IAC Increases Stake in MGM Resorts in Bet on Online Gambling Growth

- Oops!Something went wrong.Please try again later.

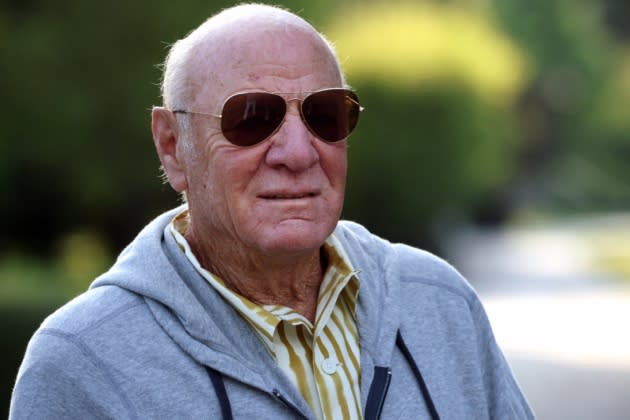

IAC, the digital media and internet services company led by mogul Barry Diller, has upped the ante on MGM Resorts International, eying the growth of the online gambling and sports betting market.

Between Aug. 11-23, IAC purchased shares in MGM Resorts totaling about $41.7 million, increasing its stake in the company to 16.5 percent, the Las Vegas-based hospitality and betting firm disclosed in a filing with the Securities and Exchange Commission on Friday. The move could be an opportunistic buy, given that share prices have ranged between $27-$35 in July and August, down from $45-$48 at the beginning of the year.

More from The Hollywood Reporter

'Land of Gold' Director Nardeep Khurmi Signs With Rain (Exclusive)

Britney Spears Reacts to Success of Elton John Duet 'Hold Me Closer': "Best Day Ever"

IAC — which backs assets like the Angi digital marketplace, Dotdash Meredith magazines like People and InStyle, and content brands like Ask and news sites like The Daily Beast — disclosed a buy-in to MGM Resorts two years ago, in the middle of pandemic-era shutdowns for resorts and casinos.

At the time, IAC accumulated a 12 percent stake in the company for about $1 billion, in August 2020. Diller and IAC CEO Levin described the bet as one on online gaming revenue. “Similar to Disney’s advantages over pure-play streaming companies with an iconic brand and multiple avenues to monetize the same intellectual property between streaming, theatrical releases, merchandise, and theme parks, we believe MGM also is an aspirational brand, which could be delivered with daily accessibility and offer gaming consumers,” Diller and Levin wrote to shareholders at the time.

BetMGM, MGM Resorts’ 50/50 joint venture with gambling giant Entain, has been the vehicle for those aspirations. The sports betting firm — which has signed up brand ambassadors like Jamie Foxx, Wayne Gretzky, Kevin Garnett and Jerry Ferrara — and its rivals like FanDuel and DraftKings, are counting on more U.S. states legalizing online sports betting. (Online gambling is now legal in 21 states.)

Since 2020 the company has increased its investment, buying $202.5 million worth of shares in February from hedge fund Corvex Management that upped its stake in MGM Resorts to 14.4 percent.

In a shareholder letter on Aug. 9, IAC’s Levin pointed to solid consumer demand at MGM Resorts properties — which include hotels like the Bellagio and MGM Grand and operations of the Cosmopolitan — noting the resort giant saw “consistent strong demand from the leisure consumer and all-time high average daily room rates for Las Vegas.”

“We’ve learned a lot since we’ve been there,” Levin said on an earnings call in May, of IAC’s investment in MGM Resorts. “I’d say that the gaming business, both the online gaming business overall, which is both sports betting and i-gaming, has outperformed our expectations relative to when we came in. It’s grown really tremendously, and that growth is going to continue for a long time.”