The government can't stop people from making the single-biggest investing mistake

The most important thing to do when saving for retirement is to actually do it.

And do it early and often.

On Friday, the Treasury Department announced it would close the myRA program — announced by the Obama administration in 2014 — a government program meant to aid retirement savers without access to a pension or 401(k) plan through an employer.

Over the last two-and-a-half years, 30,000 people had signed up for accounts through the myRA program, though only 20,000 of those had any money in them according the Treasury department. The median balance on these accounts was $500 with contributions into these accounts totaling $34 million since inception, the department said.

And while the lack of enthusiasm for the program from savers could be argued to be the result of ineffective communication out of the Treasury department, this government program could not overcome the most basic problems Americans have when saving for retirement, which is simply not doing it enough.

Not the least of which is simply not saving early or often enough. As we’ve highlighted before, this chart from JP Morgan shows the difference between starting saving for retirement — and sticking to it — at age 25 versus age 35 can be almost $1 million by age 65.

And while experts disagree on whether the U.S. is facing a “retirement crisis” or not, what is clear is that many Americans do not feel prepared for retirement.

A study published by the Federal Reserve in May found that 28% of U.S. adults have no retirement savings whatsoever, and that 13% of adults with retirement savings either borrowed from this stockpile or cashed out these savings (both depriving themselves of future gains and incurring a tax penalty).

Additionally, 53% of Americans with a self-directed retirement plan like a 401(k) or IRA — meaning those without a pension — are either not comfortable or only slightly comfortable with their decisions. This discomfort is almost certainly a contributing factor when folks make decisions like pulling money from a retirement account early, which almost no investment professional would recommend.

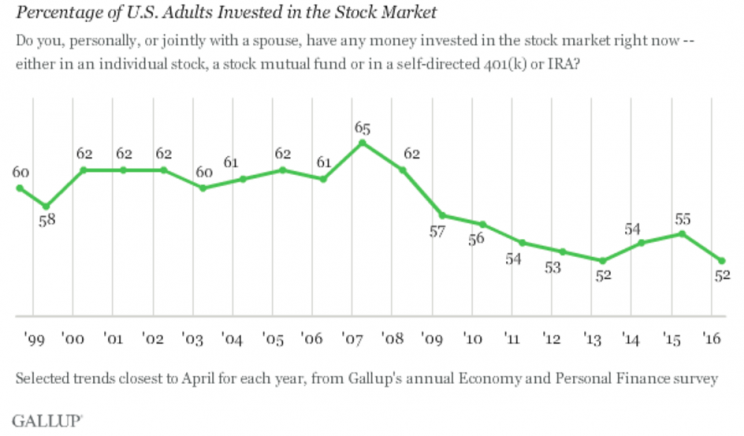

The myRA program also did not help alleviate the divide between the haves and have nots when it comes to the stock market. As we noted earlier this year when the Dow cracked 20,000 for the first time — the index is now closing in on 22,000 — just 52% of American adults own stocks.

In 2016, many expected stocks would sell-off if Trump were to pull out a surprise win, the opposite happened — stocks shot higher. Since the election, the S&P 500 is up about 18%; in 2017, the market is up 10%. And about half of America has missed out.

Those with myRA accounts, would also not have seen any of this stock market benefit as accounts were invested only in U.S. Treasury bonds. These accounts were also untraditional as the principle was fully protected, and contributions could be withdrawn tax-free at any time, making these accounts essentially glorified savings accounts.

Now, the myRA program was explicitly billed as a bridge to getting savers into a private Roth IRA, as the accounts would top out at $15,000 or a 30 year investment. Existing accounts will be moved into private sector offerings as part of Treasury shutting down this program.

In a release, the Treasury department said the program cost $70 million since 2014 and that demand for the program “has been extremely low.”

The Treasury department added that myRA was expected to cost $10 million per year going forward and that the program was cut, “as part of the Administration’s effort to assess existing programs and promote a more effective government.”

Of course, with a nearly $12 billion budget in fiscal 2016, it’s unlikely cutting this program makes a meaningful dent in the department’s day-to-day operations.

But the lack of enthusiasm for this program shows that the basic issue of getting Americans to save more has still not been overcome and that this government program was not enough to change this behavior.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: