Powell faces record dissent as Fed splits further on interest rates

The chasm among Federal Reserve officials widened on Wednesday as Jerome Powell faced the highest number of dissents since becoming chairman, raising questions about the central bank’s ability to balance wide-ranging views on where rates should go next.

On Wednesday, the Federal Open Market Committee cut rates by 25 basis points for the second consecutive time, citing increased signs of weakness in geopolitical conditions abroad. The target federal funds rate is now in a range of 2% to 2.25%.

But three members dissented. St. Louis Fed President James Bullard called for a 50 basis point cut while Boston Fed President Eric Rosengren and Kansas City Fed President Esther George pushed for no change at all.

In his press conference Wednesday, Powell acknowledged the challenges of communicating policy with so many different views but waved off concerns over whether it complicates the Fed’s future path on monetary policy.

“This is a time of difficult judgments and, as you can see, disparate perspectives,” Powell said. “I really do think that’s nothing but healthy.”

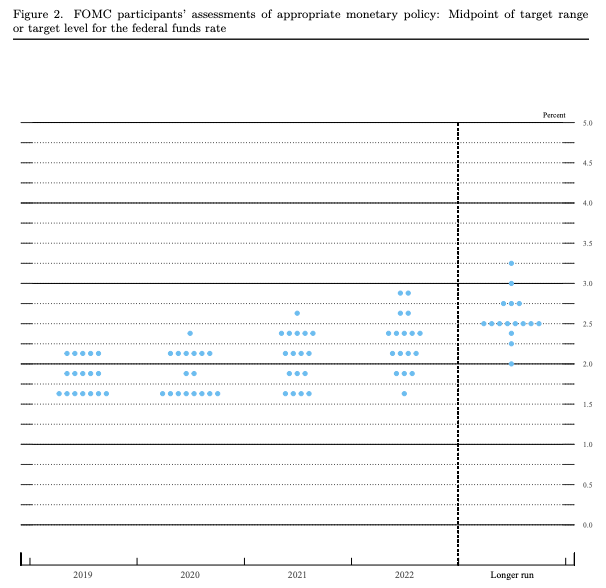

The rift is also seen in the dot plot projections released Wednesday, mapping out policymakers’ forecasts for where rates would be by the end of the year. Seven of the 17 participants on the committee saw another 25 basis point cut by the new year, but five participants feel the appropriate level by year-end would in the range of 2% to 2.25% (the level prior to Wednesday’s cut).

Capital Economics wrote Sept. 18 that the deeper Fed split muddles clues on the central bank’s next moves.

“Under those circumstances of such a big split, the median rate projections are essentially useless,” CapEcon wrote.

Opposite dissents

Dissents occur frequently, but three dissents on opposite sides made Wednesday’s decision particularly remarkable.

The last time three members dissented was under the Janet Yellen-led Fed in September 2016, when George, Rosengren and Cleveland Fed President Loretta Mester advocated for a rate hike.

But to find dissenting votes on completely different ends of the policy spectrum you would have to rewind to the Ben Bernanke era in June 2013, based on an archive at the St. Louis Fed. George opposed the Fed’s continuation of $85-billion-a-month asset purchases while Bullard pushed for a more aggressively accommodative tone.

Bernanke had been used to dissents during his 12 years at the helm of the central bank, but he would later admit that corralling differing opinions on the policysetting committee has its risks.

Bernanke wrote in his memoir that “too many dissents, I worried, could undermine [the Fed’s] credibility.”

Powell’s challenge with Wednesday’s dissents is reflective of the heightened uncertainty over what to do next. Although the Fed committed to data-dependence in the beginning of the year, the central bank has now turned to “insurance” cuts to hedge against the uncertainty of trade concerns and geopolitical risk. In Jackson Hole in August, Powell said the biggest problem is that there have been “no recent precedents” for the Fed to model trade risk in particular.

In his press conference Wednesday, Powell emphasized that policymakers have had the distinct challenge of navigating the economy through a noisy 12 months that pushed the Fed from its gradual hikes, to a pause on hikes, and then finally to rate cuts.

“Our eyes are open, we’re watching the situation,” Powell said Wednesday. “We cut rates twice. We’ve moved really through the course of this year.”

As the Fed has moved, policymakers have faced more dynamic decisions on where to take monetary policy, fueling the divide among the FOMC.

In Bullard’s call for 50 basis points of cuts, he felt the trade risks were large enough to warrant a stronger move to insure the U.S. economy against an adverse effect.

But in the July meeting, George and Rosengren felt that even a 25 basis point cut in that meeting ignored decent data on U.S. conditions and warned that lowering rates could invite more leverage into the financial system.

Dissenters usually offer more color on their decisions in the days following an FOMC decision. As Bullard, George, and Rosengren tee up their explanations for why they disagreed with the 25 basis point cut, markets are wondering if the rift will widen further as the Fed heads into its last two meetings of the year.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Trade tensions, oil shock cloud Fed efforts to steer clear of recession

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

The Fed is thinking globally despite Trump's push for an 'America First' monetary policy

Read the latest financial and business news from Yahoo Finance