How the Major Streamers Stack Up Right Now – in Subscribers and Revenue | Charts

Warren Buffett’s recent $2.6 billion purchase of Paramount Global/Paramount+ stock rounds out his streaming portfolio — which already includes Apple TV+ and Amazon Prime Video — and shows that despite recent disappointing quarterly earnings reports and stock declines for most entertainment companies, streaming is still the business to be in.

This past cycle of quarterly earnings placed a new emphasis on the health of the streaming business after Netflix reported its first loss in subscribers in more than a decade. Other companies’ lackluster Q1 earnings were delivered with vows to curtail their extravagant levels of content spending and plans to introduce ad-supported tiers for price-conscious consumers.

Wall Street analysts are fearing a coming recession and the stock market has reflected those fears. Even though Disney most recently reported a nearly 8 million increase in subscribers for Disney+, the company’s stock has fallen nearly 44% from its high in the past year as of market close on Thursday.

Also Read:

Make No Mistake, Content Spending Isn’t Going Down Anytime Soon | PRO Insight

It’s not hard to see that when giants like Netflix and Disney are struggling, it casts a shadow on the entire industry — one in which companies pretty much across the board have been investing in heavily for the past few years.

Let’s take a closer look at where the major streamers stand now when it comes to subscribers and average revenue per user (ARPU), according to the companies’ most recent earnings reports.

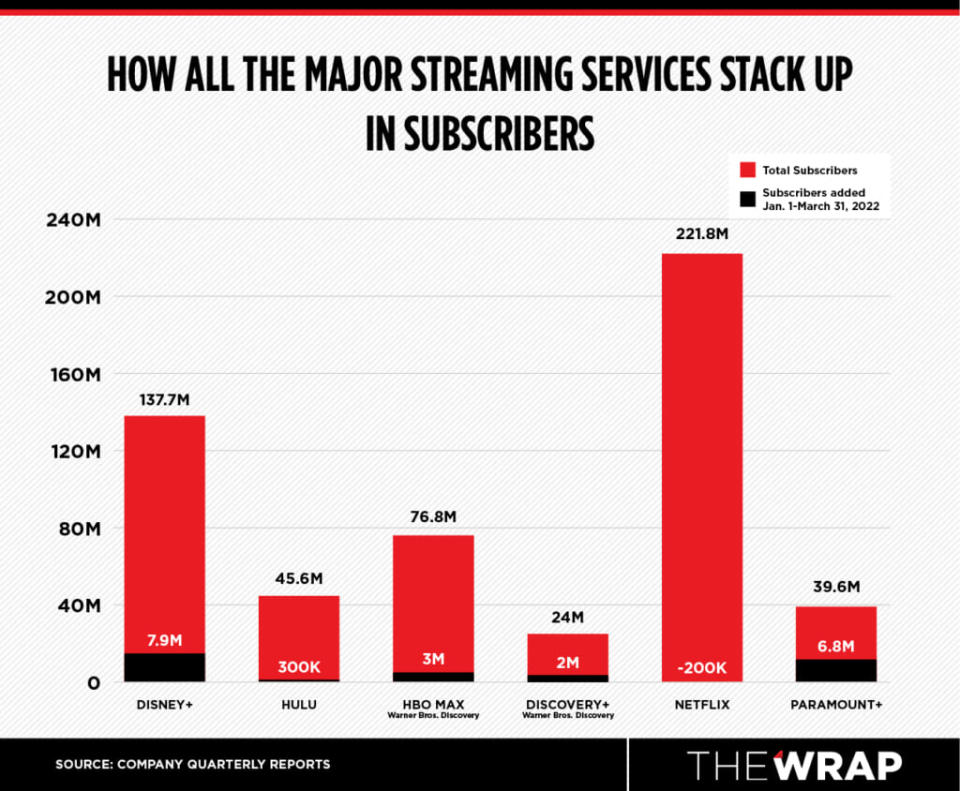

Total subscribers

Note: Amazon Prime Video doesn’t release subscriber numbers other than saying last year more than 200 million Prime members worldwide streamed content (though many sign up just for free Amazon shipping). Apple also doesn’t release subscriber numbers for its Apple TV+ platform — which comes free to purchasers of other Apple products like phones and computers.

