First-Half TV Trends: Impressions Grow, Revenue Shrinks, iSpot Says

In its First Half TV Transparency Report, measurement and analytics company iSpot.tv pointed out viewing trends that illustrate the changes and challenges facing the industry.

iSpot said linear TV ad impressions grew by 5% to 4.21 trillion in the first half of 2023. At the same time, national TV ad spend dropped by 7.4% to $21.6 billion.

While primetime — where ad prices are highest — was relatively flat (up 0.7%) in terms of impressions, viewing was up a strong 6.8% for morning shows including ABC’s Good Morning America, NBC’s Today and Fox News Channel’s Fox and Friends. Daytime viewing was also up 5.4%.

Sports continued to be a winner, with National Basketball Association games generating 14% more impressions, mainly on ESPN and TNT. The NBA was the top generator of ad impressions in the first half of the year. Also at the top of the list were the NFL and men’s college basketball.

Next in primetime were ABC’s American Idol and NBC’s The Voice, followed by NHL hockey on TNT and ESPN.

Spanish-language broadcaster Univision was another winner, with impressions up 16% compared to a year ago.

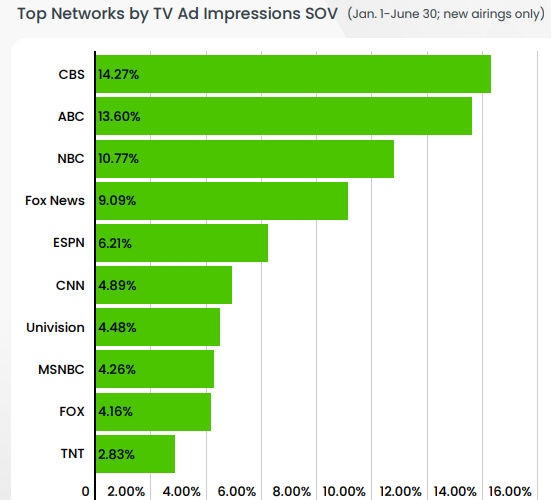

The top networks by ad impression share were CBS, ABC, NBC, Fox News Channel, ESPN, CNN, Univision, MSNBC, Fox and TNT.

The brands that bought the largest share of impressions in the first half of the year were Progressive, Domino’s Liberty Mutual, Verizon and Burger King.

iSpot said the funniest commercial in the first half of the year was for Cheetos popcorn. The spot, titled For Every Great Idea Hundreds Bit the Dust, had 394 million impressions and scored 18% above norms for likability and 19% above norms for positive purchase intent.

“Sports may grab the biggest headlines (and largest ad budgets), but that's just one way to approach TV advertising,“ the report said. ”For all of the brands that dedicate significant time and budget into that premium programming, TV still offers plenty of additional avenues for ad value — from differing dayparts, to unsung networks and emerging programming — at costs that allow even occasional advertisers to scale the medium for its own preferred business outcomes.”