International TV World Buzzes About What’s Next for Weinstein Co.

CANNES — The extraordinary meltdown of the Weinstein Co. has been the talk of the Mipcom conference, in part because so many of the big international TV players gathered recently had a look at the company’s finances.

The Weinstein Co. has been aggressively shopping the sale of its TV division for more than two years, with little luck. Prospective buyers have consistently scoffed at the $700 million-plus valuation sought by the company.

More recently, two knowledgable sources said Weinstein Co. COO David Glasser held meetings with TV players within the last eight weeks in an effort to attract partners to help finance its upcoming TV slate. Just a few weeks later, the question has turned to how quickly TWC assets such as the long-running reality series “Project Runway” will come up for auction in a fire sale.

A source close to the situation, who was not authorized to speak on their employer’s behalf, said the slate-financing presentation included interesting material but the deal terms TWC had set up with creative talent and its network partners were “insane.” This person said it would have been nearly impossible for Weinstein Co. to profit on its rich deals with Amazon for two upcoming drama series barring one of them turning into a “Game of Thrones”-level global hit.

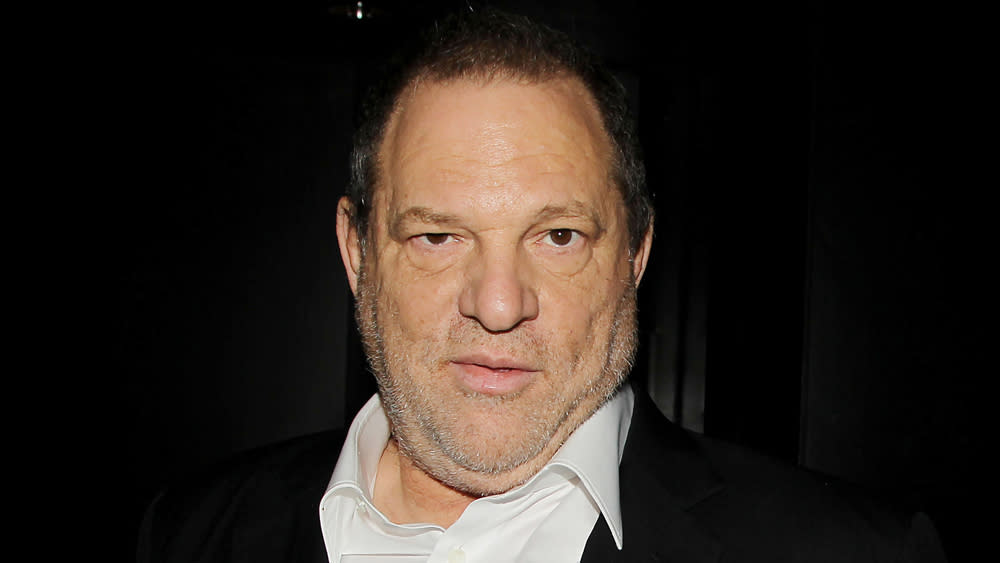

Weinstein Co. has been engulfed by scandal during the past two weeks since the New York Times and New Yorker published exposes detailing allegations of sexual assault and harassment by TWC co-founder and co-chairman Harvey Weinstein stretching back decades. The crisis has prompted the firing of Weinstein and a rush by TWC’s network partners to distance themselves from the controversy that has sparked an international furor of the prevalence of sexual harassment in the entertainment industry. Weinstein has been dumped as an executive producer on TWC’s roster of series — which includes “Project Runway” — and now even the TWC title card is disappearing from shows.

On Monday morning, news broke that Colony Capital would give the Weinstein Co. an emergency infusion of cash. Additionally, the company is negotiating with Colony Capital to sell all or a significant portion of its assets.

It’s no secret that Weinstein Co. has been shopping its TV division in an effort to generate some coin to help satisfy its long-term investors and lenders. One of the biggest problems for prospective buyers was the fact that TWC’s TV revenue and earnings were co-mingled with its film production operations. That meant it was hard to get a clean read on how the TV division was performing. It was clear, however, that TV has been the engine of revenue at TWC in recent years.

ITV was in talks for a period of time but was put off by the unrealistic valuation and by the hint of the scandal to come that erupted in early 2015. Weinstein at the time was publicly accused of groping Italian model Ambra Battilana Gutierrez. The incident hit the New York tabloids and scared off ITV for good.

Others who have looked recently at an acquisition or potential TV series partnering opportunities with TWC include Lionsgate, Studiocanal, Entertainment One, and FremantleMedia. Numerous sources said the company’s financial situation appeared to be strained. A heavy debt load rumored to be upward of $500 million and pressure to deliver returns to its initial investors drove the push to sell all or a partial interest in the TV company.

One knowledgable sources said TWC’s strategy in agreeing to lavish co-financing deals with Amazon for two series was a bid to puff up the projected earnings in future years. TWC committed to a two-season deal for a series from David O. Russell with a projected budget of $160 million for 16 episodes, with TWC believed to be on the hook for half of the financing. TWC was said to have committed to fund about half of the anthology drama “The Romanoffs,” from Matthew Weiner.

TWC was betting largely on robust international sales to turn a profit on the projects. Amid the turmoil surrounding the company, Amazon has shelved the Russell series. “Romanoffs” is well into production with Amazon paying the bills, although TWC did cover some of the show’s initial startup costs, according to a source.

TWC is also said to be caught in the Catch-22 dilemma of having deals that stipulate Weinstein is a “key man” involved in the production. Now that he’s been fired, that gives TWC’s partners an easy exit from deals. Apple moved quickly as the scandal broke to scrap a planned Elvis Presley biopic series with TWC.

The expectation among observers at Mipcom is that TWC assets will eventually hit the auction block, but will be complicated by expected storm of litigation between Weinstein and the company he co-founded with his brother in 2005. “Project Runway” is by far the brightest light in the company’s TV roster. Industry veterans said the franchise likely generates about $25 million-$30 million a year, which is spread among TWC, A+E Networks, international distributor Electus and the profit participation stakes held by stars Tim Gunn and Heidi Klum.

Related stories

Clinton Foundation Has No Plans to Return Harvey Weinstein Contributions

Mipcom: Dandelooo Picks-Up Worldwide Rights To 'Royale Sisters' (EXCLUSIVE)

Mipcom: BBC Commissions Development of 'Locked Up' Remake (EXCLUSIVE)

Subscribe to Variety Newsletters and Email Alerts!