Netflix

Netflix still has the most total subscribers with 221.8 million after its subscriber loss. That’s not the worst of it: The company forecasts that number might snowball into the millions during the next few months.

Contributing factors for the user exodus include an unpopular price hike, widespread password sharing and losing top content to competitors, such as the Marvel series to Disney+.

In the weeks following, the company has had at least two rounds of layoffs and announced plans to add an advertising tier to its subscriber offerings by the end of the year.

Also Read:

Streaming Wars on a Budget? How Hollywood Plans to Scale Back Content Spending | Chart

Disney+

Disney+ currently boasts 137.7 million global subscribers, with 7.9 million added in the first three months of the year, as well as the most in-demand premiere this year so far with Marvel’s “Moon Knight,” which outperformed HBO Max’s latest DC offering, “Peacemaker.”

In 2020, a year after Disney+’s launch, Disney CEO Bob Chapek said that the company was shooting for between 230 million and 260 million subscribers worldwide by fiscal 2024. To accomplish that, Disney+ would have to maintain an average add of 10 million subscribers globally over the next 10 quarters to reach its goal. This latest quarter, it missed that pace by 2.1 million users.

Disney+ is also adding an ad-sponsored tier, but will keep the ads family-oriented, nixing any promos for alcohol or politics, and, of course, rival streamers.

Also Read:

Why Disney Can’t Rely on Marvel and ‘Star Wars’ to Reach Streaming Subscriber Goal | Charts

HBO Max/Discovery+

Warner Bros. Discovery has confirmed plans to combine its two streaming platforms, HBO Max and Discovery+. Combined, the services total nearly 101 million (not counting for any overlap of users who already subscribe to both services). HBO and HBO Max added 3 million new subscribers in Q1 2022 — matching Q1 2021 pandemic numbers — while Discovery+ added 2 million.

Warner Bros. Discovery officially became a new company on April 8, and with CNN+ being shuttered just three weeks after its launch this spring, the new media conglomerate is not looking to bust the bank to chase subscribers. “I know we have the resources, but we can plan on being careful and judicious,” David Zaslav, WBD’s president and CEO, said during the company’s Q1 conference call with analysts last month.

“As you’ve heard me say, we are not trying to win the direct-to-consumer spending war,” he added, promising that the company would “invest in scale smartly.”

Hulu

Hulu has used both original hits like “The Handmaid’s Tale, “Only Murders in the Building” and the Elizabeth Theranos series “The Dropout” as well as next-day availability of network and cable series to boost its subscriber numbers by 300,000 in Q1, for a current total of 45.6 million.

Many forget that Hulu, which only operates domestically, has the third-highest number of U.S. subscribers among the major streamers. But it faces some headwinds as some top content producers — such as NBCUniversal did recently — allowing their licensing deals with the platform to expire to bulk up their own streaming libraries. And while Disney (which owns 67% of Hulu, to Comcast’s 33%) once relied on Hulu to stream its more mature fare, Disney+ has since started branching into content outside its traditional family-friendly focus. It remains to be seen if Hulu originals can keep subscribers paying month after month.

To up the ante, Hulu announced in March that it was launching unlimited DVR storage at no additional cost for all Hulu + Live TV subscribers beginning in April. Hulu + Live TV has 4.3 million subscribers and comes in two tiers: With Disney+ and ESPN+ for $69.99/month or $75.99/month for a no-ads option.

Also Read:

Why Animation Is Still Any Streamer’s Game to Win | Charts

Paramount+

With growing franchises like Taylor Sheridan’s “Yellowstone” spinoffs (although the original series streams on Peacock as part of an ongoing licensing deal) and the “Star Trek” universe, Paramount+ added 6.8 million subs in Q1 for a total of 39.6 million subscribers, up from last quarter’s 32.8 million.

