How HBO Max Can Poach Customers From Disney+ and Paramount+ (and Vice Versa) | Charts

- Oops!Something went wrong.Please try again later.

HBO Max is poised to drop the “HBO” from its name in less than two weeks, as Warner Bros. Discovery tries to pitch the higher-priced streaming service it built around the cable brand to a broader set of subscribers.

Yet Warner Bros. Discovery may be missing a key factor about HBO’s appeal: Some of its top shows share audiences with competitors’ top properties, suggesting that it could effectively market the service to their rivals’ customers. An analysis of Parrot Analytics’ data — which takes into account consumer research, streaming, downloads and social media, among other engagement — shows a significant overlap in demand between certain HBO shows and properties on Disney+ and Paramount+.

Also Read:

How the HBO Max-Discovery+ Combo Could Challenge Netflix and Hulu | Charts

In the end, the replacement name for HBO Max may not matter as much, as long as it continues to carry shows from HBO as well as Warner Bros. movies, Cartoon Network and Adult Swim animated series, and other properties across Warner Bros. Discovery’s expansive portfolio. The recent debut of the fourth and final season of “Succession” alongside the successful video game adaptation “The Last of Us” have helped draw attention to HBO’s continued programming strength.

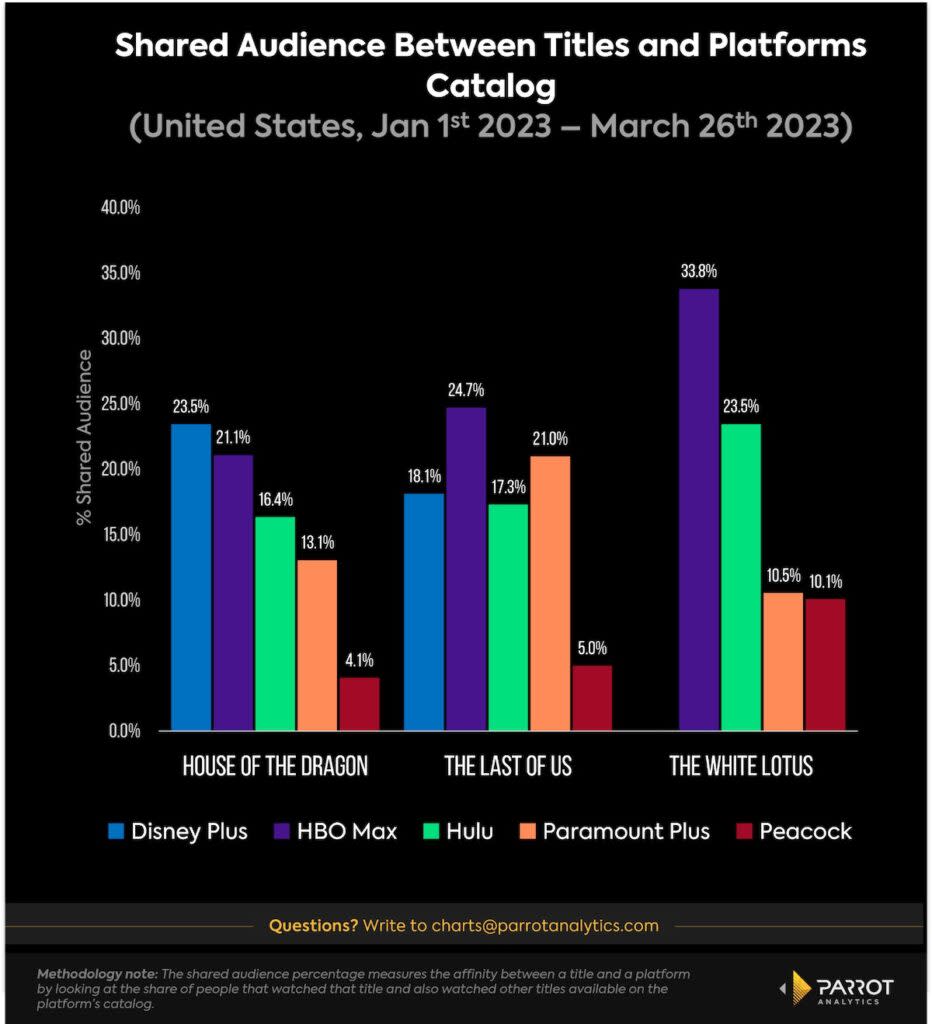

Beyond the raw pop culture impact of these shows, it helps to understand how they funnel audiences to other shows within the HBO Max catalog. Using Parrot Analytics’ affinity data, it’s possible to measure the shared audience between a title and a platform’s catalog.

