FTX Latest: US Lawmakers Began Probe of Firm Months Before Crash

(Bloomberg) -- Long before Sam Bankman-Fried’s FTX cryptocurrency empire collapsed this month, it already was on the radar of federal prosecutors in Manhattan. The US Attorney’s Office for the Southern District of New York, led by Damian Williams, spent several months working on a sweeping examination of cryptocurrency platforms with US and offshore arms and had started poking into FTX’s massive exchange operations, according to people familiar with the investigation.

Most Read from Bloomberg

How Bad Will Housing Get? The Chill Gripping a Once-Hot Market Offers a Test

Malaysia Latest: Muhyiddin Turns Down King on Unity Government

Elon Musk's 2022 Wealth Loss Exceeds $100 Billion for First Time

Stocks, Bonds Rally With Focus on Rate Outlook: Markets Wrap

Bitcoin spot hit a 52-week low at $15,574.23 on Monday. So far this year, the bellwether token has declined 66.4%.

Commodity Futures Trading Commission Chairman Rostin Behnam will testify at a Senate Agriculture Committee hearing on Dec. 1 about the collapse of FTX, the committee said in an announcement.

The wipeout of Bankman-Fried’s crypto empire, including crown jewel FTX and sister trading desk Alameda Research, is helping to reduce liquidity across the crypto market.

Key stories and developments:

Transcript: Matt Levine on the Collapse of Alameda and FTX

Crypto Exchange Tokens Pose Extreme Risks, BOE’s Cunliffe Says

FTX Fiasco Adds Wrinkle to Plan for Crypto Accounting Rules

Crypto Arb Trades Roar Back as FTX-Battered Quants Flee Market

Want to Know Where Crypto Is Headed? Remember 2008: Bill Dudley

(Time references are New York unless otherwise stated.)

Bitcoin Hits 52-Week Low at $15,574.23 (4:46 p.m.)

Bitcoin spot hit a 52-week low at $15,574.23 on Monday. So far this year, the bellwether token has declined by 66.4%.

Its 52-week high was $48,215.74 on March 28.

US Prosecutors Opened Probe of FTX Months Before Its Collapse (4:14 p.m.)

Long before Sam Bankman-Fried’s FTX cryptocurrency empire collapsed this month, it already was on the radar of federal prosecutors in Manhattan.

The US Attorney’s Office for the Southern District of New York, led by Damian Williams, spent several months working on a sweeping examination of crypto currency platforms with US and offshore arms and had started poking into FTX’s massive exchange operations, according to people familiar with the investigation.

Fidelity Must Reconsider Bitcoin Exposure in 401(k)s: Senators (3:43 p.m.)

Democratic senators Dick Durbin, Elizabeth Warren and Tina Smith are urging Fidelity Investments to reconsider allowing 401(k) plan sponsors to offer exposure to Bitcoin.

“The recent implosion of FTX, a cryptocurrency exchange, has made it abundantly clear the digital asset industry has serious problems,” the senators said in a letter to Fidelity CEO Abigail Johnson.

Tiger Global’s Now-Worthless FTX Bet Had Bain’s Due Diligence (3:03 p.m.)

Bain & Co. was among consulting firms that helped conduct due diligence for Tiger Global Management’s investment in now-defunct crypto exchange FTX, according to people familiar with the matter.

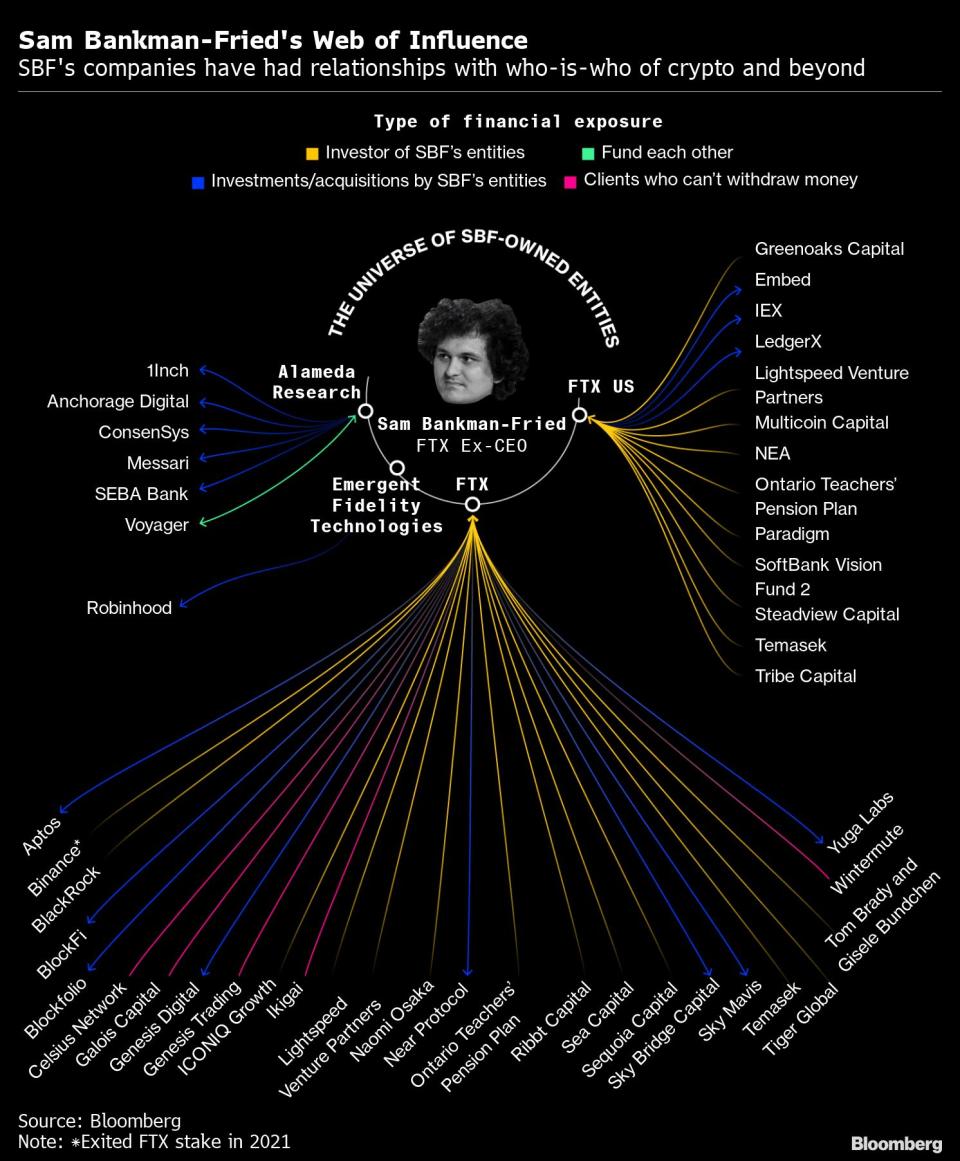

Tiger Global, which pays Bain more than $100 million a year to research private companies, has now written down its $38 million FTX stake to zero, the people said. Sam Bankman-Fried’s oversight of a vast web of FTX-linked entities was one of the risks highlighted during the due-diligence process, but the money manager still believed it was a sound investment at the time, one of the people said.

Crypto Markets Sag as Funds Drained From FTX Switch Out of Ether (2:44 p.m.)

Cryptocurrency prices slumped Monday in the ongoing crisis sparked by the downfall of Sam Bankman-Fried’s once powerful FTX empire.

The largest token Bitcoin has shed about 6% over two days, while second-ranked Ether is roughly 10% lower. Meme token Dogecoin -- a gauge of the most speculative sentiment in an already racy digital playground -- is down 14%.

CFTC Chief to Testify at Dec. 1 Senate Hearing on FTX Collapse (1:44 p.m.)

Commodity Futures Trading Commission Chairman Rostin Behnam will testify at a Senate Agriculture Committee hearing on Dec. 1 about the collapse of crypto exchange FTX, the committee said in an announcement.

Cathie Wood Goes on Coinbase Buying Spree as Wall Street Sours (12:21 p.m.)

Wall Street’s waning conviction in Coinbase Global Inc. has done little to deter Cathie Wood. Instead, she’s been scooping up shares of the struggling cryptocurrency exchange in the wake of the collapse of FTX.

Wood’s Ark Investment Management funds have bought more than 1.3 million shares of Coinbase since the start of November, worth about $56 million based on Monday’s trading price, according to data compiled by Bloomberg. The shopping spree, which started just as FTX’s demise began, has boosted Ark’s total holdings by roughly 19% to about 8.4 million shares. That equates to around 4.7% of Coinbase’s total outstanding shares.

‘Alameda Gap’ Seen Helping Dry Up Liquidity Across Crypto Market (11:26 a.m.)

The wipeout of Sam Bankman-Fried’s crypto empire, including its crown jewel FTX exchange and sister trading desk Alameda Research, is helping to reduce liquidity across the crypto market.

The decline has been dubbed the “Alameda Gap” by blockchain-data firm Kaiko, named for the trading group at the center of the storm which is closing its books. Plunges in liquidity usually come during periods of volatility as trading shops pull bids and asks from their order books to better regulate risks, Kaiko noted in a Nov. 17 newsletter.

Crypto ETPs See Net Inflows $44.4 Million Led By Proshares’ BITO (9:25 a.m.)

Global exchange-traded products focusing on cryptocurrencies and related themes posted a net inflow of $44.4 million in the week to Nov. 18, according to Bloomberg calculations.

ProShares Bitcoin Strategy ETF had net inflows of $15.7 million, followed by ProShares Short Bitcoin Strategy ETF with $12.3 million. Bitcoin-themed ETPs led the inflows at $33.1 million, followed by Ether with $14 million. Solana-focused products saw the biggest outflows at $3.3 million, followed by Ripple ETPs with $1.4 million.

Congress Plans Hearings to Probe FTX Collapse: Crypto in DC (9:08 a.m.)

House and Senate panels are planning hearings in December about bankrupt crypto exchange FTX and its former chief executive officer, Sam Bankman-Fried, amid renewed calls for Congress to strengthen regulation and oversight for the industry.

The House Financial Services Committee is seeking testimony from Bankman-Fried, his trading house Alameda Research, rival exchange Binance, as well as other FTX employees. US and Bahamian authorities are also discussing bringing Bankman-Fried to the US for questioning.

Crypto Exchange Tokens Pose Extreme Risks, BOE’s Cunliffe Says (8:11 a.m.)

Exchange-issued crypto tokens such as bankrupt FTX Group’s FTT can pose “extreme” risks when accepted by their issuers as collateral, Cunliffe said.

“A firm accepting its own unbacked cryptoasset as collateral for loans and margin payments, as there are indications may have happened with FTX, creates extreme ‘wrong-way’ risk -- i.e. when the exposure to a counterparty increases together with the risk of the counterparty’s default,” he said in a speech on Monday.

Crypto Arb Trades Roar Back as FTX-Battered Quants Flee Market (7:32 a.m.)

The wild-west days of crypto markets are back again as the large trading houses that once thrived on arbitraging price gaps pull back in the wake of FTX’s collapse. That’s opening up profitable opportunities for anyone that still dares to trade.

Prices for essentially identical assets on various platforms are diverging in a clear sign the dominoes are still falling across the crypto trading world. The gap between the funding rates of identical Bitcoin futures on Binance and OKEx, for instance, has been as wide as an annualized 101 percentage points and remained at least 10, compared to mostly single-digit gaps last month.

FTX Fiasco Adds Wrinkle to Plan for Crypto Accounting Rules (5:00 a.m.)

US accounting rulemakers were already considering tackling the thorny issue of accounting for freshly minted crypto tokens in their prolonged effort to write guidance for digital assets. Then came the collapse of crypto exchange FTX, and a new headache for accounting rulemakers.

While questions about the worth of FTX’s self-generated tokens are just a part of the company’s puzzle, there’s an area where the Financial Accounting Standards Board could bring clarity to the market: ensuring that businesses creating a crypto token don’t just assign it a value and report it on their balance sheets as an asset.

FTX’s Federal Net Operating Loss Carryover Stood at $3.7 Billion (2:32 a.m.)

Crypto exchange FTX and related companies now in bankruptcy collectively had a carryover federal net operating loss of at least $3.7 billion as of Dec. 31 last year based on tax returns, according to court filings.

The document from Alvarez & Marsal North America LLC, released as part of the Chapter 11 process, also showed that the minimum state net operating loss carryforward stood at $715 million. Earlier filings signaled the losses could help offset tax liabilities.

Most Read from Bloomberg Businessweek

US Is Focused on Regulating Private Equity Like Never Before

A Nation in the Crosshairs of Climate Change Is Ready to Get Rich on Oil

©2022 Bloomberg L.P.