Experts Predict a 'Major Recession' — Here's How to Prepare, According to Suze Orman

- Oops!Something went wrong.Please try again later.

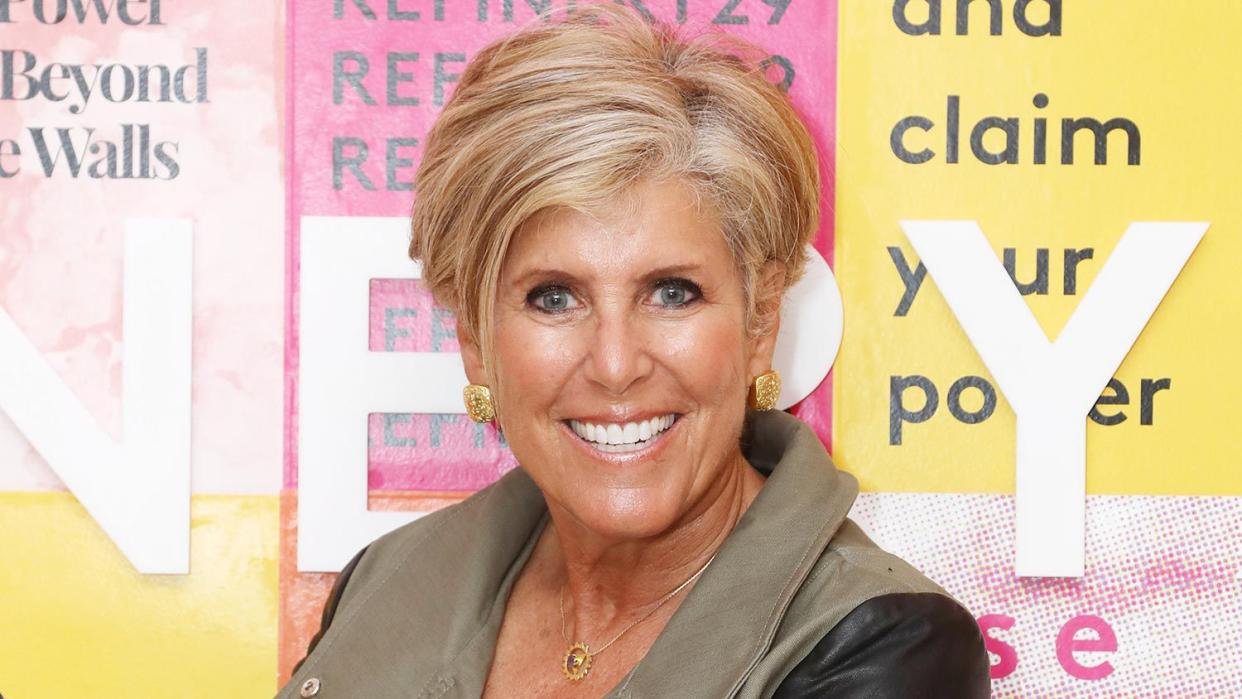

Anna Webber/Getty Suze Orman

As economic alarm bells ring for some experts, PEOPLE is turning to financial expert Suze Orman for tips on recession-proofing your finances.

"Think about it as an economic pandemic, where you don't spend, you don't go out, unless you have the money to do so," Orman says. "You need to start stockpiling now."

There are some good reasons to remain alert. On Tuesday, researchers from Deutsche Bank said in a report to clients that a "major recession" is coming to the U.S., spurred by the Federal Reserve's plan to cut inflation, and the "coming recession will be worse than expected," according to CNN.

On top of that, the Commerce Department reported Thursday that the U.S. economy shrank 1.4% in the first quarter of 2022, but Ian Shepherdson, the chief economist at Pantheon Macroeconomics, said "this is noise; not signal," CNBC reported.

"The economy is not falling into recession," Shepherdson added.

Whether a recession comes soon or not, Orman — host of the Women & Money podcast — tells PEOPLE how to prepare for a worst-case scenario.

"If you are really worried about a recession, because in fact it's going to affect you in every possible way, then you have to cut back now. That's the greatest tip I could give you," Orman says.

Read on for more of Orman's tips.

RELATED: This Divorcée's Finances Were Better Than Ever After She Left Her Husband — She Retired at 49!

Don't: Spend Money on Unnecessary Things

Bulking up your savings is the first step, Orman says.

"You can recession-proof yourself, truthfully, by not spending money, because everything you buy right now will be more expensive," she says, referring to recent cost increases for common goods and services amid inflation.

But as the U.S. transitions out of a full-blown pandemic, people are thrilled to leave the house and venture out to restaurants, concerts and sporting events. If you don't have ample savings and are worried about how you're going to pay bills in the coming months, resist the temptation to make up for what you've missed with pricey experiences, Orman says.

"That isn't easy to do coming out of a pandemic," she adds, "because everybody has this urge to just spend, spend, spend right now. Credit card debt is going up."

RELATED: Texts, Emails and Direct Messages from Debt Collectors Are Now Allowed — What to Know

Monica Schipper/Getty Suze Orman

Do: Only Buy Essentials

There are certain things that you have to buy, like food and toothpaste. But, as always, Orman suggests asking yourself before every purchase, "Is this a need? Or is this a want?"

"You really should only be spending your money right now on staples, things that you need," she says.

If you don't have a large savings reserve, hold off on redecorating your home or buying a new house, she says.

Don't: Mess Up Your 401(k)

Cutting corners by not contributing to your 401(k) or retirement accounts isn't advised. Neither is taking out cash early to pay bills, which could lead to pricey penalties.

"If you have 10, 20, 30 years or longer [before retirement]," says the best-selling author, "you should be so happy and continue to dollar-cost average in your retirement account."

Dollar Cost Averaging is when you put the same amount of money into your 401(k) every month, regardless of the market's fluctuations. If you're following this principle and automatically putting a percentage of your paycheck into a 401(k), Orman advises you to keep up the good work so that you can benefit from the market's long-term growth.

"Every month that you put your money into your 401(k), just continue to do it," she adds, "and don't take your money out of the market."

It's also smart to continue saving for your kids' education. If your child is 10 or 20 years away from going to college, keep making contributions to their 529 College Savings Plan, she says: "You bet I would."

RELATED: Financial Experts Share Their Easy Steps to Manage Debt: It 'Cannot Define You'

Do: If You're Near Retirement, Protect Your Money

"If you're near retirement, you better be really careful here," Orman says. "Remember, you cannot have money in the market that you're going to need within five years."

Instead, she suggests keeping those funds safe in an account, "because at times like this, you don't take money from stocks — you take money from cash."

As Orman recommended in her book, The Ultimate Retirement Guide, if you want to recession-proof your retirement account, you should have a three to five year cash reserve, "so that when the markets are going down in a recession, when interest rates are going up because of inflation, you don't touch your stocks," she says. "You use your cash."

Don't: Invest Every Penny You Earn

While Orman encourages responsible investments, she says you shouldn't invest 100% of your money. It doesn't matter if it isn't earning much in a savings or money market account.

"At times like this, that's where you get your money," she says. "It's a cash cushion."

RELATED VIDEO: Suze Orman Says Her Spinal Surgery for a Rare Tumor Was 'A Journey to Hell and Back'

Do: Hold Off on Refinancing Your Home

Interest rates are expected to rise even more — and that has Orman advising folks to avoid refinancing their homes.

Last summer, Orman urged people to refinance as home interest rate loans hit record lows. But now they're at a 10-year high.

"If you're refinancing a house or possibly even buying a house because you're afraid that the market's going to miss you, you're going to miss the market," Orman says. "The fact is rather than a 2.5 percent interest rate on a 30-year fixed [mortgage], you're going to get a 5.5 or 6 percent [rate]."

Don't: Panic

"Do not come from a place of fear," Orman says of your mindset going into changes.

While everyone has a unique financial situation, folks should feel empowered to "take action," she adds. "That is sensible for these kinds of times."