How the Major Streamers Stack Up in Subscribers and Revenue | Charts

Netflix is still the king of streaming. But while it continues to lead in subscribers and average revenue per user (ARPU) after the latest round of earnings, Disney and Warner Bros. Discovery have continued to make strides toward reaching profitability.

Netflix outpaced the legacy media competition in the 4th quarter of 2023, reporting 260.2 million subscribers total, 13.1 million of which were new, making it the company’s second best quarter ever for sign-ups (the record was set in 2020 during the COVID-19 lockdown).

Disney+ cemented the No.2 position with 149.6 million, despite losing 1.3 million core subscribers during its latest quarter as a result of churn from recent price increases. When combined with Hulu’s 49.7 million subscribers and ESPN+’s 25.2 million subscribers, the House of Mouse collectively boasts 224.5 million streaming subscribers.

Meanwhile, Warner Bros. Discovery’s direct-to-consumer division made third place with just shy of 100 million subscribers (97.7 million to be exact). Paramount Global and NBCUniversal’s Peacock continue to lag behind with 67.5 million and 31 million subscribers, respectively.

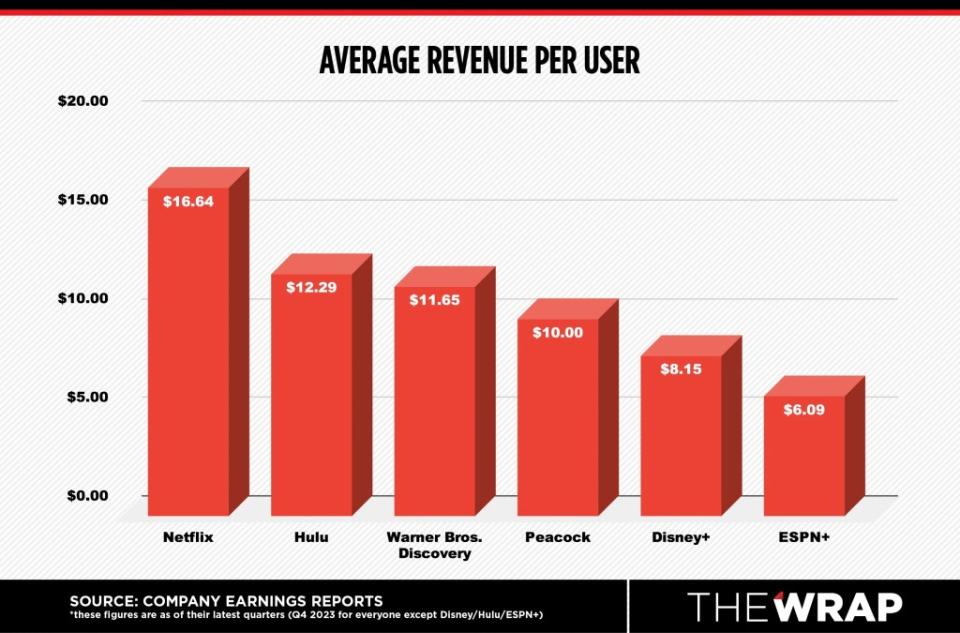

Netflix is still the ARPU champ, for now

Netflix continues to lead on the ARPU front with $16.64 in the United States and Canada. But Warner Bros. Discovery has started to gain ground on Hulu, while Disney+ is closing in on Peacock. During their latest quarters, Hulu reached an ARPU of $12.29, followed by Warner Bros. Discovery’ $11.65, Peacock’s roughly $10, Disney+’s $8.15 and ESPN+’s $6.09. Paramount does not disclose the average revenue per user figure for its DTC business.

The light at the end of the profitability tunnel is starting to come into view as Disney and Warner Bros. Discovery expect to get there in 2024, while Paramount Global and Peacock could follow in 2025.

Because Amazon Prime Video and Apple TV+ don’t release streaming subscriber or ARPU figures, they are not included in this analysis.

In 2021, Amazon reported more than 200 million Prime members worldwide and said over 175 million of them had streamed its film and television content in the past year. But the tech giant has not offered an update since then. Amazon CEO Andy Jassy told analysts in February that the tech giant has “increasing conviction” that Prime Video can be “a large and profitable business on its own.”

On Jan. 29, Prime Video launched its ad tier offering, which will be the default for all subscribers. The streamer will offer a new ad-free option for an additional $2.99 per month for U.S. members. Currently, Amazon Prime, which includes Prime Video, costs $14.99 per month or $139 a year. A membership that only includes Prime Video and none of the company’s shipping benefits costs $8.99 a month.

Apple says it has over 1 billion paid subscriptions in its Services segment, which includes Apple TV+, Apple Arcade, Apple Fitness+, Apple News+, Apple Music and iCloud. But the tech giant does not break that total out by individual services.

Check out TheWrap’s quarterly deep dive on each company below, with updated numbers from their financial disclosures.

Netflix

Netflix added 13.1 million subscribers in Q4 for a total of 260.28 million. The figure includes 80.13 million in the U.S. and Canada, 88.81 million in the Europe, Middle East and Africa region, 46 million in Latin America and 45.34 million in the Asia-Pacific region.

The company recorded revenue of $3.93 billion in the U.S. and Canada, $2.78 billion in the EMEA region, $1.1 billion in Latin America and $963 million in the APAC region. Average revenue per user grew 3% year over year to $16.64 in the U.S. and Canada and $10.75 in the EMEA region and 4% to $8.60 in Latin America, but fell 5% to $7.31 in the APAC region.

In its shareholder letter, Netflix said that paid sharing is now the “normal course of business” and will allow it to grow and more effectively penetrate an addressable market of about 500 million connected TV households (excluding China and Russia). The streamer expects that addressable market to increase over time as broadband penetration rises.

The ad tier surpassed 23 million monthly active users globally and now accounts for 40% of all sign-ups. The offering’s base grew by nearly 70% quarter over quarter, supported by product improvements and the phasing out of Netflix’s Basic plan for new and rejoining members.

The ad tier is currently available in 12 countries, including the U.S., Canada, Australia, Brazil, France, Germany, Italy, Japan, Korea, Mexico, Spain, and the United Kingdom — representing about 80% of global ad spend.

“We’ll see in the fullness of time, but I’d say we’ve got years of work ahead of us to take the ads business to the point where it’s a material impact to our general business,” co-CEO Greg Peters told analysts during the company’s earnings call.

Looking ahead, paid subscriber additions are expected to fall in the first quarter, but be up compared to 1.8 million additions in the first quarter of 2023. Netflix said it would retire the Basic plan in some of the countries where its ad tier is available, starting with Canada and the United Kingdom in the second quarter.

Disney, Hulu and ESPN+

Disney narrowed its total streaming losses by 79% year over year to $216 million in its first quarter of 2024, with DTC revenue growing 14% year over year to $6.08 billion. The company, which is on track to exceed $7.5 billion in cost savings, expects to reach profitability across its three streaming services by the end of the fiscal year.

Disney+ shed roughly 600,000 subscribers for a total of 149.6 million. The service lost 1.3 million core subscribers for a total of 111.3 million, including 46.1 million subscribers in the U.S. and Canada and 65.2 million international subscribers. Disney+ Hotstar accounted for the remaining 38.3 million of the total.

The loss in core subscribers was driven by the expected temporary uptick in churn due to recent domestic price increases, as well as the end of a global summer promotion. Those losses were offset by ad tier net additions and launches in certain international markets during the quarter.

At the same time, Hulu added 1.3 million subscribers for a total of 49.7 million, including 45.1 million SVOD only subscribers and 4.6 million Hulu + Live TV subscribers. ESPN+ shed 800,000 subscribers for a total of 25.2 million.

Disney+ saw its domestic ARPU grow 9% quarter over quarter to $8.15. Elsewhere, its core subscriber ARPU climbed 2% quarter over quarter to $6.84, while Hotstar’s ARPU increased 38% quarter over quarter to $1.28. Excluding Hotstar, international ARPU fell 3% to $5.95 due to a higher mix of subscribers to promotional offerings.

Hulu reported SVOD-only ARPU growth of 1% quarter over quarter to $12.29 and Hulu + Live TV growth of 4% to $93.61. ESPN+ grew 14% quarter over quarter to $6.09.

In addition to ESPN+, Disney is launching a joint sports streaming venture with Warner Bros. Discovery and Fox this fall, as well as a fully direct to consumer version of ESPN in August 2025, The Disney+/Hulu combo app, which is currently in a beta, is also targeting an official launch in March.

Looking ahead, Disney expects between 5.5 million and 6 million net subscriber additions in the second quarter. Domestic net adds are expected to be in the 7.5 million range, while international core subscribers are expected to decrease modestly, reflecting changes to certain wholesale deals and slightly elevated churn impacts from price increases.

Disney also plans to begin cracking down on password sharing in 2024, with a notable benefit from the paid sharing initiatives expected in the back half of calendar year 2024.

Warner Bros. Discovery

After two consecutive quarters of subscriber declines, Warner Bros. Discovery added 1.8 million subscribers for a total of 97.7 million. That includes 54.6 million domestic subscribers and 42.3 million international subscribers, with 1.3 million subscribers coming from the company’s acquisition of BluTV.

Revenue for the DTC segment grew 3% year over year to $2.53 billion. Average revenue per user grew 7.5% year over year to $11.65 domestically, 12.4% year over year to $3.88 internationally and 7% year over year to $7.94 globally for the quarter. The DTC division includes traditional HBO cable subscriptions and the Max and Discovery+ streaming services in its results.

On the profitability front, WBD posted a loss of $55 million in its direct-to-consumer division for the quarter, down from a loss of $217 million. For the full year, it swung to a profit of $103 million — its first profitable streaming year — compared to a loss of $1.59 billion in 2022.

Looking ahead, WBD said its DTC business would record “modestly negative” EBITDA in the first half of 2024 before turning profitable in the second half of the year. WBD is targeting $1 billion of direct-to-consumer EBITDA in 2025.

Paramount Global

As speculation around a potential sale hangs over the company, Paramount narrowed its streaming loss for the quarter to $490 million, an $85 million year-over-year improvement. The company expects to attain domestic streaming profitability in 2025.

The direct-to-consumer division, which includes Paramount+ and its free, ad-supported streamer Pluto TV, added 4.1 million subscribers during the fourth quarter for a total of 67.5 million. DTC revenue grew 34% year over year to $1.87 billion. Subscription revenue grew 43% to $1.3 billion, driven by subscriber growth and pricing increases at Paramount+.

Paramount+ revenue grew 69% to $1.35 billion, driven by subscriber growth and ARPU expansion. Paramount does not disclose its streaming ARPU figure, but touted a 31% year-over-year increase.

The media conglomerate expects 2024 subscriber growth to come in lower than 2023, but expects “very healthy” growth in Paramount+ revenue. Chief financial officer Naveen Chopra said Paramount would exit hard bundle relationships where the economics weren’t compelling, representing a loss of “a couple million subs.”

“Ultimately, the ability to drive deeper engagement and ARPU growth, while slowing the rate of growth in content expense, is the path to profitability in streaming,” Chopra told analysts.

Peacock

Peacock ended 2023 with 31 million paid subscribers after adding 3 million during the fourth quarter, up nearly 50% year over year. Average revenue per user is around $10, unchanged from the previous quarter.

The NBCUniversal-owned streamer’s adjusted EBITDA loss narrowed to $825 million from $978 million in the prior year period and its revenue grew 57% year over year to $1 billion, compared to $660 million a year ago. Peacock marked peak losses of $2.7 billion in 2023, with meaningful improvement expected in 2024.

Comcast president Mike Cavanagh said leveling off the growth rate of programming spend would “clearly” be part of improving Peacock’s losses, but noted that he’s more focused on the long-term “totality of the media business.”

“We’ve navigated a very good path for us,” he told analysts.

The post How the Major Streamers Stack Up in Subscribers and Revenue | Charts appeared first on TheWrap.