Former Black employee accuses JPMorgan Chase of racial profiling

EXCLUSIVE: “Immediately I’m already being prejudged that I’m doing something criminal or fraudulent, that they have to go and do all these extremes,” Ricardo M. Peters alleges of his treatment at a JPMorgan Chase branch

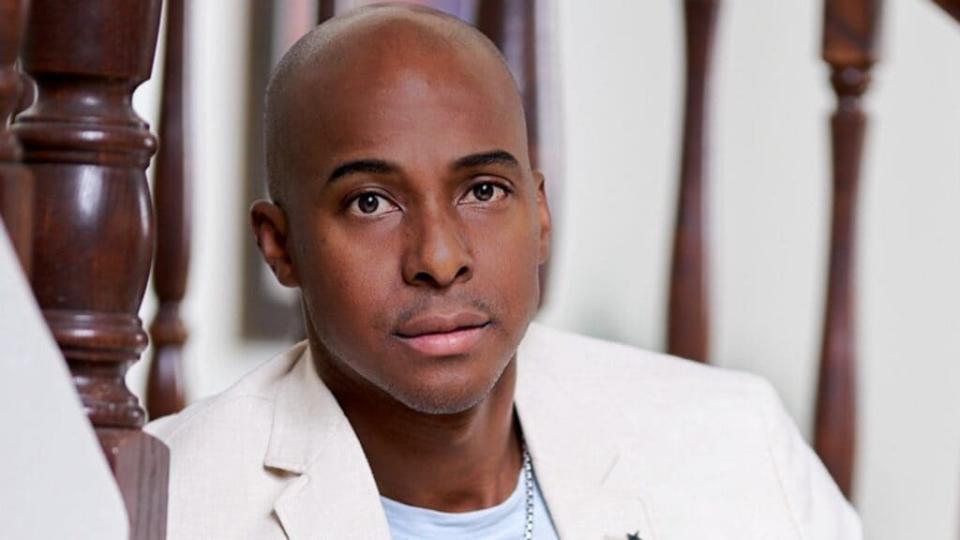

A former Black financial advisor at JPMorgan Chase, who previously alleged racial discrimination against the banking giant, is taking the firm to task once more.

Ricardo M. Peters was employed by JPMorgan Chase as a financial advisor in Phoenix, Arizona for 10 years. However, theGrio reported last summer that Peters claimed the company passed him over for promotions, treated him differently from his white peers, and was retaliated against after he believes being unjustly fired.

Read More: Black financial advisor accuses JPMorgan Chase of racism, retaliation over firing

Peters filed suit against JPMorgan Chase and according to him, the two sides entered into a mutual agreement late last year. However, Peters has now alleged that he was the victim of racial profiling after attempting to renegotiate two Chase cashier checks that were payable to him on December 14, 2020, at a Chase branch in Arizona.

According to Peters, a white male teller was reluctant to proceed with his transaction beyond asking for identification and his pin number attached to his debit card. He was then told to wait and then an assistant flagged the substantial amount who then escalated it to the manager. Furthermore, conversations about this matter were held in the lobby and made references to the sensitive information amount of money and possible fraud which is against policy.

“I’m just reissuing it back in my name, just different denominations. And he said, well, the thing is we just don’t want it to come back on us,” Peters recalled in an interview with theGrio.

“And I said, what do you mean come back on you? Are you insinuating that this is fraud? There’s some suspicion of criminal activity about it?”

Peters added that the insinuation of fraud was not only unwarranted but occurred quickly.

“So immediately there— immediately I’m already being prejudged that I’m doing something criminal or fraudulent, that they have to go and do all these extremes and had I not done this with two other branches and seen that I was in and out in two minutes.”

Peters stated the ordeal took about 40 minutes and it wasn’t until a month later when he was given his funds. He opted to go to a Chase Bank in a more urban area.

Read More: JPMorgan and the New Voices Foundation launch business bootcamp for WOC

A representative for JPMorgan Chase denied the allegations when contacted by theGrio for a response and also countered the version of events put forth by Peters.

“Mr. Peters came in with an uncommon request for this branch – to take two cashiers checks equaling millions of dollars and change them into multiple smaller cashiers checks,” Anne Pace, Managing Director, Chase Communications declared in a statement.

“Typically, a transaction like this would have the checks deposited into an account and then issue new checks, but Mr. Peters made clear he did not want to deposit the checks. Since he wanted the transactions completed outside of his account, the branch manager needed to double-check the process, since it could require that he take additional steps before approving the transaction.”

Pace was adamant that “This had absolutely nothing to do with race. The branch manager simply wanted to make sure he handled the procedure correctly as there could be serious implications for mishandling a transaction of this size and type. These high-dollar transactions are not common for this branch.”

Pace also denied that there was any suspicion of fraud and contested that the encounter took more than 40 minutes but rather 20. She claimed the checks were verified as valid and that the Fraud hotline was never called.

Peters filed a claim with the Arizona Attorney General’s Office, Civil Rights Division over the incident that was received by the agency on Feb. 1. TheGrio reviewed the document in which Peters cited being denied “less quality of service, and ultimately denied service,” due to his “race.”

Peters shared that his lawyer urged him “not to worry about it,” but believes accountability is critical to turn change into a promise kept.

“When I first spoke out against JP Morgan and then we came to that mutual agreement, they assured me changes were coming… and to literally several months later go through the same thing as a client. Now, it shows me that no—nothing’s really changed.”

Peters added that to brush off his alleged profiling is “just enabling or continuing that behavior, that bad behavior. And it’s only through things like this litigation that they start to learn.”

Peters is committed to legally pursuing the matter and JPMorgan Chase told theGrio it would be just as vigorous in its defense. Pace declared that JPMorgan Chase does “not intend to mediate and are prepared to defend this in court, if needed. We’ve asked the Arizona Civil Rights Division to dismiss his charge in its entirety and issue a no cause finding.”

Have you subscribed to theGrio’s podcast “Dear Culture”? Download our newest episodes now!

TheGrio is now on Apple TV, Amazon Fire, and Roku. Download theGrio today!

The post Former Black employee accuses JPMorgan Chase of racial profiling appeared first on TheGrio.