JOBS WEEK — What you need to know in markets this week

This is Yahoo Finance’s preview of the week ahead in markets. For Myles’ take on the stock market’s surprising rally this year, scroll down.

—

After we wrapped up the month, the quarter, and the first three-quarters of the decade last week, markets this week will turn their attention the U.S. jobs report and the second half of 2017.

On Friday, the June employment numbers will cross, with economists expecting the economy added 177,000 jobs last month while the unemployment rate remained steady at 4.3%.

And after a half-year that saw stocks in the U.S. rally, bond yields fall, and the focus move from what the Trump administration had planned to what America’s biggest tech companies were up to, investors will head into the back half of the year looking for a new script.

David Rosenberg, a strategist at Gluskin Sheff, wrote this week that right now it is, “a dangerous market.”

Rosenberg added, “What else can one say when the CBOE’s VIX is at 10x, the S&P 500 is within 0.6% of an all-time high, the P/E multiple on reported earnings is the second highest in the past thirty years, and value stocks have lagged the broad market by over 10 percentage points this year and have underperformed growth by an extent we have not seen in three decades.

“The risks are endless at the current time.”

Economic calendar

Monday: Markit U.S. manufacturing PMI, June (52.1 expected; 52.1 previously); ISM manufacturing PMI, June (55.2 expected; 54.9 previously); Construction spending, May (+0.3% expected; -1.4% previously); Auto sales, June (16.5 million expected; 16.58 million previously)

Tuesday: Markets closed for July 4th holiday

Wednesday: Factory orders, May (-0.5% expected; -0.2% previously); FOMC minutes, June 13-14 meeting

Thursday: ADP private payrolls, June (+190,000 expected; +253,000 previously); Initial jobless claims (243,000 expected; 244,000 previously); Trade balance, May (-$46.3 billion; -$47.6 billion previously); Markit services PMI, June (53 expected; 53 previously); ISM non-manufacturing PMI (56.5 expected; 56.9 previously)

Friday: Nonfarm payrolls, June (+177,000 expected; +138,000 previously); Unemployment rate, June (4.3% expected; 4.3% previously); Average hourly earnings, month-on-month, June (+0.3% expected; +0.2% previously); Average hourly earnings, year-on-year, June (+2.6% expected; +2.5% previously)

The bull case for stocks this year fell apart, then stocks rallied

Coming into 2017, stock market investors were bullish on the plans then-President elect Donald Trump had for the U.S. economy.

At the top of the list was tax reform, which Trump pledged would take the U.S. corporate tax rate down to 15% from its current level of 35%. This, analysts argued, would be a boon to U.S. profit margins and stocks rallied after his win.

Additionally, stocks levered to an increase in infrastructure spending rallied, as did financials, as the Trump agenda was seen as something which would both be goods for stocks and executed in due time. Higher expected interest rates also sent bond yields higher.

But by the end of the first quarter, these trades had started to unwind and yet, stocks were on the move higher. In the first half of 2017, the S&P 500 gained 8.2%.

And as the Trump trades fell apart, big-cap tech companies once known as FANG but re-cast by Goldman Sachs analysts as FAAMG, became the market story in 2017. Facebook (FB) shares gained 31%, Apple (AAPL) gained 24%, Amazon (AMZN) added 29%, Microsoft (MSFT) shares rallied 10%, and Google parent Alphabet (GOOGL) rose 17%.

Together, these companies added about $600 billion in market cap this year and are worth over $2.6 trillion collectively. This is the world we live in.

Instead of investors looking to Washington, D.C. for guidance on where stocks would go they instead look to the big-cap tech stocks that define our digital lives and power the trend towards buying growth stocks that investors became enamored with this year.

And while the market’s driving narrative shifted from Trump to tech, the seas were calm, with the market’s biggest peak-to-trough drawdown this year coming in at 2.8%, the lowest since 1995, according to Charlie Bilello, director of research at Pension Partners.

Meanwhile, Bitcoin, blockchain, and digital currencies closed out the first half of the year with a cover story in Barron’s, a sentiment check for those who have seen this space emerge as perhaps the most talked about asset class of the year.

In the end, however, the old adage was true: stocks usually go up.

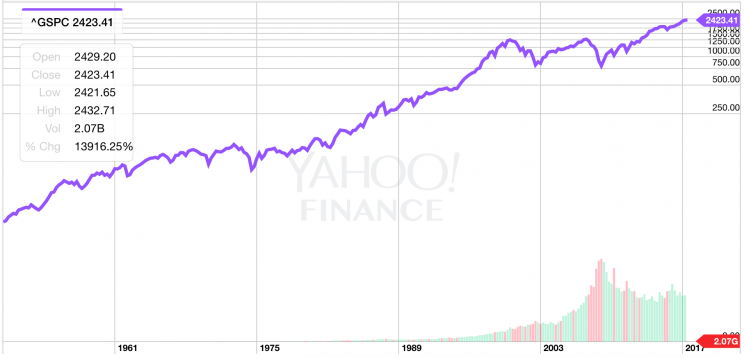

But the lessons of the first half of 2017 — just as those we highlighted in 2016 — remain very much the same. Since 1950, the S&P 500 has gone up just shy of 9% per year; over the last century stocks have risen, on average, closer to 7% per year.

Over this long arc, the returns look smooth and the idea is simple.

As it happens, however, the market’s action and the stories we tell about it appear lumpy, foolish, and contradictory, at the very least. The daily market action is jumble of ideas and technicalities and humans and computers colliding.

Or as the philosopher Joseph Campbell attributes to Arthur Schopenhauer, “when you look back on your life, it looks as though it were a plot, but when you are into it, it’s a mess: just one surprise after another. Then, later, you see it was perfect.”

In markets as in life.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: