The Latest R-I-P to Linear TV: Cord-Cutters Will Outnumber Cable Subscribers by EOY

Cable subscribers, prepare to be the weirdo outliers.

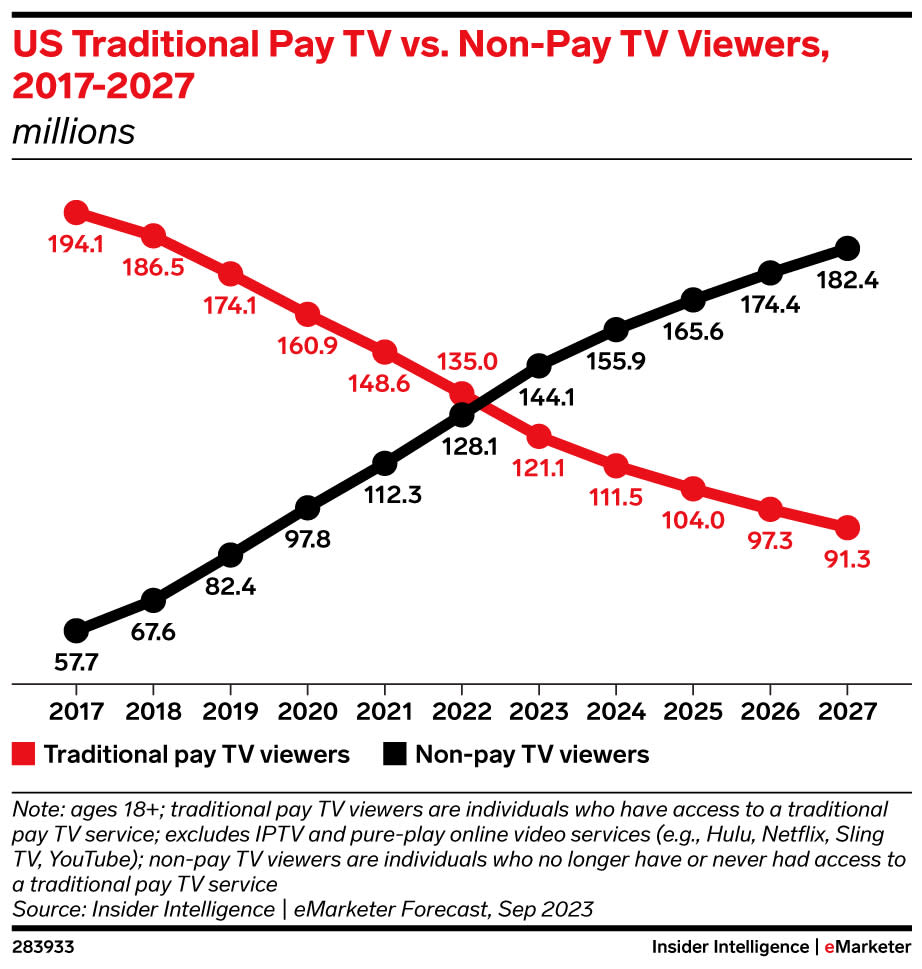

For the first time ever, by the end of 2023, viewers who do not pay for a traditional TV service (i.e. cable) will outnumber those who do, new research from Insider Intelligence finds. The combination of U.S. adult cord-cutters and cord-nevers (viewers who didn’t have to cut a cord because they never had one — typically the younger adults), will total 144.1 million. That’s 12.5 percent growth from the prior year.

More from IndieWire

'The Boys' Season 4 Trailer Shows a Divided World Preparing for Its Biggest Battle Yet

'House of the Dragon' Season 2 Teaser: House Targaryen Continues to Fracture with War on the Horizon

Simultaneously, traditional pay-TV viewers will decline 10.2 percent to 121.1 million. For the purposes of this study, “traditional pay-TV viewers” include those who subscribe to live TV packages delivered either via cable, satellite, or through a telecomm provider. Subscribers to digital pay-TV services — YouTube TV and Hulu + Live TV, for two prominent examples — don’t count. (If they did, add another 40 million subscribers to the traditional subscribers and easily reverse the 2023 trend, delaying the tipping point “by several years,” the study says.)

The “irreversible decline” began in 2014. Paul Verna, the principal analyst at Insider Intelligence, told IndieWire that was the year “streaming was coming into its own” — and into the “mainstream.”

Remember those days of innocence? Verna vividly does.

“Netflix (was) not only expanding access via digital channels but also producing high-quality content on a subscription basis,” Verna told us. “It took another decade or so for the tables to turn with pay TV and cord cutting, but that was the point where the trend lines started moving in opposite directions.”

He’s got the literal trend lines to prove it. See below, which also includes four years of forecast.

“There is an unmistakable attrition in the number of people who are willing to pay upwards of $100 a month for a live TV bundle,” Verna wrote in his analysis. “The cord cutters have won.”

But don’t take Verna’s word for it — take recent industry actions as evidence. Practically the entire Disney vs. Charter kerfuffle was in recognition of the new reality.

Charter, the second-largest cable-TV provider in the U.S. (Comcast, the parent company to NBCUniversal and its Peacock streaming service, is no. 1), did not want to keep paying for cable channels its subscribers didn’t really watch. Disney’s best content had been going to Disney+ for years, the MVPD (Multichannel Video Programming Distributor) argued, rendering a lot of the company’s linear presence unwatchable and worthless.

The eventual resolution included the death (for Charter subscribers, at least) of eight Disney channels, including Freeform, Disney Junior, and Nat Geo Wild. It’ll also bring Disney+ and ESPN+ to certain Spectrum customers, free of charge.

Industry experts do not expect Charter v. Disney to be a one-off. “We’re on the edge of a precipice,” Charter president and CEO Chris Winfrey said. “We’re either moving forward with a new collaborative video model or we’re moving on.”

Disney countered at the time that Winfrey’s “collaborative” idea “does not make economic sense.” Days later, it made enough sense — even if the new arrangement made Disney fewer dollars.

Hey, if those two can come to an agreement, maybe even cord-nevers and cable subscribers can find common ground.

Best of IndieWire

The Best LGBTQ Movies and TV Shows Streaming on Netflix Right Now

Guillermo del Toro's Favorite Movies: 54 Films the Director Wants You to See

Nicolas Winding Refn's Favorite Films: 37 Movies the Director Wants You to See

Sign up for Indiewire's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.