“House of the Dragon,” the spinoff of HBO’s most successful show so far, “Game of Thrones,” boasts a very high shared audience with Disney+, even more so than its affinity with the rest of HBO Max’s catalog. Combined with the huge demand the show generated in 2022, it indicates potential for the series to attract nonsubscribers to HBO Max. Affinity for “House of the Dragon” overlaps with other tentpole fantasy and science-fiction shows, a focal point of the Disney+ original programming strategy. Some of the shows with highest affinity with the HBO title include “Andor” and “Obi-Wan Kenobi,” both Disney+ shows from the “Star Wars” franchise.

In contrast, “The White Lotus” has the highest affinity with HBO Max’s catalog. That makes the soapy comedy-drama a good contributor to retaining subscribers and reducing churn on HBO Max. This, along with its cultural impact — its viral theme song and Jennifer Coolidge’s can’t-not-watch appeal — were doubtless factors in HBO renewing the show for a third season (though it’s assumed Coolidge won’t be back for obvious reasons…)

Also Read:

Viewers Want More Foreign Content – but the Mix Is Changing Dramatically | Charts

“The Last of Us” stands in between “House of the Dragon” and “The White Lotus.” It has a strong affinity with HBO Max’s catalog, but the size of the shared audience between “The Last of Us” and Paramount+ originals “1923” and “Star Trek: Picard” stands out.

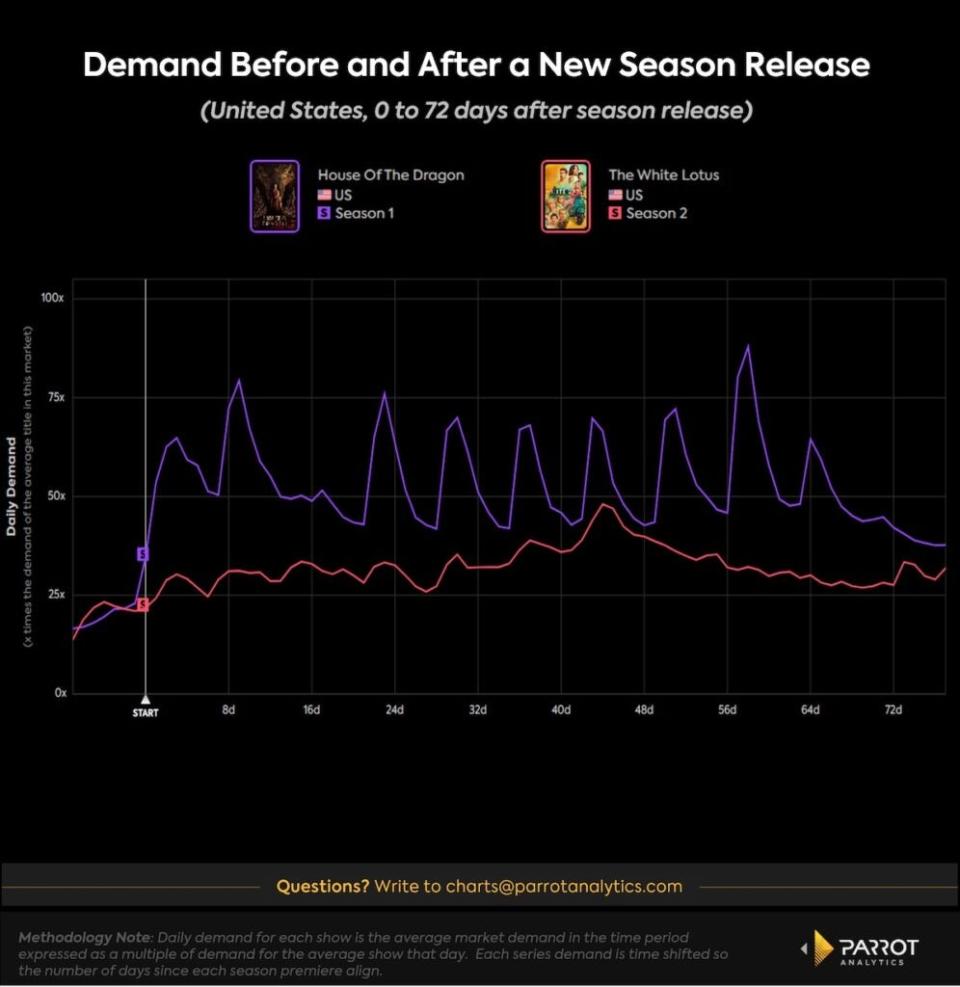

When it comes to subscriber retention, a show like “The White Lotus” is very effective at redirecting audiences to other shows available within the catalog, even though it has lower overall audience demand than blockbusters like “House of the Dragon.” The “Game of Thrones” prequel enjoyed consistently more demand in the months following its premiere than “The White Lotus” generated following the release of the second season. But, demand for both series converges to a similar level roughly 70 days after their respective premieres. Every streamer should be thinking about this question: What will fans watch next?

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

HBO’s ’The Last of Us’ Holds On to Top Spot for Most In-Demand New Shows | Chart