Intel Corporation's (NASDAQ:INTC) Numbers Outshine the Brand Image

This article first appeared on Simply Wall St News.

Maintaining brand value is a lot of work for large corporations. It takes a coordinated effort to keep a positive brand image through multiple product life cycles. Alternatively, the company ends struggling to innovate and relying on the success from the past.

Unfortunately, that is what Intel (NASDAQ: INTC) has been stuck with, as the stock has been ranging for over 3 years now. As the company's strategies shift, we will examine the current return on equity (ROE).

See our latest analysis for Intel.

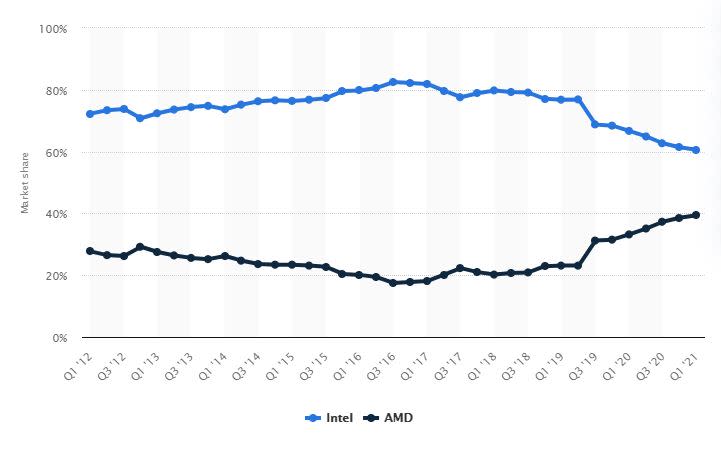

In the latest chapter of the battle with AMD, Intel could take advantage of its vertical integration to lower the final pricing of server processors. While the company just shut down this rumor, it remains on the table as a weapon of the last resort.

With this strategy, Intel can keep large accounts from switching over to a rival by changing a variable in the cost-benefit analysis. Technically speaking, switching the server infrastructure brand comes at a much higher cost than just upgrading from the same brand.

Yet, given the global trends about energy sustainability and the recent criticism about power consumption from Cloudflare, one should rightfully question if there is more to be done.

Meanwhile, the company explores the lucrative robotaxi market by partnering up with Nio and the German car rental leader Sixt. Tests are scheduled for 2022 in Munich and will feature NIO's all-electric ES8 SUV. An expansion for the automotive chip production should include capital investments in Europe worth US$100b.

A look at ROE

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it receives from its shareholders.

In simpler terms, it measures the profitability of a company concerning shareholder's equity.

See our latest analysis for Intel

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Intel is:

22% = US$19b ÷ US$85b (Based on the trailing twelve months to June 2021).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each $1 of shareholders' capital it has, the company made $0.22 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains" and how effectively it does so, we can assess a company's earnings growth potential.

Assuming all else is equal, companies with both a higher return on equity and higher profit retention are usually the ones with a higher growth rate compared to companies that don't have the same features.

Intel's Earnings Growth And 22% ROE

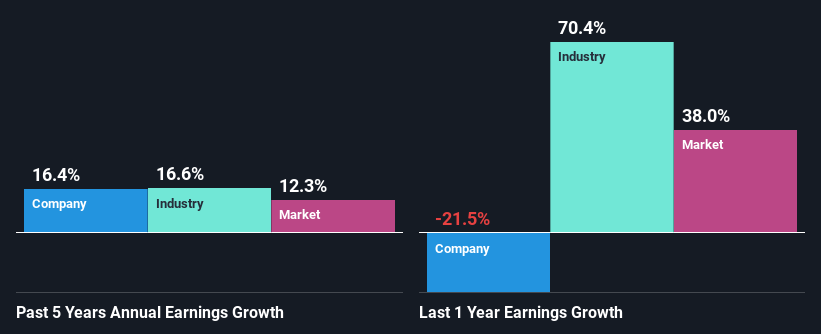

To start with, Intel's ROE looks acceptable. Further, the company's ROE compares quite favorably to the industry average of 15%. This probably laid the ground for Intel's moderate 16% net income growth seen over the past five years.

As a next step, we compared Intel's net income growth with the industry and found that the company has a similar growth figure compared with the industry average growth rate of 17% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. An investor needs to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future.

Has the market priced in the future outlook for INTC?

You can find out in our latest intrinsic value infographic research report.

Is Intel Making Efficient Use Of Its Profits?

Intel has a three-year median payout ratio of 27%, implying that it retains the remaining 73% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

Additionally, Intel has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Looking at the current analyst consensus data, we can see that the company's future payout ratio is expected to rise to 35% over the next three years.

Consequently, the higher expected payout ratio explains the decline in the company's expected ROE (to 16%) over the same period.

Conclusion

Overall, Intel's performance looks better than what you'd expect, given the current vibe around the brand.

In particular, it's great to see that the company is investing heavily into its business, and along with a high rate of return that has resulted in a sizeable growth in its earnings. That being so, according to the latest industry analyst forecasts, the company's earnings are expected to shrink in the future.

To know more about the latest analysts' predictions for the company, check out this visualization of analyst forecasts for the company.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com