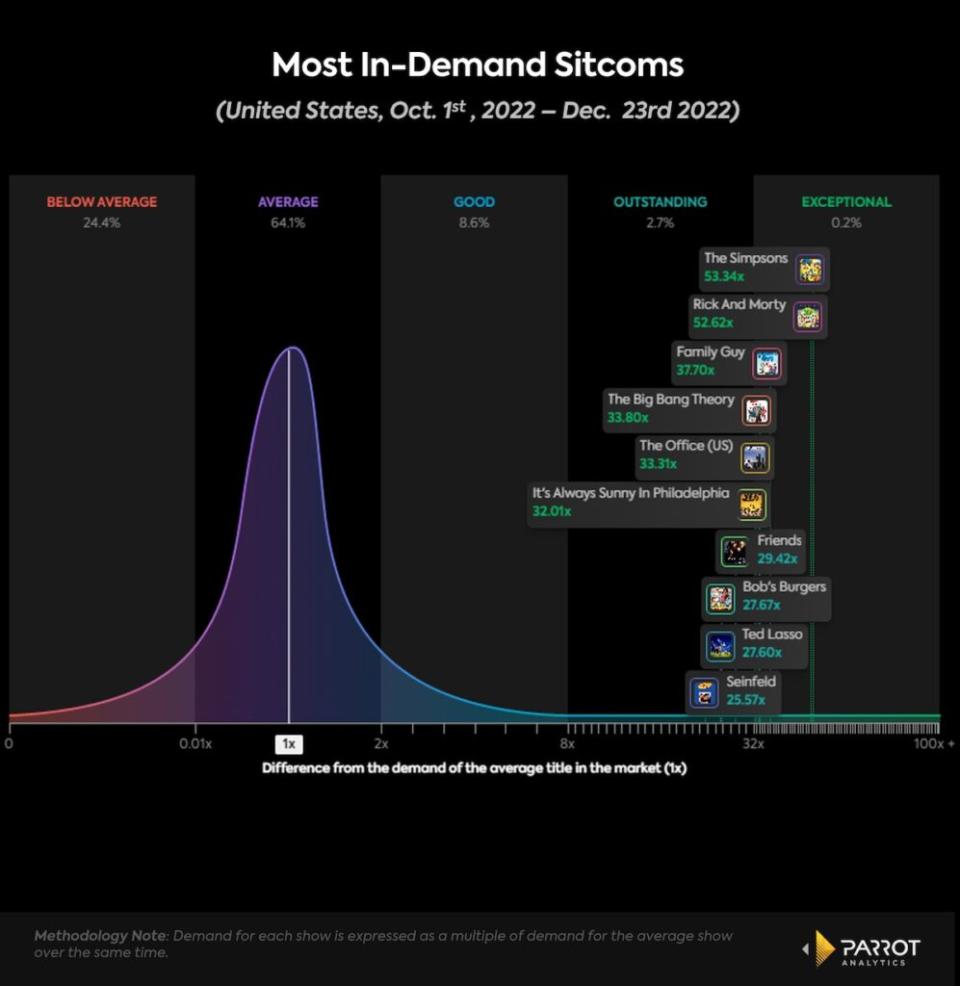

The top three in-demand sitcoms in the U.S. at the end of 2022 are animated. At No. 1, “The Simpsons,” is arguably the most globally well-known American animation and remains very successful with audiences more than 30 years after its first season. The legacy show is followed closely by another animated sitcom, “Rick and Morty.” Both shows are the only comedies to figure among the top 10 overall shows in the U.S. in that same period, placing seventh and eighth among all series.

The top non-animated sitcoms in that list are “The Big Bang Theory,” “The Office” and “It’s Always Sunny in Philadelphia.” Huge hit shows from the 1990s and highly influential legacy shows “Friends” and “Seinfeld” came in seventh and 10th place in that period, respectively.

It’s interesting to note that the top non-animated sitcoms on the list are centered around groups of friends or coworkers, while the animated ones, like “The Simpsons,” “Family Guy” and “Bob’s Burgers” are centered around families.

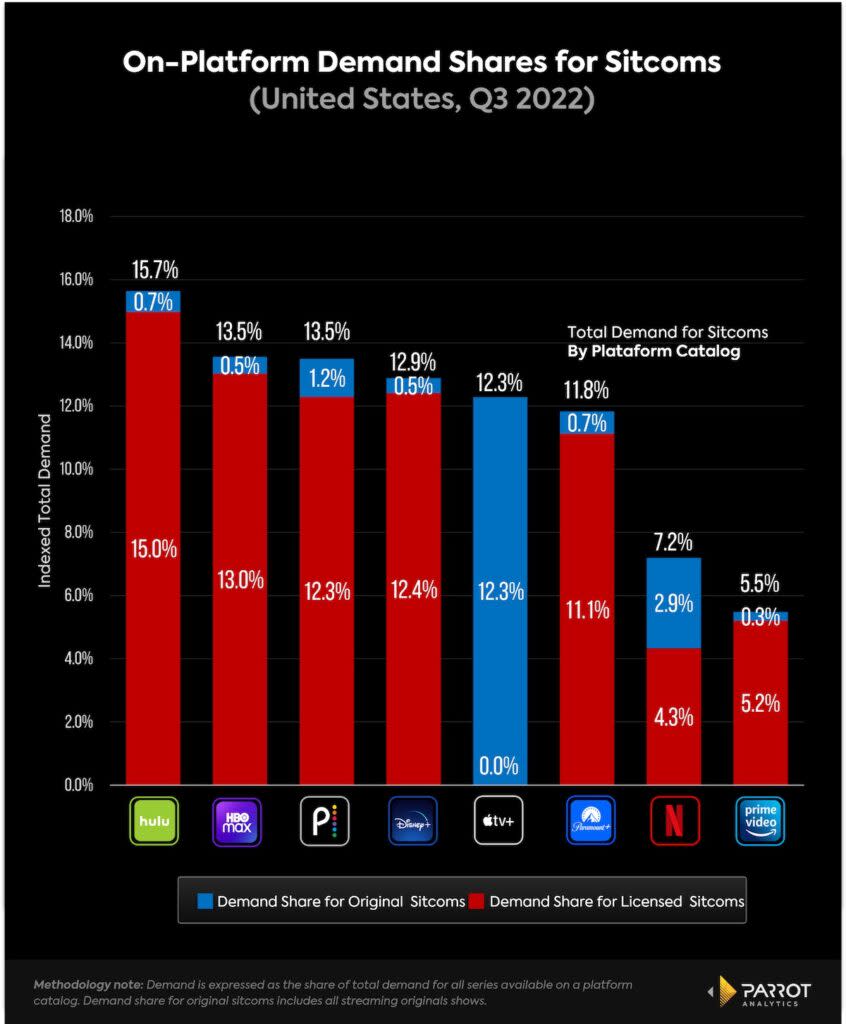

The ranking also shows that when it comes to comedies, network-released titles are preferred by the public. Only one show on the top 10 list is a streaming original, Apple TV+’s “Ted Lasso.” Despite the low number of highly in-demand streaming original sitcoms, streaming platforms rely heavily on this content. As shown in the chart below, comedies represent a relevant share of the total catalog demand for the major SVOD platforms, with the exception of Netflix and Amazon Prime Video. From the top four platforms with the highest share of demand for sitcoms, almost all of the demand comes from a licensed show.

The best example of this is Hulu. Sitcoms are responsible for 15.7% of the total demand for its catalog in the third quarter of 2022, of which 95.8% comes from a licensed show, meaning that 15.0% of the total demand for the platform’s catalog is from a comedy licensed from a network. Hulu’s ability to invest heavily in acquiring highly in-demand shows for its catalog is what makes the platform the one with the higher share of demand for sitcoms. Of the 10 most in-demand comedies shown in the chart above, half of them were available on Hulu’s catalog during the third quarter of 2022, including the top three shows.

Besides Apple TV+, all of the main SVOD platforms garner most of their sitcom demand from a licensed show. Even Netflix, which boasts raunchy animated comedies such as “BoJack Horseman” and “Big Mouth,” sees around 60% of its demand for comedies coming from more in-demand licensed shows such as “Seinfeld” and “Community.” Besides that, Netflix has a lower dependency on licensed sitcoms than some of the other platforms where the sub-genre plays a larger role. While platforms like Hulu, HBO Max, Disney+ and Peacock have more than 12.0% of their catalog demand from licensed comedies, Netflix’s share is only 4.3%. This is something of a safety net for Netflix in the eventual case that some networks reclaim their licensed content from the streamer for their own exclusive in-house platforms.

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

The Streaming Services That Are Priced Right – and the Ones That Miss the Mark | Chart