Paramount CEO Bob Bakish highlighted the company’s growing subscriber base last month: “Our differentiated playbook — including a broad content lineup, a streaming business model that spans ad-supported and subscription, and a global portfolio that links streaming with theatrical and television — drove strength across our entire ecosystem.”

While Paramount+ saw a big boost, the company’s other services, including Showtime and BET+, were down by 500,000 users. The total for all Paramount-owned streamers was reported at 62 million in Q1.

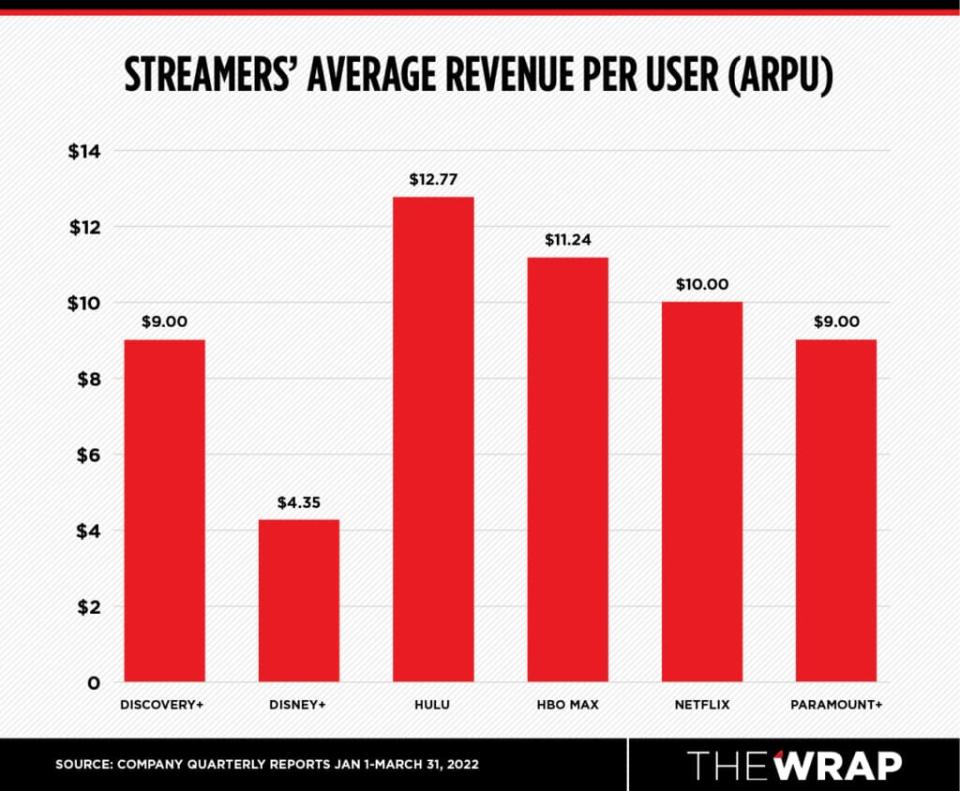

Average revenue per user (ARPU)

While total subscribers can give us one view of how streamers are faring compared to one another, another data point paints a fuller picture: Average revenue per user (ARPU) tells us how much companies are making on each subscriber after factoring in the amount spent on content for such things as A-list talent, high production costs and marketing.

The streamer with the highest ARPU during the quarter was Hulu, which collected $12.77 for each subscriber. HBO Max was up next, with $11.24 during the quarter. Netflix sits at $10 for its users in the U.S. and Canada. Paramount+ and Discovery+ both come in at about $9 per subscriber. Coming in with the lowest ARPU is Disney, which reported that it earned only $4.35 per subscriber (though that number rose from last quarter’s $4.12 and last year’s Q1 ARPU of $4.03).

Also Read:

How Demand for CW Series Stacks Up, Both Canceled and Renewed Shows | Charts