JOBS DAY — What you need to know in markets on Friday

August is over and stocks eked out gains in what has been one of the year’s weakest months for markets.

The tech sector, as has been the case for all of 2017, led the way with the tech-heavy Nasdaq gaining about 0.8% during the month while the benchmark S&P 500 was the laggard adding just 0.05%.

But for those who like to be aware of seasonal market trends, beware September, as this has been the S&P’s worst month, on average, since 1928, according to LPL Research.

The firm notes that September, on average, posts a 1% loss, the worst of any month since 1928, and the month has also been down 10% or more seven times, more than any other month of the year over that period.

And while the impact Hurricane Harvey continues to have on Texas has been the main story both on and off Wall Street this week, the week will end with the busiest day of economic data as the August jobs report, readings on consumer sentiment, manufacturing activity, and auto sales will all be released.

Trading volume, however, will likely be on the lighter side as Friday is the final day before a three-day holiday weekend in the U.S., with the Labor Day holiday marking the unofficial end of summer.

August jobs preview

In August, the U.S. economy is expected to continue 2017’s string of strong job creation.

Wall Street economists are forecasting nonfarm payrolls will grow by 180,000 with the unemployment rate expected to hold steady at 4.3%, according to estimates from Bloomberg.

Average hourly earnings are expected to rise 0.2% over the prior month and 2.6% over the prior year. Earnings trends have been closely watched by economists for signs of inflation bubbling up in the economy.

This report will also follow Wednesday’s private payrolls report from data processing firm ADP, which indicated that 237,000 jobs were created in the private sector during August. Notably, August has been one of the weaker months for the jobs report in recent years, due to seasonal factors.

In a note to clients ahead of the report, Spencer Hill, an economist at Goldman Sachs, said he expects 160,000 jobs were created in August. Hill said this forecast, “reflects somewhat more mixed labor market fundamentals and a drag from residual seasonality, as first-reported August payroll growth has been consistently weak in recent years.”

A miss relative to expectations, however, should not change the Fed’s outlook on the labor market and the economy given that recent data have been solid, the seasonal adjustment issue in August is well-known, and there is time between now and December for the labor market to improve before another rate hike is announced, according to Hill.

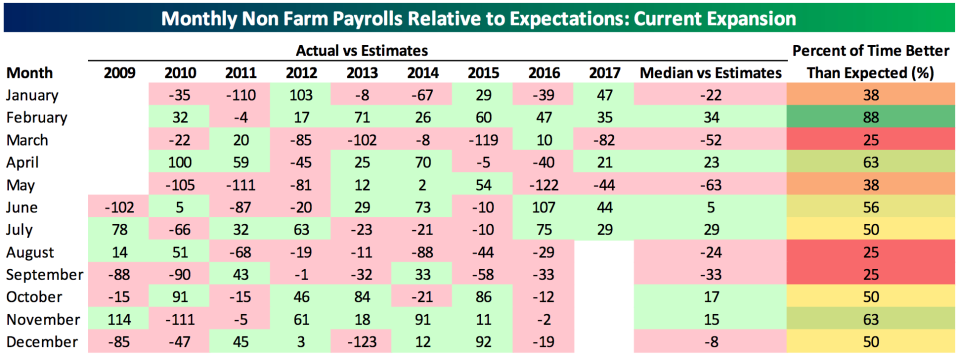

Bespoke Investment Group noted ahead of Friday’s report that along with September and March, August has had the lowest percentage of job report “beats” — that is, reports which top Wall Street estimates — during the current economic expansion.

But while the seasonal adjustment process could potentially hamper headline numbers on Friday, Bespoke notes that secondary indicators of labor market strength have been “overwhelmingly positive” in August.

Regional Fed surveys, consumer confidence data, and the Institute for Supply Management’s service and manufacturing readings have largely pointed to positive developments in the labor market during August, Bespoke notes.

Additionally, while impacts from Harvey are likely to weigh on economic data in September and potentially beyond, no major weather events or labor strikes should dampen Friday’s figures, said Ian Shepherdson at Pantheon Macroeconomics.

And of course, we’ll have the full breakdown and live coverage of the numbers Friday morning on Yahoo Finance.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: