How the Major Streamers Stack Up Right Now in Subscribers and Revenue | Charts

- Oops!Something went wrong.Please try again later.

While the now-resolved Hollywood strikes disrupted Hollywood streamers’ original content pipelines, nearly all of the major players saw a boost in their subscriber bases during the latest round of earnings.

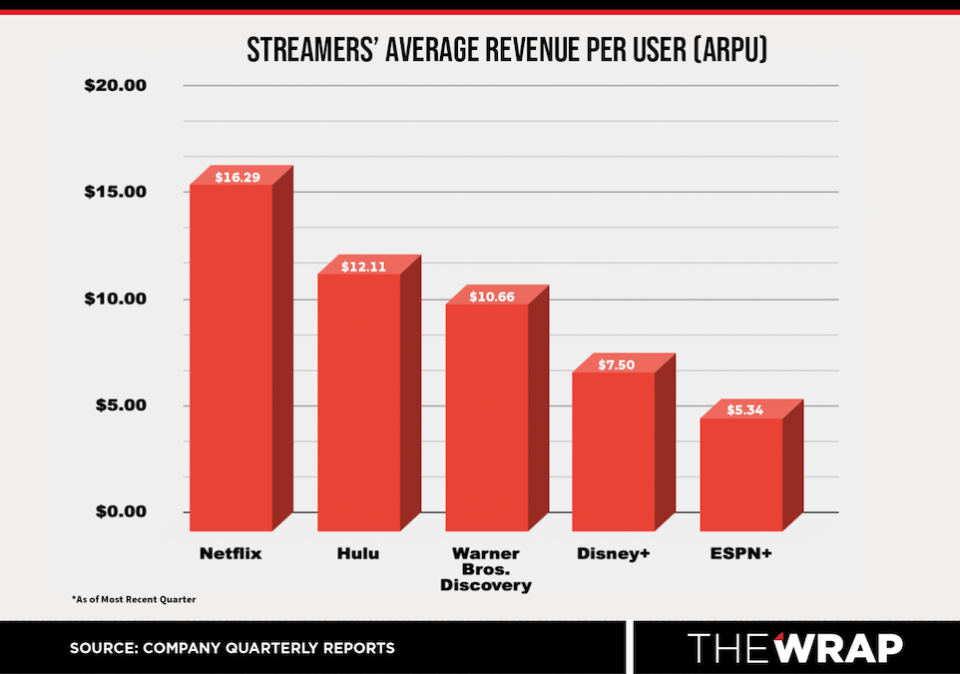

Price increases and ad-supported tiers have given a lift to average revenue per user, while cost-cutting and lower content spend from the strikes have helped the legacy media giants make progress on their paths to streaming profitability.

Unsurprisingly, Netflix, with 247 million subscribers, continues to lead the pack in both subscribers and average revenue per user. On the subscriber front, Disney+ is in second with 150 million subscribers, followed by Warner Bros. Discovery’s Max and Discovery+, Paramount+, Hulu, Peacock and ESPN+.

As for ARPU, Hulu has done the best job of narrowing the gap with the market leader, followed by WBD and Peacock. Meanwhile, Disney+ and ESPN+ have lagged behind the pack. Paramount+ said ARPU increased 16% year over year, though it didn’t break out its quarterly figure.

TheWrap’s analysis doesn’t include Amazon Prime Video and Apple TV+ because those companies don’t release streaming subscriber or ARPU figures. Apple says it has over 1 billion paid subscriptions in its Services segment, which includes Apple TV+, Apple Arcade, Apple Fitness+, Apple News+, Apple Music and iCloud. In 2021, Amazon reported more than 200 million Prime members worldwide and said over 175 million of them had streamed its film and television content in the past year.

Check out TheWrap’s quarterly deep dive on each company below, with updated numbers from their financial disclosures.

Netflix

Netflix added 8.76 million subscribers during the third quarter of 2023 for a total of 247.15 million globally.

The company’s total revenue grew 7.8% year over year to $8.54 billion. Revenue in the United States and Canada came in at $3.73 billion, while the Europe, Middle East and Africa region, Latin America and Asia-Pacific region generated $2.69 billion, $1.14 billion and $948 million, respectively.

Average revenue per user was flat year over year at $16.29 in the U.S. and Canada. It grew 2%to $10.98 in the EMEA region, increased 3% to $8.85 in Latin America and fell 9% to $7.62 in the APAC region.

Netflix’s password-sharing crackdown on an estimated 100 million households globally, including 30 million in the U.S. and Canada, has officially launched in every region the company operates in.

“The cancel reaction continues to be low, exceeding our expectations, and

borrower households converting into full paying memberships are demonstrating healthy retention,” the company said in its quarterly shareholder filing. “As a result, we’re revenue positive in every region when accounting for additional spin off accounts and extra members, churn and changes to our plan mix.”

Moving forward, Netflix said it would continue to refine its strategy to convert additional borrower households into either full paying or extra members over the next several quarters.

The company also raised prices for its ad-free basic and premium tiers in the U.S. by $2 to $11.99 per month and $3 to $22.99 per month, respectively. Pricing for the $6.99 per month ad-supported tier and $15.49 per month standard plan will remain the same. Meanwhile, in the U.K. and France, pricing will be £4.99 and 5.99€ per month for the ad-supported tier, £7.99 and 10.99€ for the basic tier, £10.99 and 13.49€ for the standard tier and £17.99 and 19.99€ for the premium tier, respectively. Similar to the U.S., pricing on the ad-supported and standard plans in the U.K. and France remain the same.

Netflix’s ad-supported tier has surpassed 15 million subscribers globally, with the offering’s membership increasing nearly 70% quarter-over-quarter. The ad tier now accounts for roughly 30% of all new sign-ups. Those gains were driven in part by phasing out the ad-free basic plan in the U.S., U.K., Italy and Canada — and Netflix will do the same in Germany, Spain, Japan, Mexico, Australia and Brazil. Going forward, it also plans to introduce a download feature to the offering and will include the ad plan in device and internet service provider partner bundles. While ad revenue will not be material to Netflix in 2023, the company remains “very optimistic” about its long-term opportunity.At Bloomberg’s Screentime conference, Netflix co-CEO Ted Sarandos acknowledged that the ad tier was still in its infancy and “definitely not at the scale we want it to be at yet.” Netflix has tapped Amy Reinhard as its new advertising president, following the exit of Jeremi Gorman after about a year.

Looking ahead, Netflix expects revenue to grow 11% year over year to $8.7 billion in the fourth quarter, with paid net subscriber additions similar to the third quarter. Meanwhile, global average revenue per member for the quarter is expected to be roughly flat year-over-year, primarily due to limited price increases over the last eighteen months. The company expects a roughly $200 million drag on Q4 revenue and average revenue per member, citing the U.S. dollar’s strengthening over other currencies in the past few months.

Netflix is also anticipating free cash flow of roughly $6.5 billion for 2023, up from its previous forecast of at least $5 billion. The estimate includes roughly $1 billion in “lower-than-planned cash content spend” in 2023 due to the WGA and SAG-AFTRA strikes.The streamer plans to spend around $13 billion on content in 2023 and roughly $17 billion in 2024.

Disney+, Hulu and ESPN+

Disney+ reported a total of 150.2 million subscribers for its fourth quarter of 2023, an increase of 4.1 million from the 146.1 million in the previous quarter. Disney CEO Bob Iger told shareholders that the entertainment giant would make achieving “significant and sustained profitability” for its streaming business a top priority.

The service added 6.9 million core subscribers during the quarter for a total of 112.6 million, a 7% increase quarter over quarter. Disney+ subscribers in the U.S. and Canada grew 1% to 46.5 million and 11% internationally to 66.1 million.

In the U.S. and Canada, Disney+ average monthly revenue per paid subscriber increased from $7.31 to $7.50 due to higher advertising revenue. International Disney+ (excluding Disney+ Hotstar) average monthly revenue per paid subscriber increased from $6.01 to $6.10 due to an increase in average retail pricing, partially offset by a higher mix of subscribers gained through promotional offerings.

Disney+ Hotstar subscribers fell 7% quarter over quarter to 37.6 million. Disney+ Hotstar average monthly revenue per paid subscriber increased from $0.59 to $0.70 due to a lower mix of wholesale subscribers and higher advertising revenue.

Disney+’s ad-supported tier grew by 2 million subscribers during the quarter to a total of 5.2 million. More than 50% of new Disney+ subscribers during the quarter chose the ad-supported tier.

During the quarter, Hulu added 200,000 subscribers for a total of 48.5 million, including 43.9 million SVOD-only subscribers and 4.6 million Live TV and SVOD subscribers.

Hulu SVOD Only average monthly revenue per paid subscriber decreased from $12.39 to $12.11 primarily due to lower advertising revenue and a higher mix of subscribers to multi-product offerings. Hulu Live TV + SVOD average monthly revenue per paid subscriber decreased from $91.80 to $90.08 primarily due to lower advertising revenue.

Disney, which plans to pay at least $8.61 billion for Comcast’s minority stake in Hulu, will complete an appraisal process in 2024 to determine the asset’s full value. The company plans to launch a beta version of a combined Disney+ and Hulu app offering in December, before an official rollout in early spring 2024.

Disney’s direct-to-consumer division, which includes Disney+, Hulu and ESPN+, saw revenue grow 12% year over year to $5.03 billion, while its operating loss narrowed 70% year over year to $420 million. Iger said the streaming business remains on track to reach profitability by the end of fiscal year 2024, though he noted that progress “may not look linear from quarter to quarter.”

Elsewhere, ESPN+ subscribers grew 3% quarter over quarter to 26 million, with the service generating operating income of $33 million, compared to a loss of $116 million a year ago. ESPN+ average revenue per user fell 2% quarter over quarter to $5.34. Disney is also targeting a 2025 launch for a fully direct-to-consumer version of the flagship linear sports network.

Looking ahead, Disney anticipates that core Disney+ subscribers will decline slightly in its first quarter of 2024 due to the expected temporary uptick in churn from its recent price increase in the U.S., as well as from the end of a summer promotion. It expects subscriber growth to rebound later in the fiscal year.

“We are bullish about the future of our streaming business,” Iger told analysts.

Disney projects content spend for 2024 will be $25 billion, down from $27 billion in 2023. The company, which reported free cash flow of $3.4 billion during the quarter, expects it to grow significantly in fiscal 2024, approaching levels last seen pre-pandemic. It also said it is on track to achieve roughly $7.5 billion in cost reductions, up from its previous target of $5.5 billion.

Warner Bros. Discovery

Warner Bros. Discovery’s direct-to-consumer division, which includes traditional HBO cable subscriptions and the Max and Discovery+ streaming services, lost 700,000 subscribers during the quarter and dropped to 95.1 million globally, including 53.6 million domestic subscribers and 41.4 million international subscribers.

The “modest sequential loss” was largely the result of “an extraordinarily light content slate and some expected decline in the overlapping Discovery+ and Max subscribers,” chief financial officer Gunnar Wiedenfels told analysts.

Adjusted EBITDA for the DTC segment was $111 million, a $745 million year-over-year improvement and its second profitable quarter in a row. Wiedenfels said the company is on track to “at least break even or even [be] profitable across the DTC segment.”

Revenue for the DTC segment grew 5% year over year to $2.43 billion. Distribution revenue grew 6% to $2.17 billion. Advertising revenue grew 30% to $138 million, primarily driven by Max U.S. ad-lite subscriber growth and higher engagement per subscriber. Content revenue fell 17% to $120 million, primarily driven by lower third-party licensing.

Average revenue per user came in at $10.66 domestically, $3.37 internationally and $7.38 globally.

WBD’s total cash provided by operating activities increased to $2.52 billion during the quarter, while free cash flow climbed to $2.06 billion from negative $200 million in the prior year quarter. The company repaid $2.4 billion in debt during the quarter, with $45.3 billion of gross debt and $2.4 billion in cash on hand.

While acknowledging that the strikes helped WBD preserve more cash, Wiedenfels said that the vast majority of the improvement was the result of its cost-cutting efforts.

“By the end of the year, we will have realized over $4 billion of cost synergies and we will have already implemented initiatives to deliver more than $5 billion [in free cash flow] through 2024 and beyond,” he told analysts.

Wiedenfels maintained the company’s guidance of adjusted EBITDA in the range of $10.5 billion to $11 billion for the full year. In a September filing with the U.S. Securities and Exchange Commission, WBD said it expected to take a $300 million to $500 million earnings hit due to the strikes in 2023.

Paramount+

Paramount+ added 2.7 million subscribers during the quarter for a total of 63.4 million.

Paramount Global’s direct-to-consumer division, which includes Paramount+ and Pluto TV — a free, ad-supported streaming service — saw revenue grow 38% year over year to $1.69 billion. The company narrowed the division’s loss31% to $238 million from $343 million a year ago.

Advertising revenue for the DTC segment grew 18% year over year to $430 million, reflecting growth from Paramount+ and Pluto TV. Subscription revenue grew 46% to $1.25 billion, driven by subscriber growth and pricing increases for Paramount+ and revenue from pay-per-view events. And licensing revenue was flat at $4 million.

In June, Paramount hiked subscription prices for Paramount+ following the integration of Showtime into the platform. Paramount+ with Showtime is currently available for $11.99 per month, up from its previous pricing of $9.99 per month. Meanwhile, the cheaper, ad-supported Essential tier, which does not include Showtime, has increased to $5.99 from $4.99 per month.

During Paramount’s earnings call, chief financial officer Naveen Chopra told analysts that he expects the Paramount+ and Showtime combination to exceed the previously forecasted $700 million of future expense savings. He added that the company will not see the full ARPU benefit of the recent price increase until the fourth quarter.

Looking ahead, Paramount anticipates that its full-year DTC losses in 2023 will be lower than in 2022, with the division’s losses in the fourth quarter of 2023 similar to the fourth quarter of 2022.

“We remain on the path to achieving significant total company earnings growth in 2024,” Paramount Global CEO Bob Bakish said.

Paramount generated $377 million in free cash flow during the third quarter and anticipates strong free cash flow in the fourth quarter due to the strike’s lingering impact on content production. Chopra noted that the strikes resulted in nearly $60 million of related idle costs to retain production capabilities over the three-month period ending Sept. 30.

“These costs impacted both our TV media and film entertainment segments,” Chopra said. “We expect to incur additional strike related idle costs in Q4.”

Peacock

Peacock added 4 million paid subscribers during its third quarter of 2023 for a total of 28 million. The streamer’s revenue grew 64% year over year to $830 million, compared to $506 million during the same period a year ago.

The service posted revenue of $830 million, up 64% from $506 million a year ago, and narrowed its adjusted EBITDA loss to $565 million, compared to $614 million a year ago — the first year-over-year improvement in EBITDA since the platform launched in 2020. Peacock’s average revenue per user sits at roughly $10.

Comcast, which owns NBCUniversal and Peacock, expects the streaming platform’s losses to peak at $2.8 billion in 2023, down from previous guidance of peak losses of $3 billion, and “meaningful EBITDA improvement” over 2023 for the streamer in 2024.

The NBCUniversal parent generated free cash flow of $4.03 billion, up 19.1% from $3.39 billion a year ago, and net cash of $8.2 billion, up 17.4% year over year from $6.95 billion, during the quarter.

The post How the Major Streamers Stack Up Right Now in Subscribers and Revenue | Charts appeared first on TheWrap.