Lately everyone's buying stocks

Buy, buy, buy.

The ‘buy the dip’ theme appears to be in full swing. When the broad S&P 500 (^GSPC) fell 1.2% last week, marking the worst week for the stock market since May, Bank of America Merrill Lynch clients were buying stocks, according to a new report Tuesday.

“All three client groups - hedge funds, institutional and private clients - were net buyers last week,” the analysts, led by Savita Subramanian, Bank of America Merrill Lynch’s head of U.S. equity & quantitative strategy, wrote in a note to clients. “For private clients, last week marked the first time they bought equities in nine weeks, and only the fourth week of buying so far this year.

Their clients poured money into nine out of the eleven sectors in the S&P 500, with financials attracting inflows close to record highs. The move comes amid the major banks -- Goldman Sachs (GS), JPMorgan Chase (JPM), Bank of America (BAC) and Citigroup (C) -- posting solid second quarter results, replete with share buybacks and dividend increases.

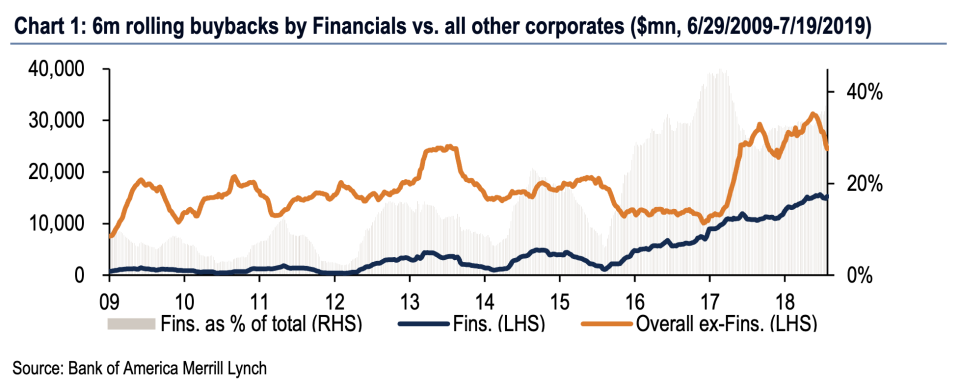

“Increasingly competitive cash returns of financials is one of the reasons we are overweight the sector - buybacks remain strong within financials even as the overall activity is slowing down elsewhere and the sector is now yielding 3.2% div yield post-CCAR,” the analysts added.

The S&P Financials Sector ETF (XLF) is up over 18% so far this year.

Bank of America clients have also been selling tech, which remains the best performing sector so far this year. The S&P 500 Technology ETF (XLK), which includes names like Apple (AAPL) and Microsoft (MSFT), is up over 31% year-to-date.

“Tech stocks saw outflows for the seventh consecutive week, and retail clients in particular have been net sellers of tech for 16 straight weeks,” the Bank of America analysts added.

Even with the decline in the broader Nasdaq (^IXIC) last week, Microsoft managed to continue building on its monstrous $1.06 trillion market cap after last week posting another quarter of double-digit revenue growth in its formidable cloud division Azure.

Scott Gamm is a reporter at Yahoo Finance. Follow him on Twitter @ScottGamm.

More from Scott:

Here is how corporate stock buybacks are changing the earnings picture

Morgan Stanley downgrades global stocks, projects ‘poor returns’ over the next year

Gabrielle Rubenstein’s new private equity firm focuses on healthy foods

The earnings picture for 2019 is showing more signs of deterioration

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.