GOP tax bill is heavily weighted towards wealthy by 2027

UPDATE [6:30 PM ET]: The Tax Policy Center states that it made an error in its calculations. Consequently, the analysis has been withdrawn until it is revised. We will update this post.

UPDATE Nov 9: Updated analysis from the Tax Policy Center can be found here. This post has been updated with figures. The only major change is that low-income taxpayers would not pay more in 2027. They would have a $10 tax cut instead.

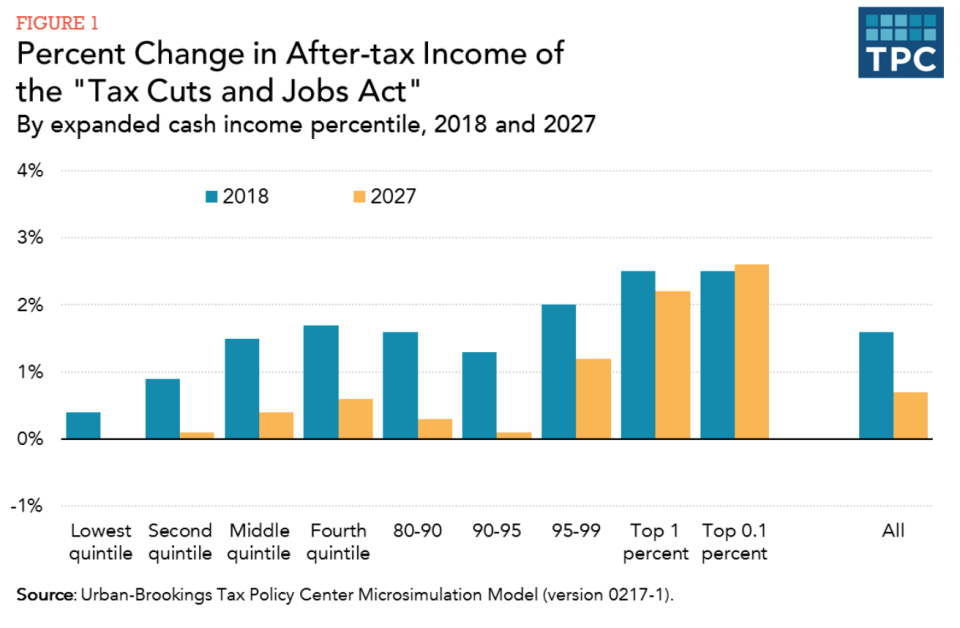

New analysis from the nonpartisan Tax Policy Center released on Monday painted the House Republicans’ tax plan in a regressive light. The preliminary analysis of the “Tax Cuts and Jobs Act” found that while taxes would go down for all income groups in 2018 they would strongly favor wealthier households by 2027.

“The largest cuts in terms of dollars and as a percentage of after-tax income would accrue to higher-income households,” said the analysis. An error was found in the initial analysis and the Tax Policy Center issued revised calculations.

Taxpayers earning over $730,000 a year — the top 1% — would receive 20.6% of the total tax cut, according to the report. In terms of dollars, that is an average tax cut of $37,440.

For the top 0.1% — those who make $3.4 million or more a year — the average tax savings would be a massive $178,560. This group would receive 10.0% of the total tax cut. All together, the top quintile of richest taxpayers would receive 56.6% of the total tax cut.

Meanwhile, the lowest two quintile taxpayers would see a tax increase in 2027 after enjoying a modest tax cut of about $60 for those making around $28,000 a year, and $380 for those making $48,000.

The middle quintile of the population would see a $840 tax cut in 2018, which would diminish to $320 in 2027.

Though most taxpayers will enjoy a cut in 2018, the wealthy will enjoy a significantly greater tax cut in 2027. By then, the top 1%’s tax cut will have risen to $52,780 and the top 0.1% will see an extra $278,370 — a 2.6% increase in their after-tax earnings.

According to the Tax Policy Center, the changes over the next decade are due to a variety of factors, including expiration of certain tax credits, and the fact that not everything in the tax code is subject to inflation indexing.

Ethan Wolff-Mann is a writer at Yahoo Finance. Follow him on Twitter @ewolffmann. Confidential tip line: emann[at]oath[.com].

Read More:

Jack Dorsey on bitcoin and cryptocurrency

How cutting the 401(k) limit would affect people’s saving

Former ambassador: Mexico has ‘moved on’ from NAFTA

Vanguard, genocide, and a $18 million campaign to get you to vote

Venmo is one step further to becoming a full-service digital wallet

ATM fees have shot up 55% in the past decade

Big bitcoin-friendly companies like Microsoft and Expedia hedge their bet

The real reason Mexico will never pay for the Trump’s wall: It’d be ‘treason’

How Waffle House’s hurricane response team prepares for disaster

Trump weighs slashing one of the most popular tax deductions