JOBS — What you need to know on Friday

To cap off what’s been perhaps the busiest week of the year in business and economics, the October jobs report will be the highlight on Friday.

Expectations are for the report to show a sharp rebound in job gains after September’s disappointing — but hurricane-impacted — report showed the U.S. shed 33,000 jobs during the month.

Wall Street economists are looking for job gains of 300,000 with the unemployment rate set to hold at 4.2%, according to estimates from Bloomberg.

Elsewhere on the economic calendar we’ll also get the September data on the trade balance, factory orders, and the final reading of durable goods orders. The October data on service-sector activity is also due out from both Markit Economics and the Institute for Supply Management.

On the earnings side, the calendar will be a bit more quiet with results expected from Duke Energy (DUK), Moody’s (MCO), and Berkshire Hathaway (BRK-A, BRK-B).

Thursday’s crazy calendar is also still expected to be in play on Friday, notably results out after the bell from Apple (AAPL) which sent the stock to a new all-time high above $170 per share after beating on both the top and bottom lines.

Elsewhere, investors are also still digesting the official announcement from President Donald Trump that Jerome Powell will be nominated to replace Janet Yellen as Chair of the Federal Reserve.

And of course the GOP’s tax plan, released on Thursday, will continue to get scrutiny as lawmakers attempt to sell the bill which, as Yahoo Finance’s Rick Newman notes, remains a tough sell.

October jobs preview

Last week, we noted that after Hurricane Katrina, it took two months for jobs data to return to its prior trend. And given the expectations for a monster print in Friday’s October report, it appears we will similarly have a two-month period where headline payrolls data is at least slightly tweaked by the impacts from natural disasters.

“These hurricane-related swings make it harder to see the underlying trend in the labor market,” said Jed Kolko, chief economist at Indeed.

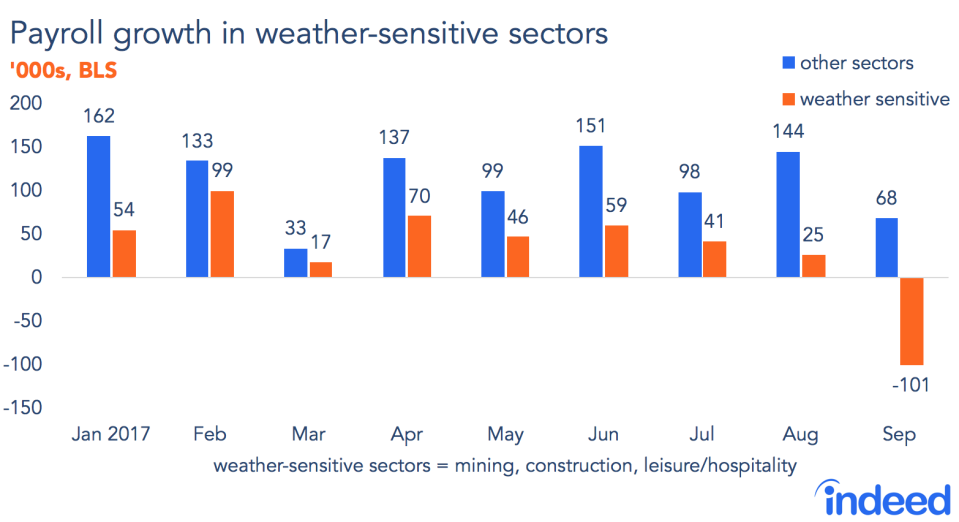

Kolko notes, however, that if you strip out the most weather-sensitive sectors — leisure & hospitality, construction, and mining — from the September report, payrolls grew by 68,000 while these three sectors saw losses of 101,000.

Another major focus in Friday’s report will be wage growth, as wages rose 2.9% over the prior year in September, better than expected by economists and matching a post-crisis high.

Ellen Zentner, an economist at Morgan Stanley, wrote Thursday that the monthly wage gain of 0.3% her team is forecasting for October is smaller than the 0.5% increase seen in September, but is “still consistent with gradually building wage pressures.”

“Some of last month’s upside represented a compositional bias as more lower-paying industries were impacted by the hurricane, and the composition should normalize in October as workers in these industries reenter the employment pool,” Zentner writes. “Still, we expect earnings growth will remain strong even after accounting for this normalization.”

Over at Goldman Sachs, economist Spencer Hill forecasts that payrolls will grow by 340,000 in October, topping the 312,000 expected by Wall Street consensus.

Hill says this forecast, “reflects solid underlying job growth and a sharp rebound in employment in hurricane-affected areas, as we estimate flooding and power outages reduced the level of September payrolls by approximately 180,000.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: