Elon Musk, Marissa Mayer and 25 More CEOs That Have Saved or Sunk Major Corporations

For a company to achieve success, it needs a strong leader at the helm. Top-performing CEOs can transform sinking businesses into profit-making corporations -- but not all leaders have the magic touch. Some CEOs are now known for turning failed companies around, whereas others are largely credited with the demise of the corporation they founded or led.

See: Top 10 Female CEOs to Watch

Find: LinkedIn Released Its List of Top Companies – These Are the Best Places to Grow Your Career Now

One company currently facing an uncertain fate is Tesla, led by CEO Elon Musk. The savvy electric car company beat Wall Street earnings estimates for the first quarter of 2021, Investors Business Daily reported. However, it was the sale of regulatory credits and Bitcoin, and not electric vehicle sales, that drove the company's profits.

See: The Most Outrageous CEO Salaries and Perks

Although Musk noted in the Q1 earnings statement that Tesla would begin delivering its Model S vehicles in May, it was June before delivery began. And now, barely a week before Tesla is due to announce its Q2 earnings, deliveries are on hold, according to Electrek, with no clear indication of how long or why. But experts see positive signs for the company ahead of the July 26 earnings release.

Last updated: July 27, 2021

Mary Barra: General Motors

General Motors chairman and CEO Mary Barra was crowned No. 1 on Fortune's list of the most powerful women in 2017. When Barra ascended to her position as CEO in 2014, she was called a "lightweight" by a Wall Street investment banker, reported Reuters -- but she has since proven her critics wrong in many different arenas.

In the last few years, Barra has guided GM through its post-bankruptcy recovery, navigated a widespread vehicle recall and public relations crisis, and helped the company turn a consistent profit. Under her leadership, GM began a ride-sharing service called Maven, invested in self-driving technology and came out on top amid competition from Tesla in the affordably priced electric car market.

In the second quarter of 2018, GM earned $36.76 billion in revenue -- slightly beating estimates -- and its China division reached an all-time high of 858,000 deliveries. In November 2018, GM announced the potential closing of five plants in North America in part of a plan to cut $6 billion in costs by 2020.

GM's momentum has continued into 2021. First-quarter earnings beat Wall Street expectations despite production delays due to a shortage of semiconductor chips, and the company expects to see earnings or $4.50 to $5.25 per share by the end of the year.

Explore: How Many Minutes Does It Take a CEO To Earn Your Annual Salary?

Steve Jobs: Apple

In 1985, then-Apple CEO John Sculley fired Steve Jobs, co-founder of the tech company. When Jobs returned as CEO in 1997, Apple was nearly bankrupt.

Jobs sprung into action by brokering a deal with Microsoft to invest $150 million in nonvoting stock and to keep making its Office software for Macintosh. To streamline the company, he cut the number of Apple products by 70%, which led to approximately 3,000 employees losing their jobs. His gamble paid off -- the company generated a $309 million profit in the 1998 fiscal year.

Sadly, Jobs succumbed to pancreatic cancer in October 2011. Now led by Tim Cook, Apple is one of the most successful corporations in the world -- it became the first publicly-traded company in the U.S. to hit a market cap of $1 trillion.

Discover: Who Is the Highest Paid CEO in Your State?

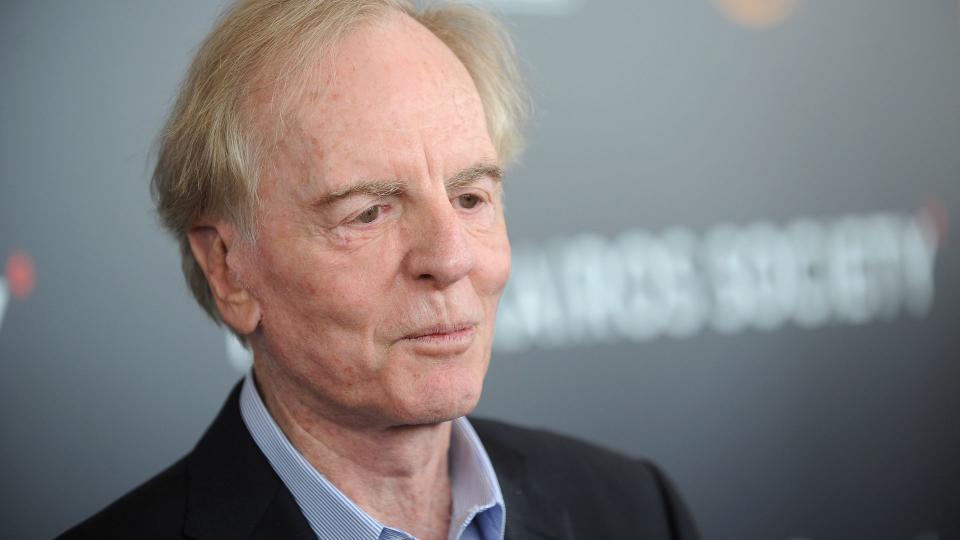

John Sculley: Apple

During his tenure as Apple CEO from 1983 to 1993, John Sculley committed the ultimate business fail -- he fired Steve Jobs in 1985. Sculley was forced out of the company in 1993 over a dispute with the board about licensing Macintosh software to other computer makers.

Sculley was opposed to the licensing idea, which the company went ahead with -- and it was the first thing Jobs canceled upon his return. In a February 2015 interview with CNN, Sculley revealed he regrets not hiring Jobs back because he believes this would have saved Apple from near bankruptcy in the late 1990s.

Read: CEO Pay Surged as Revenue Plummeted in 2020 Amidst Pandemic

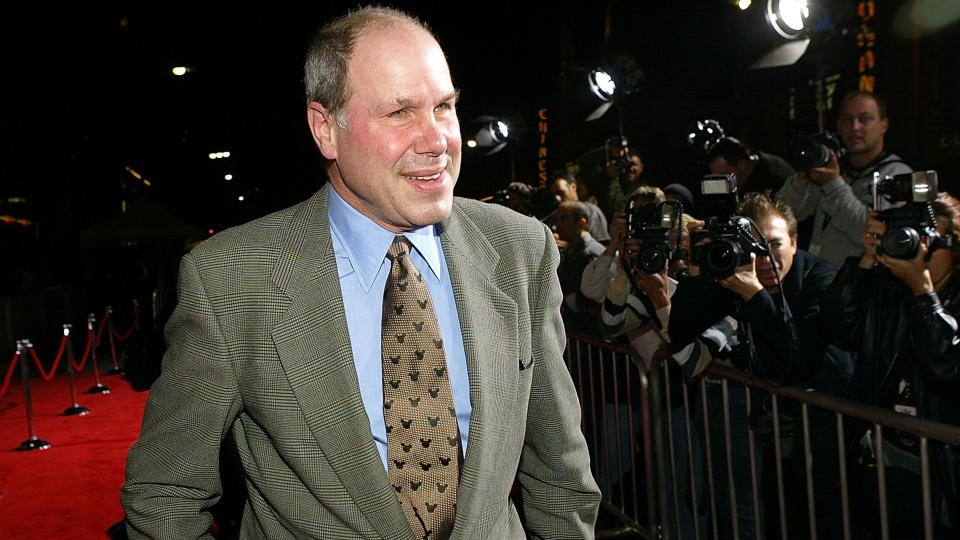

Michael Eisner: Disney

Michael Eisner stepped down as CEO of The Walt Disney Co. in 2005, but his legacy lives on. He took the reins in 1984, and during his 21 years of leadership grew Disney’s annual revenues from $1.5 billion in the year he assumed the top job to $30.75 billion in 2004.

Under his watch, the company opened several new theme parks worldwide, and the number of employees grew from 28,000 to 129,000. Eisner also spearheaded the Disney cruise ship line, a stage play division and multiple domestic cable channels -- including ESPN.

See: The Most Outrageous CEO Salaries and Perks

Elon Musk: Tesla

Since Tesla was founded in 2003, CEO Elon Musk has helped the company score some major wins. In the second quarter of 2018, Tesla achieved a milestone in producing 5,000 Model 3 vehicles per week and increased its revenue to $4 billion from $2.79 billion in 2017, which surpassed analysts’ estimates.

However, investors and analysts remain cautious about the brand's recovery from Musk's controversial behavior earlier in 2018. Tesla has already lost support from some of its most staunch advocates -- including Instinet, formerly a big bull on Tesla -- and shares fell 2.1% on Sept. 11, 2018. Things looked bleak for the automaker as it reported a $408 million loss in the second quarter of 2019 and experienced the first half in the red.

However, Tesla saw its first profitable year in 2020. That the profit stemmed primarily from the sale of regulatory credits and Bitcoin made some analysts squeamish, as did the company's $1.5 billion investment in Bitcoin and its brief experiment with accepting Bitcoin payments. However, Tesla also announced record Q2 2021 deliveries ahead of its Q2 earnings release, so only time will tell whether Musk ends up saving Tesla -- or sinking it.

Explore: How Many Minutes Does It Take a CEO to Earn Your Annual Salary?

Marissa Mayer: Yahoo

When Marissa Mayer took the reins as Yahoo's CEO in July 2012, Silicon Valley was hopeful that Google’s 20th employee could save the struggling tech company.

Under Mayer's watch, Yahoo made some big moves -- including purchasing blogging site Tumblr for $1.1 billion in 2013 -- but failed to halt revenue declines. In the fourth quarter of 2015, the company reported a $4.4 billion loss, which prompted Mayer to cut 15% of its workforce.

Yahoo finalized its sale to Verizon for $4.5 billion in June 2017. Mayer resigned at the closing of the deal and walked away with nearly $260 million -- $23 million in severance pay and about 4.5 million shares of Yahoo that were worth more than $236 million at the time.

Check Out: 4 CEOS at Remote Companies on the Challenges of Never Going Back to an Office

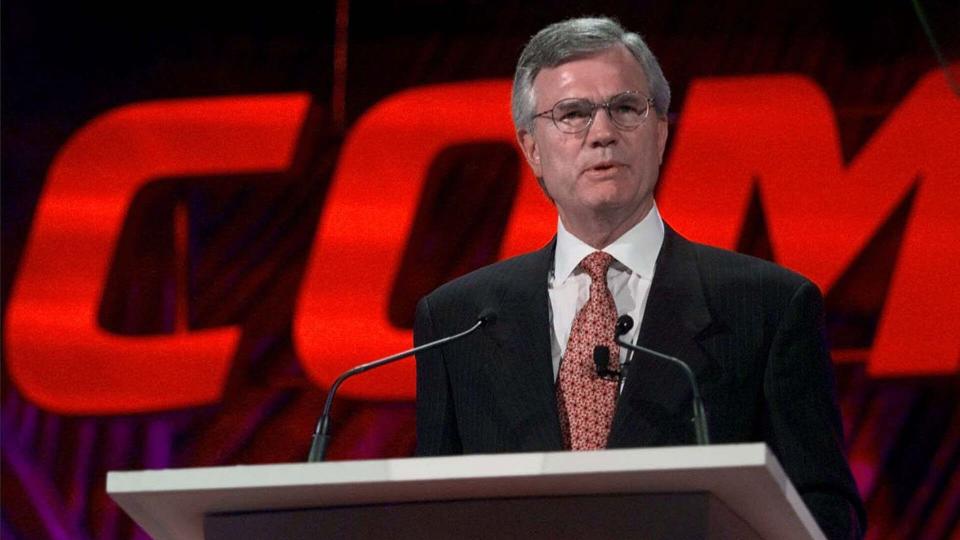

Bob Iger: Disney

Michael Eisner left big shoes to fill, but Bob Iger proved he was up for the challenge. The Walt Disney Co.’s CEO since 2005, Iger pitched buying Pixar Animation Studios to the board on his second day of work.

Disney acquired Pixar for $7.4 billion in 2006, followed by its $4 billion purchase of Marvel Entertainment in 2009 and its procurement of Lucasfilm for $4 billion in 2012. Consequently, Iger has turned Disney into a media powerhouse. In December 2017, Disney extended Iger’s contract as chairman and CEO through December 2021. In 2019, Iger caught heat from Abigail Disney, heiress to the company, for the largely different pay gap in Iger's salary and that of Disneyland employees. Disney stated in May of that year that it was a "moral issue" while testifying in front of the U.S. House Committee on Financial Services.

Iger stepped down as CEO in February 2020 to become the company's executive chairman.

Related: Disney's Bob Iger and More Who Went From Entry Level to CEO

Travis Kalanick: Uber

After co-founding Uber in 2009, Travis Kalanick turned the ride-sharing app into a business with a market capitalization of $88.25 billion as of July 23. Building the world’s most valuable startup is impressive, but in 2017, Kalanick’s leadership skills culminated in several public relations nightmares -- he resigned in June 2017.

Under Kalanick’s watch, Uber lost approximately $2.8 billion in 2016. Much of this was due to expanding the app to China, which ultimately cost the company more than $1 billion per year, Kalanick revealed in February 2016. Uber finally sold its China business to rival Didi Chuxing, CNBC reported in August 2016.

In August 2017, Uber named Dara Khosrowshahi as CEO -- he previously served as the CEO of Expedia.

Discover: Who Is the Highest Paid CEO in Your State?

Howard Schultz: Starbucks

He didn’t found Starbucks, but Howard Schultz is credited with turning the company into the world’s largest coffee business as of 2015. Schultz acquired Starbucks in 1987, and now the coffee chain has over 30,000 stores worldwide.

In 2000, Schultz stepped down as CEO, but he returned to the position in 2008. During the year leading up to his comeback, Starbucks stock had lost half its value, which forced Schultz to close underperforming stores and cut a thousand jobs to get the company back on track. His strategy worked. The coffee giant earned $22.4 billion in net revenues in 2017, and its market cap has grown to approximately $148 billion as of July 2021.

Schultz stepped down as CEO in April 2017 and vacated his executive chairman role in June 2018.

See: The Most Outrageous CEO Salaries and Perks

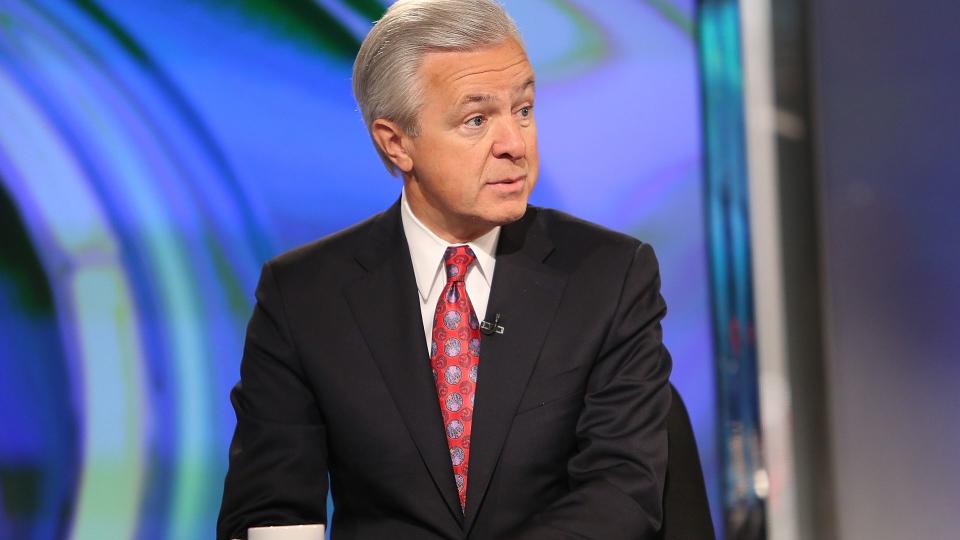

John Stumpf: Wells Fargo

In October 2016, John Stumpf resigned from Wells Fargo after 34 years of service. Having held the CEO position since June 2007, Stumpf turned in his resignation after his poor handling of a scandal regarding more than 2 million customer accounts that were opened by Wells Fargo employees without telling the customers.

During two congressional hearings, Stumpf blamed low-level employees instead of holding himself and other top executives accountable, according to USA Today. Tim Sloan -- the company's president and COO at the time -- took over, but 1.4 million more fake accounts from the Stumpf era were publicly revealed in August 2017.

