Global stock markets have gained $26 trillion since Trump's election win

One year ago Wednesday, Donald Trump was elected President of the United States.

As results rolled in late into the evening of November 8, stocks sold off as Trump’s win caught investors off guard, much as they’d been caught flat-footed after the surprising Brexit vote in June 2016.

But by dawn in New York, the stock market turned around and decided that it loved Trump. And it hasn’t looked back since.

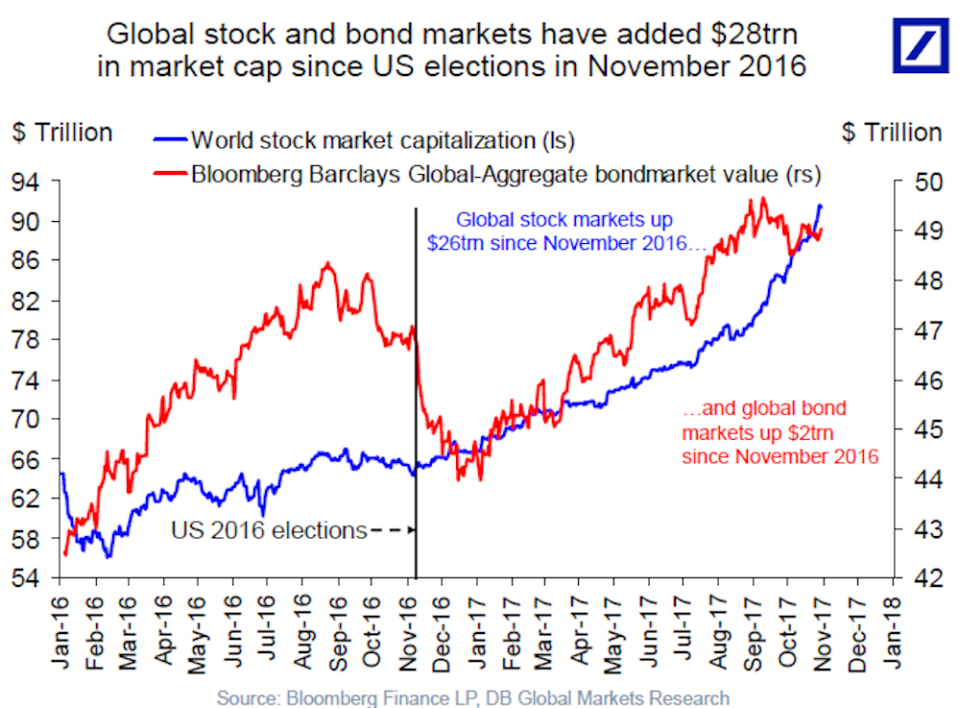

Torsten Sløk, an economist at Deutsche Bank, circulated a chart Wednesday showing that between global bond and stock markets, $28 trillion of value — $26 trillion in global stock markets and $2 trillion in global bonds markets — has been created since Trump’s election win.

This outpaces the $5.4 trillion in value added to U.S. markets, a number that Trump has been keen to highlight as the stock market has become perhaps his favorite boast to highlight successes during his tenure. The 21% gain in the S&P 500 since Trump’s win is the fourth-best since 1936, according to Goldman Sachs.

Unemployment is down to 4.1%, lowest in 17 years. 1.5 million new jobs created since I took office. Highest stock Market ever, up $5.4 trill

— Donald J. Trump (@realDonaldTrump) November 4, 2017

As for what this increase in value means for the global economy, Sløk says “it is not a surprise that this $28trn global wealth gain is having a big positive impact on consumer and capex spending decisions in the US, Europe, and [emerging markets].

“Global growth is accelerating, and the chances of overheating and an associated pick-up in inflation are significantly higher than the chances of a recession.”

In addition to the appreciation in financial markets around the world investors have seen since the U.S. election, one of the dominant themes for investors this year has been the synchronized growth cycle the world’s economies are in.

In October, the International Monetary Fund raised its forecast for global growth in 2017 to 3.6% and to 3.7% in 2018, which would mark the fastest pace of growth since 2010. The last two quarters of U.S. GDP growth — which saw the economy grow at an annualized rate in excess of 3% in each period — are the strongest back-to-back stretch since 2014.

Which all, of course, begs the question of how Trump will react if the market, or the economy, turns during his time in office.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: