iPhones, retail sales, and Irma — What you need to know for the week ahead

After a fairly quiet holiday-shortened week that saw just one day of real market action — each of the major averages lost about 1% on Tuesday — investors this week will have another hurricane, a run of economic data, and Apple’s (AAPL) big iPhone unveil.

The week’s big corporate highlight is set for Tuesday, when Apple is expected to unveil its latest update to iPhone. Reports over the weekend indicated that three new models will be released — iPhone 8, iPhone 8 Plus, and iPhone X. Typically, Apple shares rise a little bit after the news of a new iPhone. Apple shares are up about 37% so far this year and were down 1.6% on Friday.

On the economic side of things this week, investors will get data on job openings, retail sales for August, consumer prices, and consumer confidence in a nice pickup in the data flow after last week’s super-light schedule.

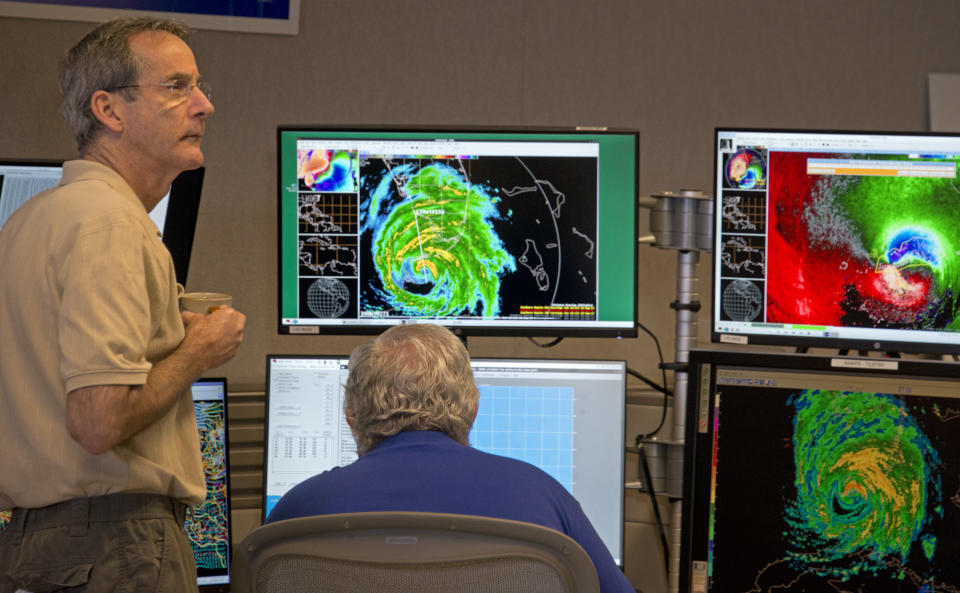

The week’s biggest story will certainly be continuing impacts from Hurricane Irma, which made landfall in the Florida Keys Sunday morning and was set to make its way up the west coast of the state.

The economic impacts from this storm are as-yet-unknown, but as we wrote over the weekend a certain economic logic can tell you the recovery efforts will be positive for economic growth — this is not, however, good growth.

Insurance stocks have been in focus as impacts from Irma, and previously Hurricane Harvey, have been anticipated by investors. And while a number of insurance names — Travelers (TRV), Allstate (ALL), and AIG (AIG), among others — bounced on Friday, over the last month these stocks have lost 5% or more.

Economic calendar

Monday: No major economic data set for release:

Tuesday: Job openings and labor turnover survey, July (5.9 million job openings expected; 6.16 million openings previously); NFIB small business optimism, August (105.0 expected; 105.2 previously)

Wednesday: Producer price index, August (+0.3% expected; -0.1% previously)

Thursday: Initial jobless claims (300,000 expected; 298,000 previously); Consumer price index, month-on-month, August (+0.3% expected; +0.1% previously): Core CPI, year-on-year, August (+1.6% expected; +1.7% previously)

Friday: Empire State manufacturing index, September (18 expected; 25.2 previously); Retail sales, August (+0.1% expected; +0.6% previously); Industrial production, August (+0.1% expected; +0.2% previously); University of Michigan consumer sentiment, September (95.6 expected; 96.8 previously)

The Equifax hack

On Thursday evening, investors were surprised to learn that Equifax (EFX), one of the country’s main credit-reporting agencies, had been hacked.

The company said that the information, including names, Social Security numbers, and potentially driver’s license numbers, of some 143 million Americans had potentially been compromised.

On Friday, the stock fell 13%.

Obviously, there will be lawsuits. But this hack also exposes a sort of weakness in our interconnected commercial world and raises the question of why Equifax had so much personal data at all.

And the simplest answer is that the company does something other businesses considered too time-consuming for them — checking the financial health of potential customers.

Almost all consumer-facing businesses lend money to people. Car dealers, retailers, and banks all lend money to customers. Even your gym membership is effectively a loan — you agreed to pay a monthly fee to use the gym and the company is expecting you to pay this. Their business model depends on this.

But ensuring that all of your customers are going to be able to make payments of a certain amount in a timely manner can be expensive and time-consuming. Enter Equifax and its competitors, TransUnion and Experian.

These companies do the work for the lenders, collecting the personal information of borrowers and sifting through who pays their bills and who doesn’t. This allows lenders — which, again, does not necessarily mean a bank, but simply someone who wants to get paid by you on a regular schedule — to vet their customers efficiently. And this business sits squarely between an incredible amount of transactions in the economy. It has become a necessary middleman.

Which is why Equifax is something resembling a household name. You might not have been 100% sure what the company’s purpose was, but you were likely aware that you had to give them information to get a credit score to borrow money for something at some point.

To use a fancy economics term, that the information of hundreds of millions of Americans has been exposed by a service we were all sort of required to use is an externality. The hack is the cost we didn’t know we were paying to have credit extended to us by a variety of lenders in an efficient manner.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: