How Hollywood May Be Sabotaging Profits With New Push to Pay Talent Upfront | Charts

Streaming studio executives believe they have gamed the system by locking talent into occasionally lucrative yet restrictive deals that pay talent substantially more upfront and hoard all the long-term benefit for the distributor. In actuality, this new system may wind up hurting creative quality and exposing studios to increased financial risk.

What was once a relatively transparent talent compensation calculation based on box office earnings or linear TV ratings has become a mathematical game of hide and seek. Amid the streaming boom, Hollywood has largely shifted away from backend compensation — where directors and key stars get a share of the revenues from the box office or from linear syndication and deals for streaming broadcast rights — in favor of more nebulous front-loaded payment for SVOD content.

“With studios stating the backend has gone away and instead they’re going to provide buyouts, I think the talent world would be naive to think that it ultimately benefits talent,” Marc Simon, chair of Fox Rothschild’s Entertainment and Sports Law department, told TheWrap.

Of course, different companies utilize different compensation methods to limit profit participation payments for talent. Disney+, for example, utilizes a system known as Series Bonus Exhibit points, which ties talent compensation to criteria such as season renewals, library ranking, awards recognition and various other metrics. This allows the streamer to pay talent participants across some established and rigid parameters. Meanwhile, Netflix infamously doles out jaw-dropping upfront fees to top talent as they buy out the backend for a healthy dollar amount long before the content reaches our screens (though recently the streamer added a bonus to attract movie talent).

The end result of both models is top-line talent earning less than they once did for their home-run hits and Hollywood’s middle class (i.e. supporting cast members, showrunners, producers and writers who aren’t on the Shonda Rhimes and Ryan Murphy level) getting squeezed.

This shift appears to be designed to most benefit the studios. Now that production companies have wholly owned in-house distribution platforms via streaming, they’re either “paying less than market value” for content their own creative divisions create or “getting long-term distribution deals and sweetheart deals” with their production companies, Matthew Wilson, AGG Corporate and Intellectual Property partner and co-chair of AGG’s Entertainment & Sports industry team, told TheWrap.

Also Read:

‘Better Call Saul’ Pays Big Dividends for AMC, Much Like ‘Breaking Bad’

Studios have long been accused of practicing “Hollywood accounting,” masking either profits in order to limit participation payments. Unfortunately for talent, this paradigm has carried over to the new model, which creates another puzzle to be solved.

But the consequences of buying out the backend leaves studios exposed on the front. Removing profit participation results in talent no longer sharing in the risk, freeing them from the financial pains of a commercial flop. That albatross now solely hangs around the neck of the studio. You don’t think Netflix might have preferred some insulation on expensive misfires such as “Jupiter’s Legacy” or “Cowboy Bebop”? Will heads roll at Amazon if Prime Video’s $465 million “Lord of the Rings” TV series proves more Gollum than Smeagol?

“Backend buyouts help the few, but harms the many,” Simon said.

More concerning is what this shift away from the previous model may mean for the actual quality of the final product.

Also Read:

Make No Mistake, Content Spending Isn’t Going Down Anytime Soon | PRO Insight

“There is now a misalignment of incentives,” Simon explained. “A fair traditional contingent compensation model aligns the interest of the financial backers and everyone invested in the creation of content. It has to be a success to be of economic benefit. Paying upfront dilutes the incentive and, ultimately, content creation is harmed.”

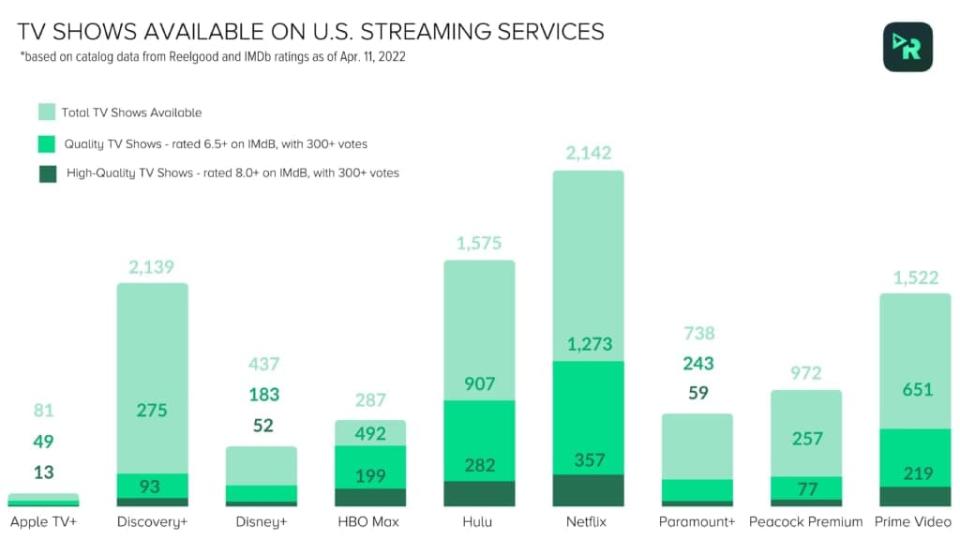

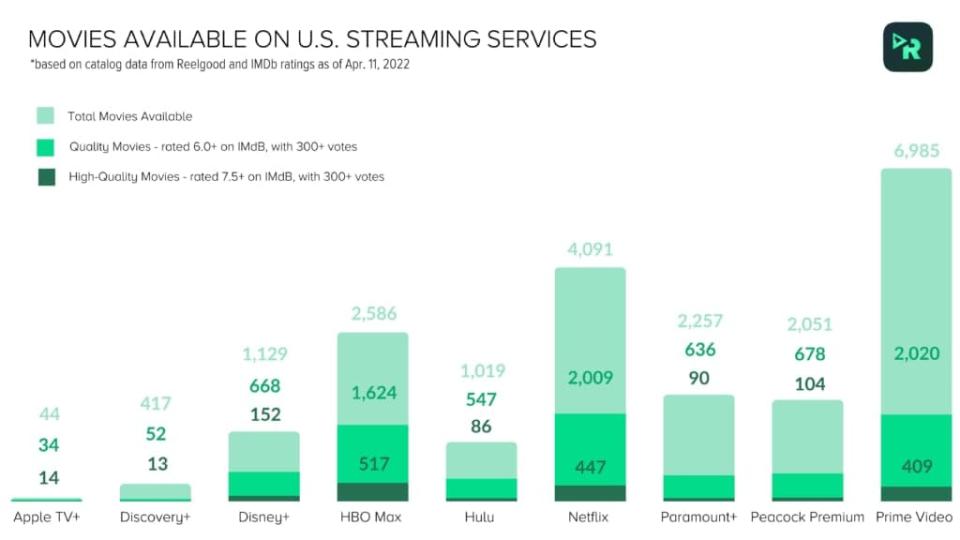

There are signs that this fear of waning standards is already reflected in our current crop of streaming content. According to IMDb, a TV show with a rating of at least 6.5/10 is considered “quality” while an 8.0 or higher rating is defined as “high-quality.” For films, quality begins at 6.0/10 and high-quality at 7.5 or higher.

When including both original programming and licensed titles, the four largest scripted SVOD libraries in the U.S. as of April are Prime Video, Netflix, HBO Max, and Peacock Premium, according to Reelgood data provided to TheWrap.

Around 50 percent of Prime Video’s TV library failed to qualify as quality or high-quality under these metrics, while 65 percent of the film library failed to qualify. For Netflix, 24 percent of its TV library didn’t make the cut while 40 percent of its movie library fell below the required metrics.

HBO Max performed much better, with just 12 percent of its TV catalog failing to qualify and 17 percent of its film library lagging below the quality marks. But then Peacock Premium saw 66 percent of its TV catalog and 62 percent of its film collection miss the mark.

Though this includes both original and acquired titles, it underscores a fair amount of ignorable subpar bloat in domestic streaming packages. And when a studio assumes 100 percent of both the upside and downside on a project, it may eventually stop taking creative risks in favor of content with the broadest possible appeal and safest return on investment. That’s partly why sharing the backend with talent participants leads to more expensive hits, but less bottom line-draining misses.

“The lack of ability to spread the risk among all participants in a production is ultimately going to result in less interesting projects being made,” Wilson said.

Less quality content can lead to the streamers’ worst enemy: churn, in which customers sign up to watch a specific series or movie and then cancel their subscription after they’ve watched it because they can’t find a new reason to continue.

There’s a case to be made that the backend model, in which the monetary incentives of both the studio footing the bill and the talent harboring a vested interest in its success, was a more cost-effective form of quality insurance. But as the streaming industry continues to mature and evolve, particularly under the harsher eye of a suddenly prudent Wall Street, there’s reason to believe the new compensation model is far from set in stone.

“This new compensation model is here for now, but I think there’s going to be analysis from both sides that will result in other options,” Simon said.

Also Read:

How the Major Streamers Stack Up Right Now – in Subscribers and Revenue | Charts