Four challenges facing investors before Santa comes to town: trader

With just 28 trading days left in 2017, investors have a lot to be thankful for this holiday season. Large caps (^GSPC, SPY) were the standout performer year-to-date, but mid-cap (^MID, MDY) and even small-caps (^RUT, IWM) held their own despite a slow start and a summer scare. Thanksgiving launches what is usually a seasonally strong period — one in which it’s easy for investors to let their guard down. Before we close the books on the year, here are four potential speed bumps Santa could face on his way to your home town.

Headline risk is high. Each news cycle presents an additional challenge for tax reform legislation as it makes its way to the president’s desk. Several GOP senators have raised concerns, including the most recent, Ron Johnson, senior Senator from Wisconsin. With seemingly no votes on the other side of the aisle, any more than two nays gives the legislation the deep six. The pushback could merely be a negotiating tactic to gain something for their states, but given the legislative goose egg, I still put odds of a bill making its way through both chambers at even money. Politics aside, some measure of a tax reform package is priced into the market, and a complete failure would force a reset.

Geopolitical threats and even terrorism have caused little more than a yawn. Buying the dip has become the Pavlovian response to negative news, but the tipping point is usually only visible in the rearview mirror.

Locking in the year

Performance at most funds — regardless of strategy — has been strong, and if you find yourself in the upper quadrant, the temptation to take money off the table by locking in the year is high. Whether you hedge by selling futures, loading up on inverse ETFs, or just good old fashioned “raising cash,” the net effect on the market is more supply.

Follow the leader

Make no mistake, U.S. investors owe some gratitude to our friends overseas. After a 5-year slump, international markets exploded higher with emerging markets (EEM) leading the way. Despite the strong year, emerging market investors who jumped on board in 2007 have spent the last decade in the red. Those that held on only crossed into the green last month. The MSCI World Index also came through, besting U.S. markets year-to-date. As pointed out in previous posts, strength in international markets is an indication that our customers are doing well — great news for U.S. multinationals. However, with 40% of S&P revenue coming from overseas, any hiccup there for whatever reason will translate into lower prices.

Growth solves a lot of problems, so before this post gets too dark let’s look at the other side of the ledger. Real GDP is lifting around the world. Goldman’s research team (which has hardly been in the bullish camp) are suggesting 4% worldwide, and even a 2.5% U.S. print next year. Not exactly a home run, but certainly above stall speed. And with estimate revisions still pointing north, it’s a number that could likely look better a year from now.

The biggest challenge — and likely the focus over the next several years — is central bank policy and a fixed-income market that dwarfs equities. Strategists, including yours truly, have been getting this one wrong for some time. Nevertheless, with a near decade-long experiment of massive expansionary central bank policy worldwide coming to an end it raises the question: Can they stick the landing as normalization runs its course?

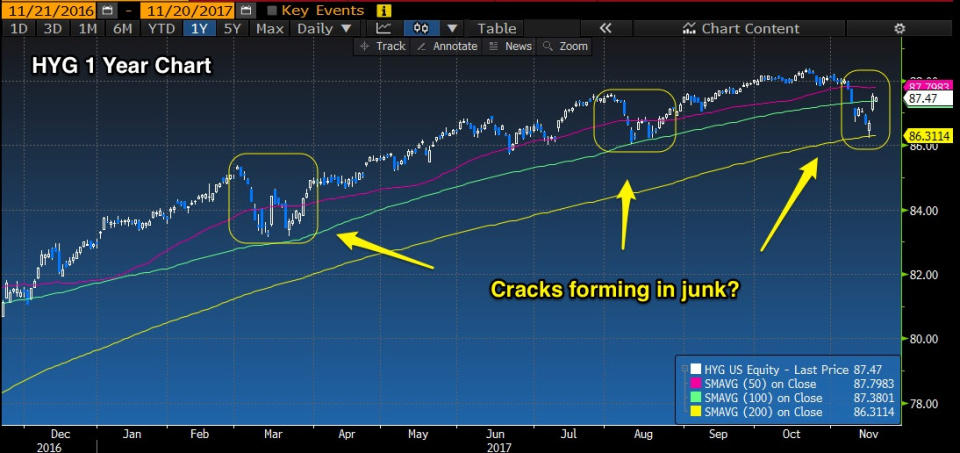

With markets close to all-time highs and the long end of the fixed income curve still relatively benign, investors are convinced the path ahead is safe. Ignoring that trend hasn’t been profitable for those who’ve fought the tape, but their fears are well placed. Cracks in equity markets will likely surface in bonds first. The recent retreat in junk bond ETFs, such as in the iShares iBoxx High Yield (HYG), speaks to that point. The quick bounce Thursday on the heels of the house passing its version of a tax reform bill was comforting, but with yield spreads between high yield bonds and Treasurys this tight, there’s little room for error.

Why is high yield important?

Investors usually offset equity exposure by placing some portion of their assets in bonds, an asset class with low and sometimes inverse correlation to stocks. With yields near historic lows, investors increasingly have pushed into high yield, or junk, over the last decade. Unfortunately, junk offers little diversification from stocks because it acts as an equity substitute with high correlation to stock prices. Last week’s crack in HYG wasn’t the first time there’s been a break followed by a recovery, but with the margin of safety as low as it is, you can bet continued weakness here will translate into lower prices for equity markets.

Every bull market has its set of challenges and a wall of worry for investors to climb. Despite the challenges, including the fact that equity valuations are less than ideal, I still come out long. I say this fully conceding that any of the above could bring a swift negative reaction not unlike our last tantrum in 2016. However, we’re coming off an earnings season I would characterize as a success and stock correlations are low, indicating IMHO that the economy and earnings are now the driving force for equity performance and not a Fed easy money policy. Valuations may be full, but stocks don’t live in a vacuum. Relative to other asset classes, owning an S&P 500 stock with a dividend and some measure of growth is far more attractive than locking up your money for 10 years in a U.S. Treasury at less than 2.4%.

Investing is about making choices. We research, weigh the evidence and then pull the trigger. The only bad decision is not making one.

* At the time of this post some funds managed by David Nelson were long SPY and TLT.

————————————————-

Please contact your Belpointe investment advisor representative if there are any changes in your financial situation or investment objectives.

Investment advice is offered through Belpointe Asset Management, LLC. Past performance is no guarantee of future returns. Insurance products are offered through Belpointe Insurance, LLC and Belpointe Specialty Insurance, LLC. It is important to read our email disclosures available at this link: http://belpointe.com/disclosures.