Fewer Feature Films Nab California Tax Credits

Independent films dominated the latest round of productions granted tax credits to shoot in the state.

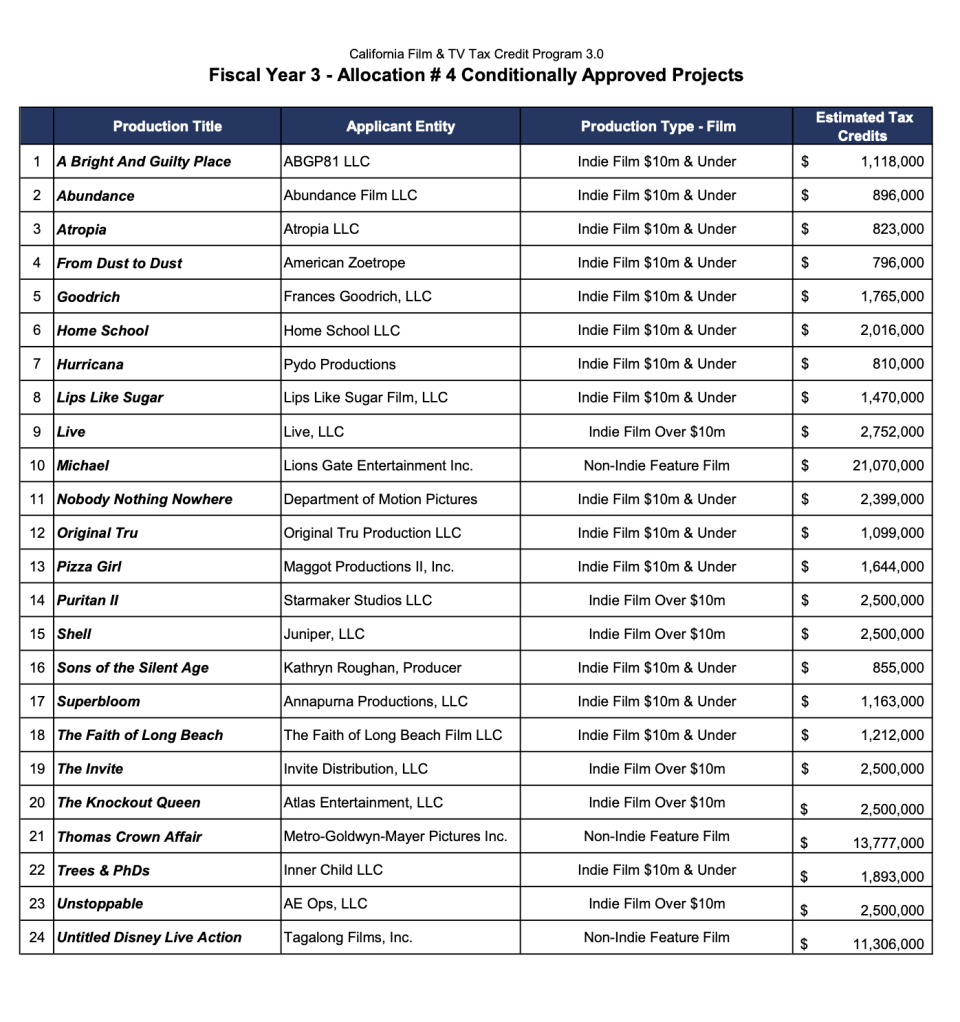

Of 24 movies selected to participate in California’s Film & TV tax credit program, only three are studio projects, the state’s film office said Monday. They’re helmed by Lionsgate ($21.1 million), MGM ($13.8 million) and Disney ($11.3 million).

More from The Hollywood Reporter

New York Gov. Aims to Boost Film Tax Credits to $700M As New Jersey Rivalry Heats Up

Hollywood Production in Quebec Fell in 2022, Province Cites "Genuine Slowdown" Globally

Gavin Newsom Seeks to Make California Film/TV Tax Credits Refundable

Netflix and Warner Bros. Pictures, which have led the way in the previous four allotment of credits over the last two years, have no to titles on the list of films getting tax breaks for filming in California.

Michael Jackson biopic Michael headlines the three studio titles that were conditionally granted incentives. The production is projected to generate more in-state spending than any other movie in the film office’s 14-year history, with $120.1 million in qualified spending. (Defined as wages to below-the-line workers and payments to in-state vendors.) It was given $21.1 million in credits.

MGM was also granted credits for Thomas Crown Affair. The third remake of the title stars Michael B. Jordan as a billionaire thief in a cat-and-mouse game with an insurance investigator who’s also his romantic interest. It’s produced by him along with Joe and Anthony Russo through their AGBO banner.

Additionally, Disney is expected to get incentives for shooting an untitled live action movie in the state.

The three studio movies account for $46.2 million of the $81.7 million tax credits allocated. For the same period last year, the Film & TV tax credit program announced 30 new movies — 11 studio films and 19 indies — to get tax breaks to film in California. Of $149.2 million in credits reserved for the projects, roughly $120 million was for studio films.

“Our tax credit program continues to welcome a diverse range of projects, from big-budget films to small independent projects, and everything in between,” said California Film Commission Executive Director Colleen Bell. “The program is an important tool for maintaining our competitiveness and curbing runaway production. We are working harder than ever to keep entertainment production here in California, where it belongs.”

California designates $330 million annually in credits to shoot in the state. That figure in 2021 was bumped up by $90 million for two years to attract productions from other areas.

In recent years, studio movies have fled California in favor of places with more lucrative tax incentives. Georgia, which doesn’t have a cap on its film and TV tax credit program, has been the most popular destination. Unlike other high-production states, only the qualified spending portion of a movie’s budget, which doesn’t include compensation for talent, is eligible for credits under the state’s tax credit program. In his 2023-24 proposed budget, Gov. Gavin Newsom proposed making above-the-line wage costs eligible for tax breaks for the first time, with certain conditions. He also proposed making California’s film and TV tax credit refundable in a bid to compete with other states.

The proposed change followed Illinois Gov. J. B. Pritzker in April signing into law a measure that similarly allowed some non-resident wages to qualify. California is currently the only state that doesn’t do so.

Six independent movies with budgets over $10 million were selected to receive tax credits, according to the film office. They include Live, Purtian II, Shell, The Invite, The Knockout Queen and Unstoppable.

In total, the 24 movies are on are on track to spend a total of $662 million in California and projected to generate $423 million in qualified spending

The California Film Commission received a total of 58 applications during feature film tax credit allocation period. The next application period for features will be from July 24-31. The next application period for TV projects will be from March 6-20.