Wells Fargo initially pledged to pay $6.1 million to refund customers for unauthorized bank and credit card accounts, $910,000 for illicit online bill pay enrollments and $142 million for fraudulent accounts opened since 2002, according to CNN. However, the company ultimately reached a $3 billion settlement on its criminal charges and civil actions, The New York Times reported in February.

Explore: How Many Minutes Does It Take a CEO to Earn Your Annual Salary?

Hubert Joly: Best Buy

Hubert Joly was named Best Buy's CEO in August 2012. He ran the company until June 2019, when Corie Barry took over as part of a "planned leadership transition," according to a statement on the BestBuy corporate website.

Critics initially deemed Joly unqualified for the job and predicted the retailer would follow in the footsteps of its failed competitors like Circuit City, but they were very wrong.

Joly’s “Renew Blue” program helped Best Buy reverse declining sales, improve customer satisfaction and increase profitability by growing online sales and cutting costs. In the second quarter of 2018, Best Buy reported results that exceeded expectations -- diluted earnings per share increased by 28% from a year ago. Best Buy has also moved into dealmaking in technology by acquiring health-services platform GreatCall and senior remote monitoring company Critical Signal Technologies.

In its announcement that Joly would become executive chairman, a role he still holds, BestBuy credited him with having "led the company through a successful turnaround over the past seven years."

Check Out: 4 CEOS at Remote Companies on the Challenges of Never Going Back to an Office

Carly Fiorina: Hewlett-Packard

Before leading an unsuccessful campaign for the 2016 Republican presidential bid, Carly Fiorina was the CEO of Hewlett-Packard. She took the company’s top spot in 1999 and remained in place for six years until the board removed her in 2005.

The first woman to lead a Fortune 100 company, Fiorina spearheaded HP’s largely unpopular merger with Compaq, which ultimately culminated in sizable layoffs and a steep plunge in the company's stock price, according to CBS News. Fiorina was so unpopular as HP's leader that when news of her departure broke, company stock prices immediately soared nearly 11%, closing the day up almost 7%.

Read: CEO Pay Surged as Revenue Plummeted in 2020 Amidst Pandemic

Meg Whitman: eBay

One of the top CEOs of all time, Meg Whitman joined eBay as president and CEO in March 1998. At the time, the online marketplace had 30 employees, 500,000 registered users and $4.7 million in revenue.

Before stepping down in January 2008, Whitman turned eBay into a global powerhouse. At the time of her departure, the company had more than 15,000 employees, hundreds of millions of registered users worldwide and almost $7.7 billion in revenue.

Learn: 10 CEOs’ Best Money Advice

Jonathan Schwartz: Sun Microsystems

Jonathan Schwartz’s tenure as CEO of Sun Microsystems from 2006 to 2010 ended with the company’s acquisition. After Sun Microsystems lost $2.2 billion in its last year of fiscal independence, Oracle announced plans to buy the tech company for $7.4 billion -- or $5.6 billion after its cash and debt -- in 2009.

Oracle’s then-CEO, Larry Ellison, blamed the company’s downfall on Schwartz, accusing him of ignoring problems as they escalated, making poor strategic decisions and spending too much time on his blog, according to Reuters.

Schwartz shared news of his departure in an unconventional manner -- he tweeted a haiku to announce his resignation.

See: The Most Outrageous CEO Salaries and Perks

Jeff Bezos: Amazon

In 1994, Jeff Bezos founded the online bookstore Amazon. Expecting to fail, he gave himself a 30% chance of success, according to the Los Angeles Times.

Fast forward to present day and -- as of July 20210 -- the company has a market cap over $1.83 billion. As an online marketplace that sells everything from shoes to dog food, Amazon had its first $100 billion quarter in Q4 2020 driven by holiday shopping bolstered by the pandemic.

Now the richest person on earth, Bezos isn't afraid to take risks or go through changes. From launching Amazon Original television series to buying Whole Foods and founding Blue Origin, the aerospace company that recently made Bezos the second CEO in history to fly in space, he’s focused on innovation.

Explore: How Many Minutes Does It Take a CEO To Earn Your Annual Salary?

Kenneth Lay: Enron

Kenneth Lay became CEO of natural gas provider Enron in 1986 as it was formed in a merger between Houston Natural Gas and InterNorth Inc. At its peak, he had grown the company into an energy giant valued at roughly $68 billion.

Top executive Jeffrey Skilling briefly became CEO in 2001 but resigned a few months later. In December, Enron filed the then-largest corporate bankruptcy in U.S. history.

The Securities and Exchange Commission charged Lay with fraud and insider trading in July 2004. Among other allegations, he was accused of garnering illegal proceeds totaling more than $90 million in 2001. One of the most legendary failed CEOs of all time, Lay was convicted on six counts of fraud and conspiracy in May 2006 but died in July 2006.

Check Out: 4 CEOS at Remote Companies on the Challenges of Never Going Back to an Office

Lee Iacocca: Chrysler

When Lee Iacocca joined Chrysler Corp. in 1978, the company was failing. After one year on the job, as CEO, he convinced the government to bail the automaker out by supplying $1.5 billion in federally backed loans.

After securing the necessary capital, he resuscitated the company by launching a series of groundbreaking automobiles, including the mid-sized K-car line and the first minivans. The success of the vehicles -- paired with cost-saving measures -- enabled Chrysler to pay back those loans seven years early and save 600,000 jobs, according to The Washington Post. Iacocca stepped down from Chrysler in 1992.

Discover: Who Is the Highest Paid CEO in Your State?

Eckhard Pfeiffer: Compaq

On the surface, Eckhard Pfeiffer was a success as CEO of the computer company Compaq. When he took the reins in 1991, the company had $3.3 billion in annual revenues -- a figure that rose to $14.8 billion by 1996.

Despite his gains, the company’s board wasn’t pleased with his performance, so Pfeiffer agreed to resign in 1999. Accused of focusing on growing the company instead of catering to its target market, he received approximately $6 million in severance pay and roughly $70 million worth of stock options.

Compaq never recovered. In 2002, Hewlett-Packard acquired the company in a stock swap valued at roughly $25 billion.

Find Out: Where These 51 CEOs Went to College

Doug Conant: Campbell’s Soup

When Douglas Conant become CEO of Campbell’s Soup in 2001, the company’s stock prices were quickly tumbling. Realizing the company had a toxic culture, he made it his mission to improve employee engagement.

Wearing a pedometer, Conant pledged to walk 10,000 steps per day at work and interact with as many employees as possible. He also wrote up to 20 notes per day to staffers, honoring their successes and thanking them for their contributions.

By 2009, the company had organically boosted its sales and earnings enough to outperform both the S&P Food Group and the S&P 500. Conant stepped down in July 2011.

See: The Most Outrageous CEO Salaries and Perks

Stan O’Neal: Merrill Lynch

The CEO of Merrill Lynch from 2002 to 2007, Stan O’Neal is considered by many as one of the players responsible for the 2008 financial crisis. Known for his confident, ruthless management style, he turned healthy profits for the firm from 2003 to 2007.

In a 2010 interview with Fortune, O’Neal claimed he didn’t understand the magnitude of the firm’s $45 million collateralized debt obligations that were buried in its books. In August 2007, he began exploring the issue and realized the firm was in big trouble.

O’Neal stepped down in October 2007. Merrill Lynch lost around $8 billion in 2007 on mortgage foreclosures and delinquencies. In September 2008, Bank of America announced plans to purchase the firm for $50 billion.

Explore: How Many Minutes Does It Take a CEO to Earn Your Annual Salary?

Anne Mulcahy: Xerox

Considered an unlikely choice for CEO at the time, Anne Mulcahy ran Xerox from August 2001 to June 2009. Praised for her focus on innovation, she quickly boosted company profits.

In 2000, Xerox lost $273 million. When Mulcahy took over in 2001, the company had more than $17 billion in debt and was nearing Chapter 11 bankruptcy. She immediately employed cost-cutting measures but remained focused on research and development. Under Mulcahy’s watch, the company generated $91 million in net income by 2003, which rose to $859 million by the next year.

Check Out: 4 CEOS at Remote Companies on the Challenges of Never Going Back to an Office

Bernard Ebbers: WorldCom

Bernard Ebbers was the CEO of WorldCom Inc. from 1985 to 2002. In March 2004, he was charged with conspiracy and securities fraud for his participation in a scandal to falsely inflate WorldCom common stock prices.

The scheme totaled $11 billion in fraud and Ebbers was found guilty on nine counts of accounting fraud. He began serving a 25-year prison sentence in September 2006.

WorldCom filed for bankruptcy in 2002 due to the scandal. The company changed its name to MCI in 2004 and Verizon bought it for $6.7 billion in 2006.

Read: CEO Pay Surged as Revenue Plummeted in 2020 Amidst Pandemic

Gordon Bethune: Continental Airlines

United Airlines purchased Continental Airlines for $3.2 billion in 2010, but the end of the company’s era had nothing to do with Gordon Bethune. Serving as the CEO from 1994 to 2004, he revived the failing carrier.

In a 2015 interview with Free Enterprise, Bethune cited poor management as the reason for the airline’s consistently low customer satisfaction ratings when he took the helm. He said he turned the airline into the highest-rated among passengers by making it a better place to work.

Continental lost roughly $600 million in 1994 but earned $225 million in 1995, according to Bethune. He credited the shift to a focus on employee satisfaction initiatives, including treating staffers right, getting to know them and earning their trust.

Discover: Who Is the Highest Paid CEO in Your State?

Robert Nardelli: Home Depot

Robert Nardelli had a good first five years as Home Depot's CEO. When he joined the company in 2000, annual sales were $46 billion, and they rose to $81.5 billion in 2005.

The housing slowdown in 2006 stalled sales, and the retailer’s stock price tumbled to just more than $40 per share -- around the same place it was at when he started. Investors began to get frustrated with Nardelli’s $200 million pay package and felt it wasn’t aligned with his performance.

Nardelli was willing to give up his guaranteed $3 million bonus but refused to take a pay cut. Wall Street cheered his January 2007 departure because analysts believed investors were not confident in his leadership abilities. The company’s sales reached $132.1 billion in 2020, which indicates Nardelli is long-forgotten.

Learn: 10 CEOs’ Best Money Advice

Marvin Ellison: J.C. Penney

When stepping into the role of J.C. Penney CEO in August 2015, Marvin Ellison worked hard to revive the struggling retailer. In 2016, the company had a positive net income for the first time since 2010, generating $514 million more in total earnings than in 2015.

In an effort to boost sales, Ellison reinvested in J.C. Penney's hair salons. He also invested more in affordable brands and aimed to bring back some of the old department store charm that could bring customers back.

However, Ellison left the company in 2018 after it took a turn downward with a $69 million loss in the first quarter of 2018. And it's still struggling. A court approved the sale of J.C. Penney in November 2020. The move pulled the company out of bankruptcy, but analysts say the odds are still stacked against its survival.

See: The Most Outrageous CEO Salaries and Perks

Steve Ballmer: Microsoft

When Bill Gates stepped down as Microsoft CEO to focus on philanthropy in 2000, Steve Ballmer assumed the role. In September 2000, the tech company was valued at $642 billion, but by the time he left in February 2014, it was worth only approximately $315 billion.

A lack of innovation and slew of flopped initiatives -- including the Windows phone, Bing and Microsoft Surface devices -- made it impossible for the company to keep up with competitors like Apple and Google.

The Ballmer effect doesn’t appear to have left a permanent mark on Microsoft. Under the direction of current CEO Satya Nadella, its market capitalization sits at a staggering $2.18 trillion as of July 2021.

Explore: How Many Minutes Does It Take a CEO to Earn Your Annual Salary?

Alan Mulally: Ford

Credited as the man who saved Ford, Alan Mulally took control of the company in 2006. That year alone, the troubled automaker lost $12.7 billion, according to The New York Times.

Mulally worked hard to make change happen, shifting the cutthroat company culture to one based on collaboration and efficiency. He also mortgaged $23.5 billion in company assets to create a cash infusion to revive Ford’s vehicle roster. When Mulally retired from Ford in 2014, it had a net income of nearly $3.2 billion.

More From GOBankingRates

Daria Uhlig contributed to the reporting for this article.

This article originally appeared on GOBankingRates.com: Elon Musk, Marissa Mayer and 25 More CEOs That Have Saved or Sunk Major Corporations