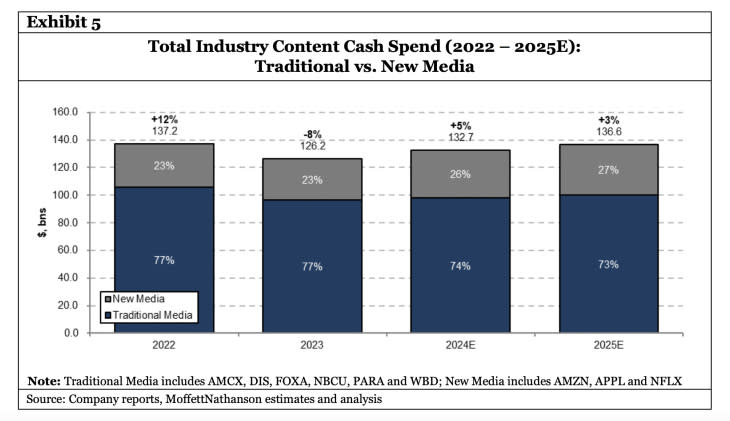

Everyone Has to Get Back to Work If We’re Going to Spend $133 Billion on Content in 2024

All that free cash flow from a strike-plagued 2023 is burning a hole in Hollywood’s pockets. Time to get back to work.

The key players in film and television will spend a combined $132.7 billion on content in 2024, MoffettNathanson analyst Robert Fishman estimates. You know, if IATSE, the teamsters, and Hollywood Basic Crafts don’t walk out on AMPTP productions and onto the picket lines. But let’s be optimistic for a moment — much of the industry is.

More from IndieWire

Forty-five percent of below-the-line crew recently surveyed by entertainment-industry tracker ProdPro had a positive outlook for 2024 vs. 20 percent with a negative view. Businesses, like vendors, were even more optimistic: 54 percent had a positive outlook with 9 percent skewing negative.

Why the (relatively) sunny outlook ahead of another potential work stoppage? No one can afford another strike year. Ten billion dollars of production spending was put on hold due to the 2023 WGA and SAG-AFTRA strikes, ProdPro estimates, $3 billion of which is expected to begin principal photography in Q1 2024.

Let’s get going, people.

In January, FilmLA president Paul Audley called the slow return to production “uncharted territory,” adding, “We have months to go before we can describe what the new normal looks like for filming in LA.”

Audley’s Los Angeles non-profit says local on-location production in the final quarter of 2023 dropped by more than one-third (36 percent) from the same period in 2022. A December 2023 Otis College of Art and Design Study found that nearly 25,000 entertainment workers in L.A. lost their jobs from April to December, while “the entertainment industry has lost nearly half of its post-pandemic gains as a result of the strikes.” TV series were hit harder than film; so long, Peak TV.

Last month, Audley told IndieWire there has been a “fair amount” of permit activity signaling the return to production, but that’s not the sort of phrasing that adds up to $133 billion.

What does? About three-quarters (74 percent, to be precise) of the estimated content spend will come from the old guard — Fox, Disney, AMC Networks, NBCUniversal, Paramount, and Warner Bros. Discovery — per Fishman’s compilation. The rest is new money: Amazon, Apple, and Netflix. The tech companies are still spending pretty liberally, with at least Amazon and Apple expected to open their checkbooks even more than before. It’s belt-tightening time for legacy media.

Even if everyone gets back on the ball and hits their 2024 content-spend number, it will still be less on a whole than 2022, the last non-strike year; the same goes for 2025. At some point along the way, Wall Street’s messaging about profit over growth got through to the CEOs.

One in particular, Disney’s Bob Iger, has taken a chainsaw to his former content budget. Per the company’s 10-Q filing in February, Disney will spend just $24 billion across films and series. The plan for 2023 had been $30 billion; in 2022, Disney spent $33 billion on content, way up from $25 billion in 2021.

Drastic times call for drastic cuts. Iger has already promised profitability at Disney+ by the final quarter of fiscal 2024, which for Disney is July 1, 2024-September 30, 2024. A quick accounting lesson: Profit = Revenues – Costs.

To swing from a loss to a profit, a company must increase its revenue or lower its costs. If you’re Disney, you do both.

In October 2023, Disney+ raised its prices — just like it did in December 2022. And Disney+ has already added an ad-supported tier and is finalizing its paid-sharing rollout as you read this; there’s your additional revenue stream.

In his Friday, March 11, 2024 note to clients (obtained by IndieWire), Fishman acknowledged there are “cost efficiencies” to be found for Disney+ (and Hulu) “through the optimization of distribution costs.” However, “the true engine” of the streaming business is control over one’s content spend. Even retroactive “control” can work in a pinch.

To that end, Iger has quietly killed a few projects before they saw the light of day, removed existing (but underperforming) films and series from Disney+, and has spoken endlessly about the need for Disney to emphasize quality over quantity. David Greenbaum, you have your marching orders.

Still, Disney lost $138 million from streaming over the final three months of 2023, which was its first quarter of fiscal 2024. The clock is ticking on that whole profit thing.

Best of IndieWire

The Best LGBTQ Movies and TV Shows Streaming on Netflix Right Now

Guillermo del Toro's Favorite Movies: 54 Films the Director Wants You to See

Nicolas Winding Refn's Favorite Films: 37 Movies the Director Wants You to See

Sign up for Indiewire's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.