The Future of Streaming Is…Verizon?

The streaming industry can hear Verizon now.

The wireless company just officially created the industry’s first streaming bundle — or at the very least its first worthwhile one between two platforms owned by separate companies. (So relax, Disney Bundle.)

More from IndieWire

Beginning on December 7, Verizon’s myPlan customers (those subscribed to its Unlimited Welcome, Unlimited Plus, or Unlimited Ultimate data plans) can get ad-supported Netflix and ad-supported Max, bundled, at a discount.

Subscribers to the new bundle will still use the individual apps to access Netflix and Max — they’ll just pay for the memberships on their existing Verizon Wireless bill. (Customers can stream on any device, not just on their Verizon Wireless phones and tablets.)

Verizon’s Netflix/Max bundle will run $10/month, which is 41 percent less than subscribing to the AVOD tiers separately — Netflix with ads typically costs $6.99 per month and Max’s own version is $9.99. Clearly, the majority of the savings here is coming on the Max side, though not necessarily out of Max’s end.

Yes, Netflix and Warner Bros. Discovery will take a haircut here on subscription revenue — Verizon also needs to get a taste. But it is no accident that we’re only talking about ad-supported tiers. Not only do deals like this bring higher subscriber totals, that added exposure can proportionately increase a platform’s advertising revenue. In the end, it is all about ARPU, or the average revenue per user.

Netflix/Max on Verizon, first reported November 9 by the Wall Street Journal, is setting the pace — but it’ll soon have company. The journal on Friday reported Apple TV+ and Paramount+ have held discussions about bundling together. (Verizon actually has a separate $10 myPlan “perk” involving the Apple streamer: Apple One, which includes TV+ among its services.)

Those discussions are in the “early stages,” WSJ wrote. Apple TV+ and Paramount spokespeople both declined comment to IndieWire on any bundle talks.

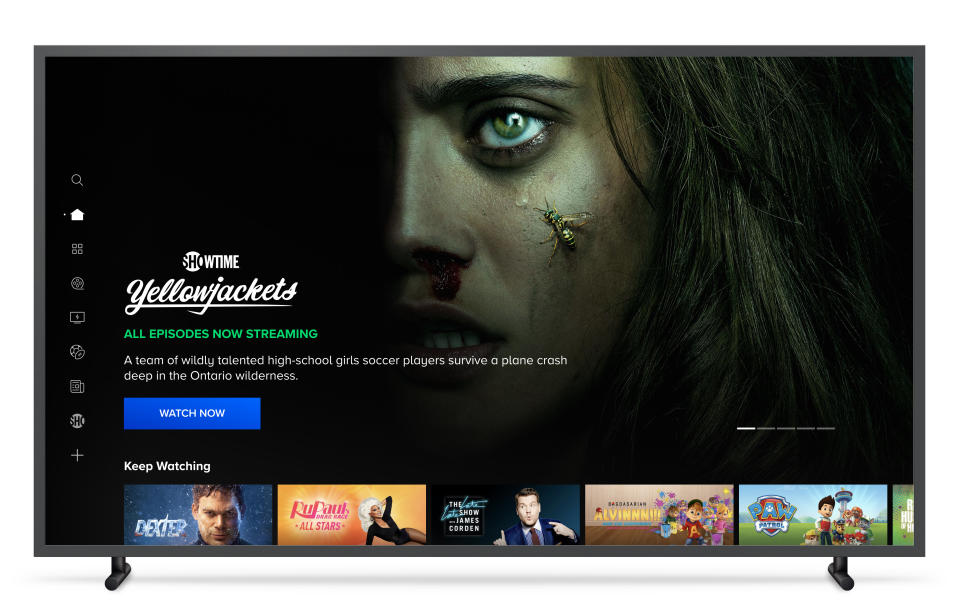

Paramount+ has been partnering up everywhere through a variety of corporate deals ranging from Delta to Walmart. It’s a survival instinct: Paramount knows it cannot compete in the present-day media landscape without either a major lifeline — like being acquired by a larger media company or private equity — or at least a bunch of these little ones. In June, Paramount integrated its Showtime into Paramount. Grow or die.

Apple, a $3 trillion company by market cap, is 280-times larger than Paramount Global ($10.5 billion). But even as a loss leader for a tech giant, the Apple TV+ library is sorely lacking for content; hey, Paramount’s got a bunch of programming!

The maker of your iPhone (which is how Apple makes its money) buying Paramount Global outright is a genuine possibility that has been bandied about in media circles for years. (As is Comcast buying Paramount or Comcast buying Warner Bros. Discovery, etc.) Think of a bundling of streaming services as a trial run at synergy — a mini-merger without all the actual M&A messiness.

This summer, Paramount chief Bob Bakish spilled on his willingness to bundle his core streamer.

“We’ve been believers in bundling for a long time. Bundling has been one of the tried and true methods of value creation in media, and certainly as we entered the streaming space, bundling is part of our strategy,” he said during the company’s August earnings call. “We’re continuing to look at incremental opportunities in this regard, and the only thing we know for sure is it will be a growing part of what we’re doing.”

Warner Bros. Discovery boss David Zaslav (along with Netflix’s co-CEOs) beat Bakish to the punch, just like Zaslav beat his former cable rival to the press. (Zaslav also beat Bakish to bundling his in-house streaming products: HBO Max and Discovery+ became Max one month ahead of Paramount+ with Showtime.)

Back in May, Zaslav said a bundle of the top few services, including his own newly combined one, “would be great for consumers.” And then he gave us the real business reason: bundling “would probably reduce churn.”

Churn — customers canceling a service — is among streaming’s biggest enemies. (Or is it?) The antidote is providing a constant stream of in-demand on-demand programming. It is no coincidence that Netflix, the largest and most culturally-relevant streamer, has among the lowest churn rates in the industry.

The next-best thing to having Netflix’s content (and content budget) to reduce churn is a bundle. (Or ideally, bundle with Netflix.) We’ve seen this primarily with Disney. Antenna data in June found that while the Disney+ churn rate was 4 percent, Hulu’s was 5 percent, and ESPN+ had a churn rate of just over 7 percent, the Disney Bundle had a churn rate of just 2 percent. That is is even lower than Netflix’s (3.3 percent) and far better than the industry average of more than 7 percent.

Best of IndieWire

The Best LGBTQ Movies and TV Shows Streaming on Netflix Right Now

Guillermo del Toro's Favorite Movies: 54 Films the Director Wants You to See

Nicolas Winding Refn's Favorite Films: 37 Movies the Director Wants You to See

Sign up for Indiewire's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.