The Era of the Original Streaming Movie Is Over

Time is the measure of success or failure in the streaming world. Gal Gadot’s “Heart of Stone” earned 143 million hours in its first 10 days of Netflix availability. That fell short of Chris Hemsworth’s “Extraction 2” and Jennifer Lopez’s “The Mother,” which each notched 175 million-178 million hours in that same time period. All three movies, along with Zack Snyder’s upcoming two-part film “Rebel Moon,” represent a swiftly disappearing notion in the streaming world: The big-budget, English-language streaming movie is becoming a comparative rarity.

As one industry executive told TheWrap, “Peak streaming is over, Wall Street no longer loves it.”

Compared to just a couple of years ago, the sheer amount of direct-to-streaming movies has plummeted. Netflix, which pioneered big-budget streaming movies, will release just above 40 English-language films in 2023, compared to 75 in 2022. Insiders and analysts blame a change in financial tune. Wall Street no longer rewards spending big bucks for big streaming movies as a show of force. They wanted subscription figures at all costs from 2017 to 2022, but now they want revenue and profit. Years of streaming viewership data have shown that, on the whole, titles released first in theaters perform better on streaming than direct-to-consumer pictures.

In late February of 2023, Warner Bros. Discovery CEO David Zaslav outright admitted that HBO Max movies were “providing really no value to us.” That echoed his year-long rebuttal of both AT&T’s emphasis on HBO Max content and conventional wisdom within the entertainment industry where his sentiments have now become industry-wide policy.

Not quite a mountain of (feature film) content

Zack Stentz, who wrote Netflix’s “Rim of the World” stated, “I’ve definitely seen a drawing back from the heights of 2018 and 2019.”

It wasn’t like most streaming platforms were overflowing with streaming-centric films even in the “boom times.” HBO Max/Max offered up 20 streaming premiere features, like “The Fallout” and “No Sudden Move” between 2020 and 2023. Peacock offered just 10 films over that timeframe, two of which were “Psych” movies based on their popular TV series.

Paramount+ had 16 originals in 2022 and 10 in 2023. Apple TV+ debuted 28 films, including a few acquisitions (like “CODA”) and theatrical-first features (like “Napelon”), between 2019 and 2023. They still treat some films, like “Ghosted,” as streaming-specific titles. Conversely, the likes of “Killers of the Flower Moon” and “Argylle” will get conventional theatrical windows from legacy studios while premiering on the streaming service at a later date.

Hulu’s output has remained steady as they premiered seven films in 2020 and 2021, 17 in 2022 just under 15 this year. Wedbush Securities Inc.’s VP Equity Research, Media and Entertainment Alicia Reese explained to TheWrap that at least some of Hulu’s consistency was due to Disney’s ownership of 20th Century Studios and Searchlight as a content mill for films like “White Men Can’t Jump” and “The Boston Strangler.”

Netflix leads the way — again

As with most things in the streaming world, Netflix started the notion of the streaming original movie, which the rest of the industry eventually tried to copy. Netflix began releasing its own original features beginning with Idris Elba’s “Beasts of No Nation” and Adam Sandler’s “The Ridiculous Six” in 2015. They offered big Hollywood stars, high production quality and production values approximating the theatrical programmer.

Moreover, in the mid-2010s, when Hollywood was chasing “The Avengers” and becoming more IP-focused, the promise of the Netflix original was a safe space for star and character-driven, mid-budget, high-concept movies that weren’t dependent upon marquee characters, franchise nostalgia or four-quadrant global appeal. Even would-be blockbusters like “Bright” were closer in spirit to the non-IP, star/concept tentpoles of the pre-9/11 era.

Alas, many of the more high-profile titles, think “Death Note” and “War Machine” were seen as inferior to the genuine Hollywood article. They made a big deal of snatching up “The Cloverfield Paradox” from Paramount and releasing it as a surprise on Super Bowl Sunday in 2018. The release strategy got more attention than the poor reviews.

As one high-ranking Hollywood executive explained, “Netflix originals now come with a presumption of mediocrity. Most of them feel closer to ’90s-era direct-to-video releases.”

Wall Street giveth, Wall Street taketh away

Nonetheless, Wall Street loved Netflix and essentially treated it like a tech company instead of an entertainment studio. With viewership mostly hidden, the streaming giant got credit for a project merely existing, regardless of whether the final product was any good or appealed to audiences.

“Everyone celebrates Netflix when they tell a story no one else wants to tell,” Paramount’s then-worldwide president of marketing and distribution, Megan Colligan, declared on the opening weekend of “Mother!” in 2017. “This is our version. We don’t want all movies to be safe and it’s OK if some people don’t like it.”

In the late 2010s, Netflix was incentivized to throw unholy amounts of money at Hollywood’s biggest and brightest as a show of force. They made power moves like spending around $200 million on Martin Scorsese’s “The Irishman” or dropping $450 million to snatch two “Knives Out” sequels away from what otherwise would have been a theatrical distribution.

That changed in 2022, when Wall Street almost arbitrarily changed its collective mind about streaming, now wanting not subscription counts but revenue and profits. That massive films like “Red Notice” and “Don’t Look Up” didn’t seem to prevent subscription losses also told the tale. If mega-budget tentpoles don’t directly correlate to subscription gains, why bother spending that kind of money on a single film versus, say, a season of television?

There is now, in 2023, less perceived value in spending over $100 million on a Nancy Myers comedy or a new “He-Man” movie. You don’t need to actually produce a sequel to “The Grey Man” just because you promised a new franchise. Not when you get similar levels of viewership for a YA-targeted romance like “Purple Hearts.”

No more COVID handoffs

Moreover, the first few years of the 2020s were inflated for every major streamer — outside of Netflix. Intended-for-theatres films like “Soul,” “Infinite,” “Shotgun Wedding,” “Greyhound,” “Vivo” and “American Pickle” were sent to streamers amid COVID.

Studios needed cash-in-hand thanks to closed theaters and delayed tentpoles while streamers were concurrently eager to stock their library and show off theatrical-worthy films they could offer at home. Wall Street also created pressure to prioritize streaming over theatrical that continued even as vaccines rolled out and tentpoles like “Godzilla Vs. Kong” reiterated the financial potential of theatrical.

“If the public perceived streaming as the future, and you need to be perceived as a leader in the future, you were forced to make iffy choices for the short-term stock price,” Legion M co-founder and president Jeff Annison said in an earlier conversation with TheWrap.

Today, streamers are no longer being rewarded by Wall Street for big-budget movies with A-level movie stars. Think Netflix’s “Red Notice” or Apple TV+’s “Ghosted,” which approximate the stereotypical theatrical blockbuster. The investor class now wants revenue and profits. The notion of loading up on pricey content to boost subscription numbers is so 2020.

Does anyone watch streaming movies?

Netflix has a massive participatory user base that presses play on almost any piece of new Netflix content but its rivals haven’t had the same luck. Netflix will argue that tons of folks watch “Extraction 2″ or “Don’t Look Up.” There is little evidence to suggest that other platforms’ originals, like HBO Max’s “Father of the Bride” or Hulu’s “The Valet,” pulled in anywhere near that level of viewership.

“Hocus Pocus 2” was an initial Disney+ ratings smash, with 2.75 billion minutes in its “opening weekend.” The same can’t be said for “Disenchanted.” Looking at the slew of Disney+ original movies, many from acquired brands like 20th Century Studios, it would seem that “Hocus Pocus 2” was the exception to the rule.

Likewise, titles like “The Princess” and “Timmy Failure” were pulled from Hulu and Disney+. This was allegedly due to low viewership. However, since streamers keep their viewership data so close to the chest, it’s unclear if that is accurate. The official reason is to save money on licensing and residual fees. That said, streamers don’t generally remove high-rated, first-party content from their platforms.

“It makes sense that the streamers want to hide the flops, and maybe the content creators want that hidden too,” noted Reese. “It’s been nice for artists to not have to worry about ratings or viewership.” She stressed that this shroud of mystery concerning the viewership data for most streaming films and shows is a big sticking point amid the ongoing labor stoppages.

Theatrical movies still rule on streaming

After years of evidence, The Entertainment Strategy Guy (a leading industry analyst in the realm of streaming ratings) affirmed that theatrical films outperform straight-to-streaming originals. Even a box office bomb like “Lightyear” performed better on Disney+ than an acclaimed streaming title like “Chip and Dale: Rescue Rangers.”

“When we release a movie theatrically,” noted Paramount president of worldwide marketing and distribution Marc Weinstock in a previous conversation with TheWrap, “you make a cultural impact and that pays off in all the ancillary markets from home entertainment to streaming.”

As previously reported in TheWrap, Paramount+ has banked on their deep library of older classics and buzzy pay-TV first-window theatricals like “Top Gun: Maverick” and “Dungeons and Dragons: Honor Among Thieves.”

In terms of recent SambaTV data the week of August 1, Marvel’s $844 million-earning “Guardians of the Galaxy Vol. 3” was in third place, while Illumination’s $1.35 billion-grossing “The Super Mario Bros. Movie” was fourth.

Parrot Analytics would tell you Netflix’s most “in-demand” film of 2022 in the U.S. was “Uncharted.” The $400 million-earning Tom Holland/Mark Wahlberg video game adaptation was one of several Sony theatricals offered on Netflix via a lucrative first pay-TV window.

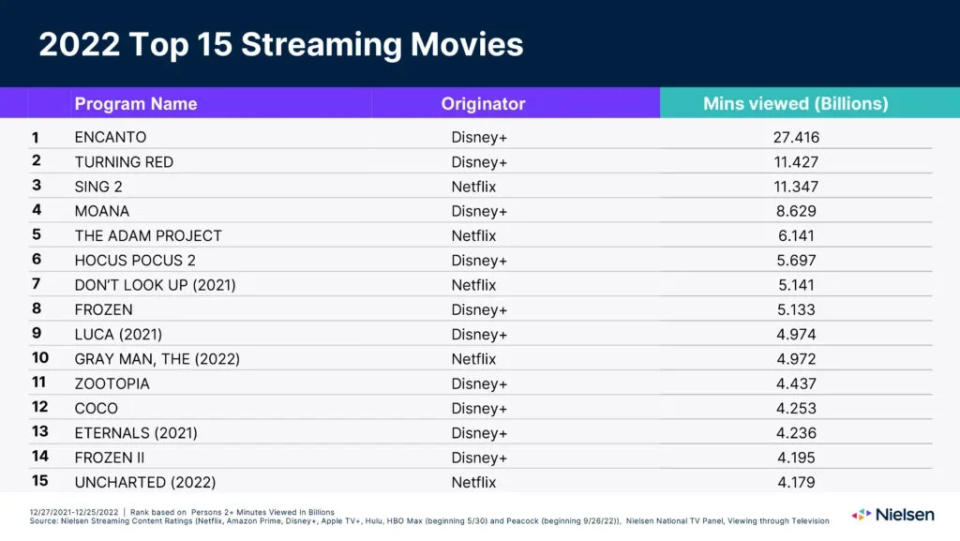

Nielsen’s most-watched films of 2022 included theatricals like “Sing 2,” supposed-to-be-theatricals like “Turning Red” and a few buzzy Netflix originals like “The Adam Project.” Save for “Hocus Pocus 2,” there wasn’t a single original non-Netflix feature in the top 15.

Studios outside of Netflix are slowly going back to holding their most promising titles (like “Napoleon,” “Blue Beetle” or “80 For Brady”) for theatrical release rather than offering them at home as a “Look what amazing would-be blockbusters you can watch from home!” subscription carrot.

The incentive is gone

“Studios can have their cake and eat it too with both a theatrical window and a streaming debut that garners strong viewership and maximum revenue potential,” Ashwin Navin, co-founder and CEO of Samba TV, told TheWrap.

Why let “Smile” just exist as a widget on Paramount+ when you can release it in theaters and have it gross $216 million worldwide? Ditto 20th Century Studio’s “The Boogeyman” and Warner Bros. Discovery’s “Evil Dead Rise.” Both were initially produced for streaming but got profitable theatrical releases instead.

However, Stentz argued that the streamers are “still open for business,” having sold a spec feature to Netflix just prior to the WGA strike. They are “becoming more specific and strategic about what they’re buying instead of just trying to build a library of content as fast as possible,” he said.

Wall Street no longer rewards making streaming movies just to create streaming volume. Theatrical releases, even box office bombs like “Dungeons and Dragons,” generally outpace direct-to-consumer films in raw viewership while making a bigger mark in pop culture. Netflix and Amazon are making fewer overall movies while expanding their audience far beyond North America.

When streamers can choose between spending $100 million on a feature film or a season of television, the choice is that much clearer. Even Netflix gets more value out of third-party theatricals like “The Woman King” and YA-targeted cheapies like “The Kissing Booth” versus mega-bucks would-be blockbusters like “Glass Onion: A Knives Out Mystery.”

“Hollywood has perhaps realized that streaming movies don’t pay,” argued that industry executive. “Streaming the future of television and Blockbuster, which is what they replaced. Leave theatrical to theatrical.”

The post The Era of the Original Streaming Movie Is Over appeared first on TheWrap.