Endangered Species: Disney Junior, BET, IFC, Syfy, Fox Sports 2 and TCM Among the Basic Cable Channels Listed as Facing Carriage Extinction

- Oops!Something went wrong.Please try again later.

The recent carriage renewal deal between The Walt Disney Co. and Charter Communications represented a paradigm shift in pay TV distribution, emphasizing integration of “plus”-branded SVOD services and further marginalizing secondary basic cable networks, according to a new report from S&P Global Market Intelligence analyst Scott Robson.

In his report, Are niche cable networks at risk following Disney-Charter deal?, Robson predicts “the next few quarters will be transformative for the cable industry as streaming services become available to traditional linear subscribers and niche cable networks start being phased out.”

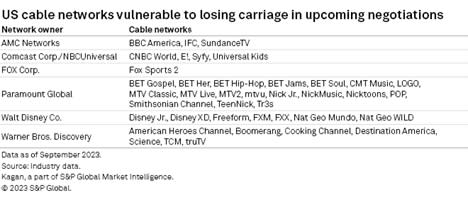

Robson listed some of the secondary cable networks he believes are in danger. The list features not only notable channels that didn't make it into Charter’s Disney renewal — Disney Junior, Disney XD, FXX and several others — but a host of recognizable network brands from other major distributors.

In its deal, Charter was able to reject secondary networks like Disney Junior while gaining wholesale access to direct-to-consumer streaming platforms Disney Plus and ESPN Plus, as well as future wholesale access to the DTC iteration of flagship ESPN, currently in development.

“Carriage deals forged in 2012 were focused on ‘TV Everywhere’ rights,” Robson wrote. "Nowadays, deals include negotiations for buythrough windows for streaming services like AMC Plus and Discovery Plus.”

Smaller cable networks are getting squeezed out as their content offering dwindles. For example, Robson said there's little incentive for operators to license MTV2 when most remaining MTV content after production cutbacks consists of repeats that are now licensed to parent company Paramount’s free ad-supported Pluto TV.

“Cable network owners with large portfolios of channels have a subset of flagship brands that generate most of the affiliate fees,” Robson wrote. “Therefore, if operators decide to follow Charter’s lead and ‘trim the fat” off their bloated channel lineups, these cable network programmers with a wide offering of channels will not necessarily be taking a huge haircut on affiliate revenue.”

Charter estimated the loss of seven secondary Disney networks resulted in a 9% decline in affiliate revenue between the two companies.

The market shift, Robson added, comes amid a flurry of upcoming renewal deadlines. He included this graphic summarizing the broad status of play TV's major carriage deals: